We have come a long way since the days of a barter system. It hasn’t been necessary to have a specific good and trade it for some other specific good for a long time. For most of written history, there were only two types of currency: fiat or commodity. Fiat currencies have been the dominant currency since the 1970s, when the US ended the Bretton Woods system and abandoned the gold standard.

Fiat currencies are great because they don’t require physical commodity reserves and countries can control their own money supply. Currencies can be valued constantly against each other in floating exchanges. As for integrity and widespread implementation, governments are generally trustworthy and are a central regulating force that ensures transactions are fair, accurate, and not manipulated.

Today, with the advent of cheap computing power and networked systems (i.e., the Internet), there is a new contender to the currency game. The new guy to disrupt the duopoly of currency is the cryptocurrency. These are Bitcoin and its peers that have only become feasible in the last twenty years or so.

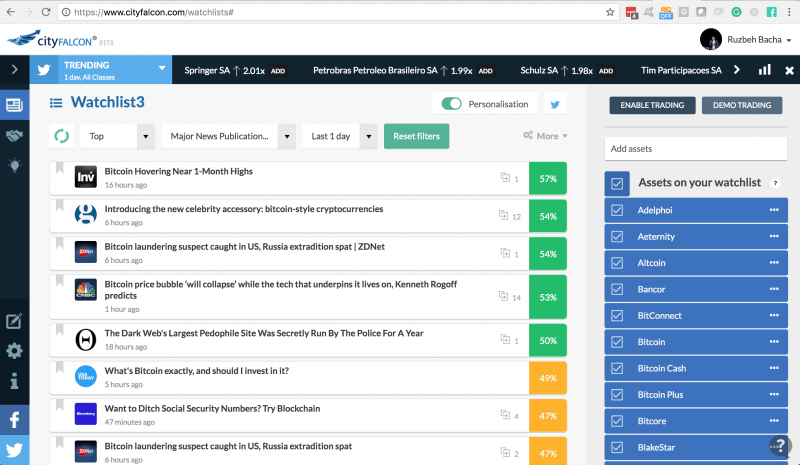

You can track personalised news for these cryptocurrencies on our award-winning platform CityFALCON here. Below is a screenshot of our platform.

What Cryptocurrencies are, and their benefits

Cryptocurrencies exist only in computers. This shouldn’t scare you, though, because the majority of most fiat currencies also only exist as numbers in a computer system. They require distributed systems to ensure integrity and reliability, and they can be a good alternative to national currencies. They are, in the simplest terms, digital records held by many parties that track how much currency any single wallet holds.

Some of the benefits of cryptocurrencies include decentralisation, deregulation, anonymity, increased transaction transparency, and the facilitation of cross-border trade. Cryptocurrencies are not based in any single country or jurisdiction, because the ledgers and servers are spread out over the globe. Since there is no central bank, the system is distributed and therefore not easily manipulated either by large institutions or by governments. This means there is little regulation and more freedom on who spends how much on what and where. This benefit is enhanced by the fact that there is less private information attached to each transaction. There are even cryptocurrencies whose main goal is to provide an untraceable, secure, and anonymous means of payment.

Payments are transparent because every transaction can be verified by anyone. This means fraud is more difficult because there are many copies of the transaction record available for anyone to see. Furthermore, everyone knows how much every wallet contains (though real names are not included). The public balances come from the way in which balances are implemented in the technology.

As for cross-border trade, since cryptocurrencies are non-national, anyone can pay anyone anywhere without needing to convert currencies. This raises interesting questions on conversion and payments, as owning 1 BTC (Bitcoin’s currency symbol) in France and owning 1 BTC in Thailand are not the same. If converted to a local currency, it means much different buying power in the two host countries.

How they work

There is a distributed ledger or a publicly viewable list of transactions. Since they are distributed, there is more than one copy (there are actually a lot of copies). There are “miners”, who are like the keepers of the system.

Whenever a transaction is made, the keepers of the system broadcast the transaction to everyone. The transaction is placed in a pool of pending transactions, whose order of addition to the chain is determined by competing miners. Participants choose a transaction and solve a math problem linking it to the last recorded transaction. Whichever miner can solve their problem first gets to add their transaction to the end of the chain, effectively determining a unique order.

If two miners finish different blocks at the same time, the blockchain branches. Each node keeps its own copy of the transaction set and works from that. Once the next block is solved, all nodes switch to the transaction set used by the last solve.

Since transactions are simply messages with the sender, receiver, and an amount, it is essential that all transactions are signed. This is completed using the sending wallet’s private key, and the signature is unique for each transaction, so it cannot be duplicated. Furthermore, a message cannot be altered or the resulting signature will no longer be valid. Even more, since transactions are lumped together in blocks, if one transaction changes, the hash output of the entire block changes, and hence doesn’t link correctly with the next block – i.e., it is not possible to modify blocks undetected.

Balances are not stored in the system, but they are based on previous transactions (basically add prior transactions A + B + … to determine if you have enough for transaction 1). This requires that “unspent” transactions be added every time one wants to send money, but it does not require the processing of the entire blockchain (that would be rather inefficient).

Where does Cryptocurrency get its value

Like fiat currencies, cryptocurrencies have no intrinsic value. They’re just numbers stored on a system somewhere, much like the way modern digital banking treats national currencies. Fiat currencies then derive their value from the collective faith of a society using them. If A believes B will accept USD, then A will accept USD for whatever they want to trade, too. B will only accept USD if s/he thinks C will also take USD, and from this collective faith, the value of USD arises.

Cryptocurrencies are similar. They are only worth as much as everyone deems them to be worth. One advantage for national fiat currencies is that a central authority issues and regulates them, and one can generally trust the government in this regard. Furthermore, governments require that taxes be paid, and they will usually only accept their own currency for this. Hence, to be a citizen of a country, one must deal with the national currency. This is a good basis to simply use the same currency for every transaction within the country.

Major Price Gains (and a major adoption event)

One major reason for the generally increasing value of cryptocurrencies is more widespread interest. While cryptocurrencies may not be prevalent, they do have a following on the Internet, and many people will ask for cryptocurrencies donations or payments. If the demand for such currencies increases faster than units are added the price will rise.

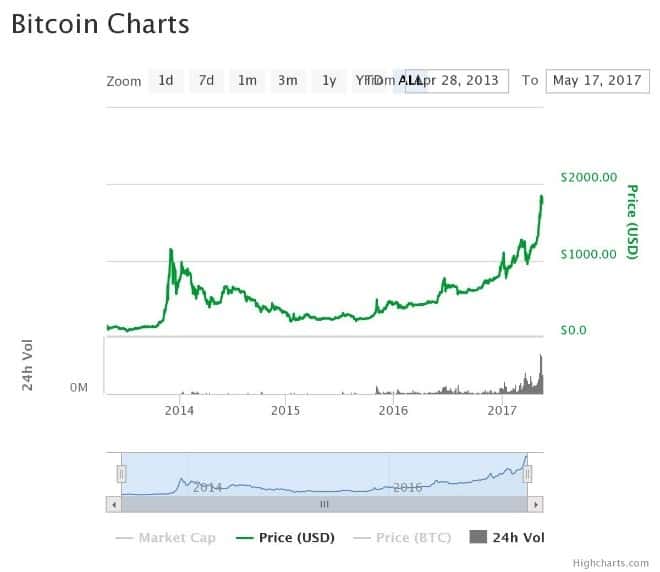

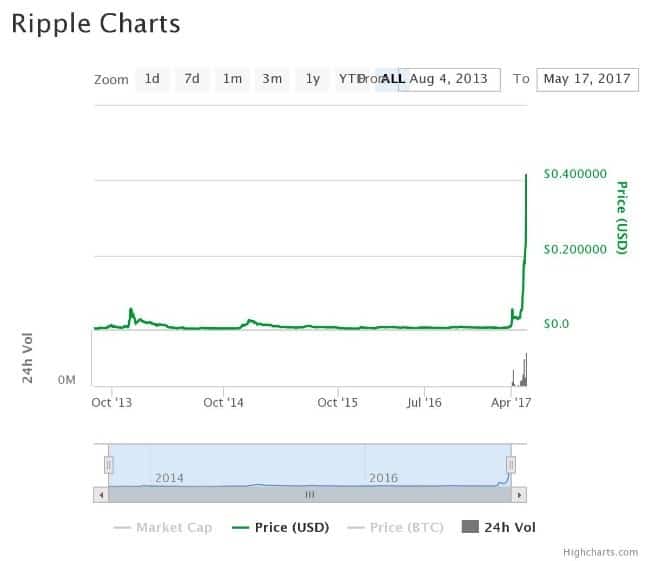

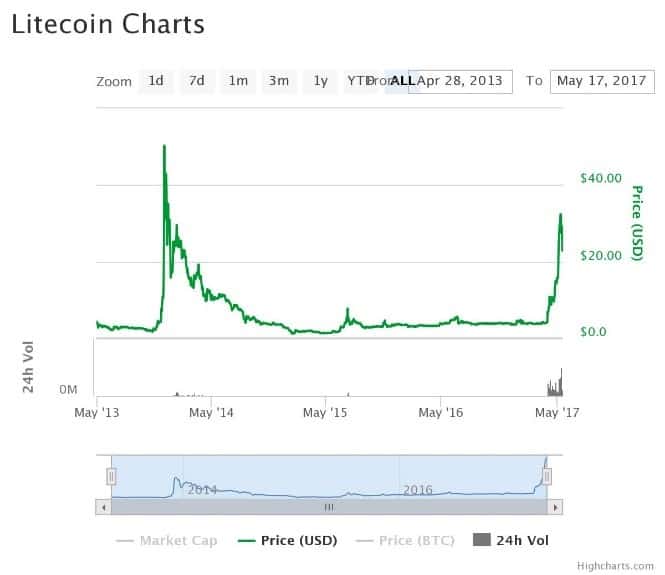

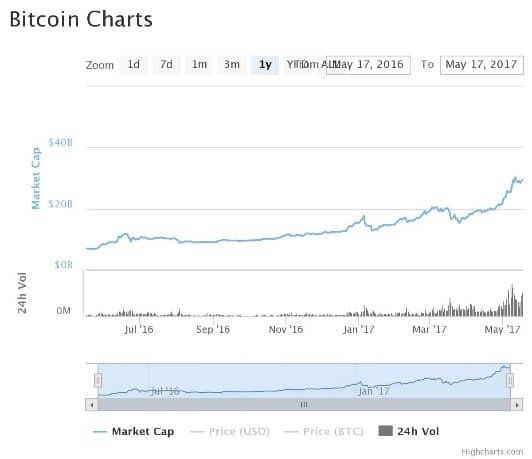

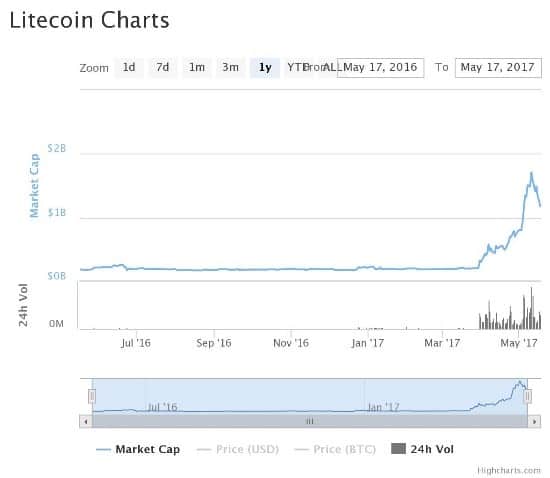

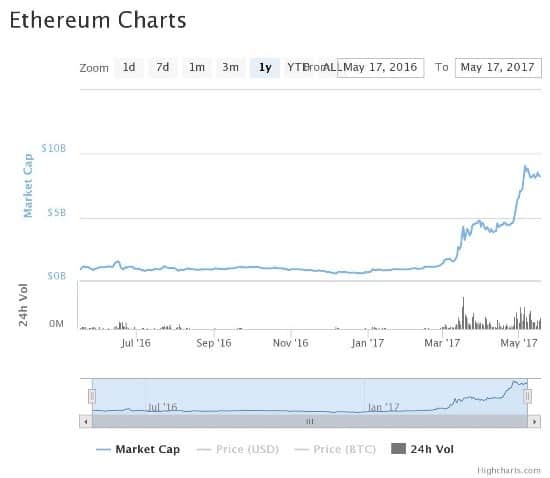

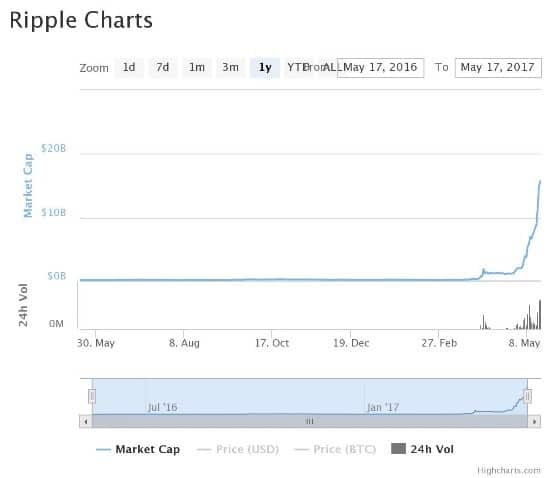

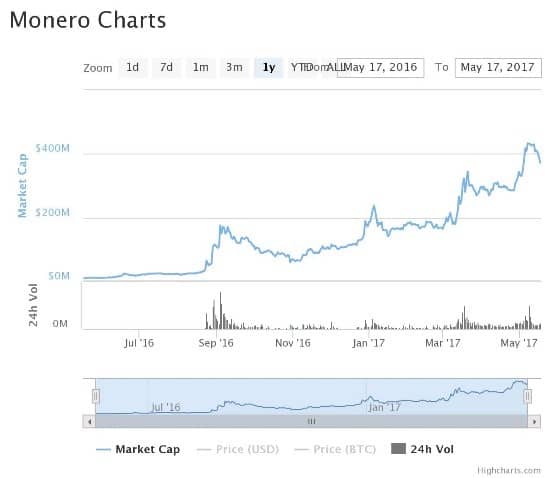

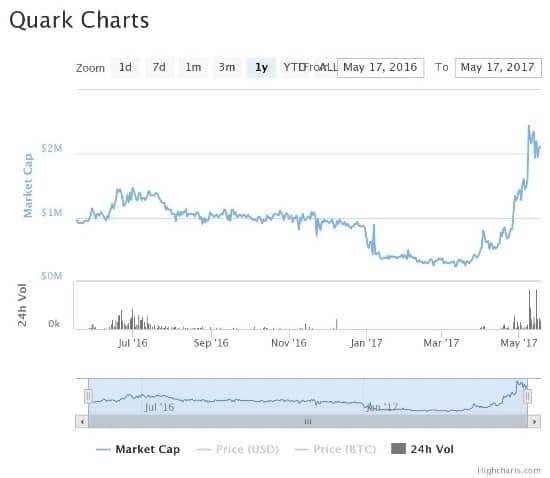

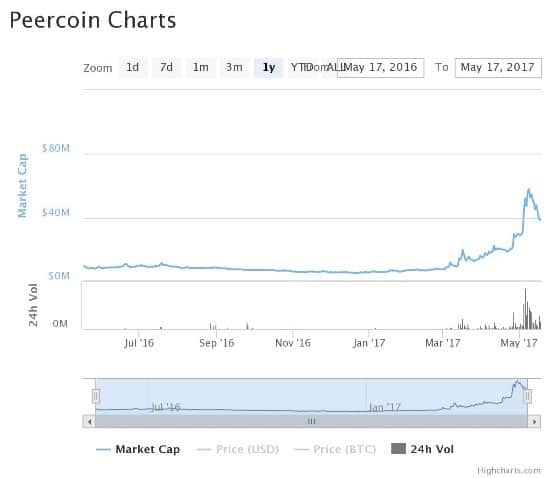

Looking at the charts of the four largest cryptocurrencies after conversion to USD, it looks like there has been a significant increase recently in all four (not all the same scale, as these are the lifetime charts). This is a phenomenon that is clear in 2017.

Fears over capital restrictions and government spying may be pushing up the price. A renewed interested in privacy, especially after the Snowden leaks, might be a reason. The increasingly watchful eye of Big Data by both Google et al. and the banks and credit card companies may be a reason. The wider general acceptance is almost certainly a reason.

Government Acceptance?

This acceptance extends to governments. Most notably, Japan, a market highly accepting of innovative technologies, recognised Bitcoin on April 1st, 2017. It is also set to standardise blockchain technology. This acceptance by the world’s third largest economy is a huge boon to cryptocurrencies. There is a clear uptrend for the four largest cryptocurrencies around the time of recognition. Russia is also attempting to legitimise, as it would help the government crack down on money laundering.

Why is cryptocurrencies value always fluctuating against national currencies

It is important to note that national fiat currencies are valued against other currencies based on the state of the issuer’s economy. If it is expected that many people will want to buy Korean products, there is more demand for KRW. This means each KRW costs more JPY, whether the central bank of Korea does anything or not. Cryptocurrencies are really no different, but they fluctuate much more.

Looking at any charts of cryptocurrencies against a national currency (usually the USD, but it doesn’t matter), one can see there are huge fluctuations. Since there is no central authority, there is no one to stabilise cryptocurrencies against national currencies. One of the libertarian goals of many cryptocurrencies is exactly this fact: market forces are the only forces that influence the value.

Advocates of a global cryptocurrencies system argue that as it becomes more popular the value should stabilise on its own. The main driver of upside movements so far has been more interest, i.e., more demand. It is somewhat similar to real estate. If someone buys 100 acres in a secluded area, it may not be worth much at first. However, if the area starts to become populated, the original owner can divide the 100 acres, unchanged in physical size, into smaller pieces, each worth as much as the original 100 acres. However, there is an upper limit to the divisions, because people can’t build houses on one one-hundredth of an acre (let’s ignore building up for this example).

Cryptocurrencies may appreciate over time, but there is also an upper limit to the number of units that are available in a currency. For example, Bitcoin miners will no longer receive coins for solving the blockchain linking problem around 2140. This is when the supply is expected to hit 21 million BTC, which is the set upper limit. At this point, coins will probably start to fall out of circulation without a replacement.

Each cryptocurrency has an associated “market capitalization”, or what the entire exchange would trade for in a national currency equivalent. This can be a determinant in which system to use because someone trying to move large amounts wouldn’t be able to trade on a small exchange or currency.

Differences between Various Currencies

Note: the charts in this section reflect MARKET CAPITALIZATION over the last year (as of May 17, 2017). The previous section was prices over the last few years. These are not in exact lockstep because the number of coins (units) increases with time.

There are many cryptocurrencies out there. They have different features for different users. This is actually one major problem for widespread adoption – without a dominant currency, which one should people adopt? Small ones inveigle people with potentially large gains, but big ones have a better chance of acceptance by more people. Being early on a new social network could give you star status later, or you could forever be confined to a quiet corner of the social media space.

Here are the four largest ones, each with a market capitalisation over 1B USD.

Bitcoin (BTC, MC: ~30B USD) – by far the largest and most well-known, this is the cryptocurrency that really kicked off the revolution. Its market cap (MC) is around 30B USD, and it has reached 350k transactions per day on busy days. The currency has an upper limit on the number of possible coins (21 million), but you can trade as little as one one-hundred-millionth of a BTC, so you don’t have to worry about it becoming too expensive to do daily transactions.

Litecoin (LTC, MC: ~1.6B USD) – this cryptocurrency’s main feature is that it is much faster to transact. Since each transaction takes so much calculation, BTC transactions take upwards of 10 minutes to confirm. This is not feasible for paying on-the-go. LTC gets the time down to about 2.5 minutes, though that is still much longer than the seconds it takes for credit cards or cash.

Ethereum (ETH, MC: ~8B) – ETH is the second largest cryptocurrency by market cap, sitting at about 8B USD. ETH was originally designed to be a platform and not really a cryptocurrency. The transaction time is on the order of 10-15 seconds for confirmation, which is a huge improvement. ETH are also released every year, so there is no hard upper limit of ETH like with other cryptocurrencies. This means that not all the coins are in the hands of early miners.

Ripple (XRP, MC: ~7.2B USD) – XRP has no public ledger, but instead uses an “iterative consensus process”. The result is a much shorter transaction time (a few seconds), and it uses much less computing power. Ripple is its own exchange, and hence there is no fear of an exchange vanishing (like the fiasco that was Mt. Gox).

There are many more cryptocurrencies, and here I mention a couple with interesting features. This is by no means an extensive list, as there are literally hundreds of CCs. These are just a couple that have interesting features (both I and others (1, 2) think they’re interesting).

- Monero (XMR, MC: ~420M USD) – the interesting feature here is that there is a “ring” of signatures for enhanced privacy. Fake signatures are mixed in with real ones, so it isn’t possible to tell which account sent which request.

- Quarkcoin (QRK, MC: ~2M USD) – claimed to be a more secure cryptocurrency compared to BTC, with 9 rounds of hashing from 6 different functions. This means there is even less ability for fraudsters to change transaction history. It is also meant for consumer miners, so its maintenance does not require massive server farms. The CC peaked in early 2014 but has since fallen very far

- Peercoin (PPC, MC: ~50M USD) – designed for large PPC holders to get even more. Its system to ensure integrity implies those that have a bigger stake are more likely to win the mining competition

Dangers to Widespread Adoption

The greatest barrier to widespread adoption is acceptance. If you can’t use it to buy a coffee at your local shop or a train ticket at the station, no one will use it. The first step in expanding acceptance is for large companies to accept them, and some do. Here is a list, longer than one might expect, of companies that accept at least Bitcoins. Unfortunately, there are not many big names on there. Once your local shops start to accept it, it will become more feasible for the average person to adopt it.

Another major problem is fragmentation. Currently, Bitcoin is the largest one, but there are many competitors that take market share. One must be adopted as a standard – people don’t want to use five different currencies, all fluctuating against each other, in their everyday life. Businesses also don’t want to have to set up all the tech to accept five different currencies and always adjust their prices.

It not only exposes businesses to wild fluctuations between customer cash inflow and material buying cash outflow, but sovereign nations will also be open to the fluctuations of the global market without a means to control the money supply in their own economies. This is something hardcore libertarians champion, but the average person is probably not interested in his country losing control of such an important affair as the economy.

Technical issues are another issue. Of course, it is possible that a bank’s electronic accounting system fails, but CC systems are very new. Do we really want to risk a potentially catastrophic meltdown of our economy because there was some exploit? At least with fiat currencies, people can still trade physical notes of cash to buy food and water even in a disaster.

Conclusion

So, what do we make of cryptocurrencies? They are an interesting technological novelty for now. If they can be completely secured, beyond doubt, and many people start to adopt them, it is entirely possible the future will be transacted in cryptocurrency. At this time, though, they are really only useful as a speculative investment tool for early capital gains or FX traders who think they can guess the direction.

You can track personalised financial news for these cryptocurrencies and on our award-winning platform CityFALCON here. Below is a screenshot of our platform.

20/06/2017 at 10:55 am

Really I impressed from this post. The person who created this post is a genius and knows how to keep the readers connected. Thanks for sharing this with us.

05/11/2017 at 3:56 pm

Very detailed explanation of cryptocurrency. Thanks for such an amazing post.

08/01/2018 at 12:49 pm

Great article! I was looking for this information for a long time. Thanks for sharing such a wonderful post! Keep up the good writing.

14/02/2018 at 9:09 am

What a informative article. Thanks for sharing it.

05/10/2018 at 2:17 pm

Thieves are everywhere and yes they are present on the crypto industry too. This cyber criminals make it hard for people to trust cryptocurrency even more! I hope potential investors should gear their minds with the right knowledge about it by checking and reading blogs about crypto. There are blogs right there which discusses everything form bitcoin prices to bitbay news to cryptocurrency exchanges and so much more!

22/03/2019 at 10:35 am

Thanks for sharing it.