Disclaimer: This is a guest post from Michael Wiggins De Oliveira, and does not reflect the views of CityFALCON and its stakeholders.

Stock: Intrepid Potash

Price: $1.80; $220m market cap

Upside potential: 35%

Date: 18/4/2017

Investment Thesis of Intrepid Potash

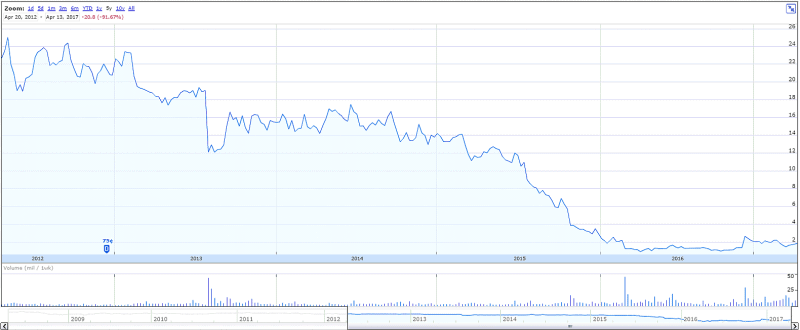

Intrepid Potash currently trades at the lowest price of nearly a decade. A lot of investors have been expecting the cyclical commodity to mean revert for some years. As the price continues to languish so does the stock of the pure play Intrepid Potash (NYSE: IPI).

As the company breached debt covenants around this time last year, a lot of investors expected the company to go bankrupt and priced it for bankruptcy. Although the company has now negotiated with debt holders and temporarily removed these debt covenants and thus most likely avoided near term bankruptcy, the company’s share price has not properly recovered to former heights.

This leads me to believe that patient and contrarian investors that are willing to invest now and patiently wait for a recovery 2-3 years down the road, might be nicely rewarded.

Business Overview

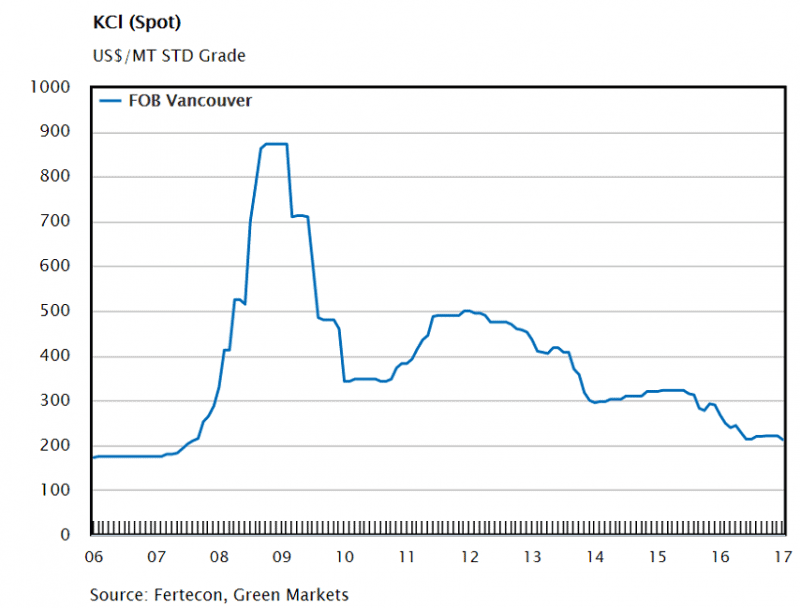

The graph above tracks the price of the compound with the common name of muriate of potash. The price of potash hit its height in 2009 and at the same time, Intrepid Potash traded for around $23 a share. The price of potash has now been falling year on year and with it the price of Intrepid Potash.

Financials

Intrepid Potash supplies 9.1% of annual U.S. potash consumption, but only 1.5% of the world potash consumption. Reinforcing the fact that this is a small cap company.

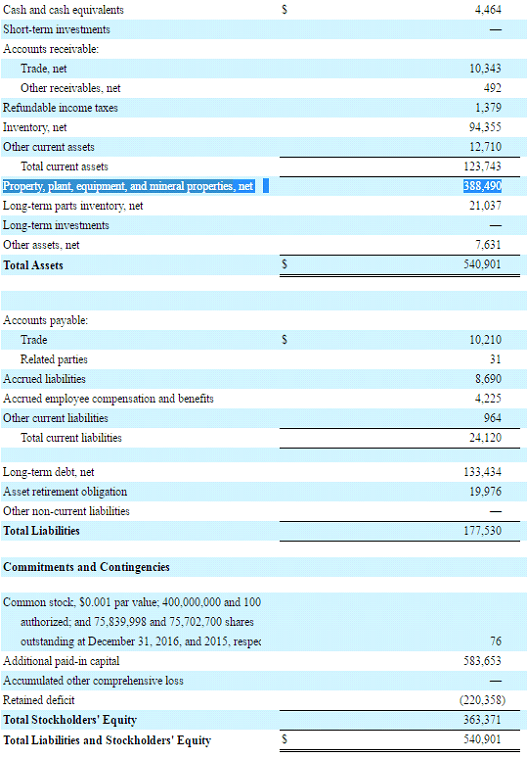

As the table above highlights, Intrepid Potash has been facing severe headwinds and has been burning cash every year since 2012, with a normalized FCF margin of -15%.

The company does have some equity built up in its property plant and equipment of around $380m. But without an improvement in the potash price, this company will certainly go bankrupt.

Insider Purchases

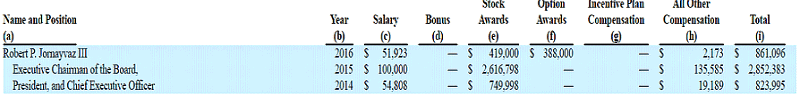

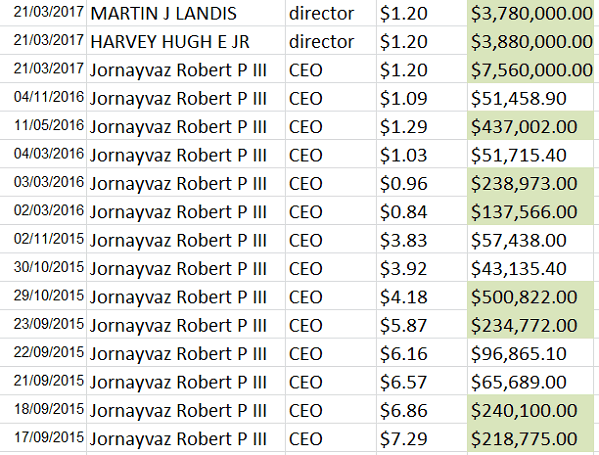

As the table below highlights, Robert Jornayvaz, the CEO, has not received an adequate salary for the last 3 financial years.

When hard times hit the company, this CEO fell on his sword and took a massive salary cut. He was truly aligning himself with the shareholder. And as the table below highlights, as the share price was falling he was purchasing huge amounts of the stock in the open market.

Three things are worth mentioning:

⦁ Mr. Jornayvaz has spent millions purchasing shares in the company.

⦁ Mr. Jornayvaz is under water in these investments.

⦁ He was not alone purchasing stock in Intrepid Potash

In addition to these insiders, Prem Watsa has also purchased the share as recently as last month.

Conclusion

In my opinion, the stock is cheap, but it is not as cheap as its price chart would lead investors to believe. Although the share price traded for more than $10 a share just a few years ago, the share dilution of 40% in March 2017 does not affect the price per share of the company but it does in its market cap.

This article is not a recommendation to purchase shares of any of the securities mentioned. Please do your own due diligence to reach your own conclusions.

If you’d like to track real-time relevant financial news for Intrepid Potash check it out.

Leave a Reply