You have excess capital and want to make an investment. Perhaps you want some stability, so you look to the fixed income market, where your return is, well, fixed. Or perhaps you want a lot more potential upside, and a lot more risk, so you take to the private equity markets. You might try WiseAlpha for the first investment or visit Seedrs for the second type. But you’ll still need to perform due diligence before you make the investment and track the progress of your portfolio post-investment. That’s where CityFALCON comes in.

Previously, investors and traders on those platforms would have to venture out into cyberspace on their own, finding relevant and trustworthy sources of information. As of November 2019, though, WiseAlpha and Seedrs will directly integrate CityFALCON content, making the due diligence process that much easier for retail investors.

Having invested in private companies and startups myself, I’ve experienced the pain associated with conducting pre-purchase due diligence and tracking progress post-investment for low-coverage securities. At CityFALCON, we are working to cover all the content that investors need to make informed decisions – news, company filings, sentiment, analytics, and alternative data. Using that as a basis, we are now working with Seedrs to provide as much transparency as possible in the private markets, where it is not easy to find timely content, while also providing a centralised location for due diligence to WiseAlpha, too.

Who are WiseAlpha and Seedrs?

Both are upstart, UK-based companies in the financial industry, and both now use CityFALCON content to power some of the data available to their customers.

WiseAlpha is an innovative corporate bond marketplace, whose main selling point is fractional bonds. They enable everyday investors to buy corporate bonds in clips of £100, financial products that were traditionally reserved only for a few institutional players due to minimum investment requirements.

This fractional offering makes it easier for retail users to buy bonds and, importantly, to diversify bond holdings. WiseAlpha uses cutting edge technology to improve the financial wellbeing of individuals and strongly believes in democratisation, empowerment, access, and transparency – just like us.

WiseAlpha’s mobile app with integrated CityFALCON Feed

Seedrs is one of the top equity crowdfunding platforms, where retail investors and traders can enter the startup and private equity market easily. Similar to the corporate bond world, traditionally private equity and venture capital were the domain of wealthy, well-connected investors, but companies like Seedrs have brought it to the public at large. They even have a secondary market where shares can be traded to others, which used to require finding buyers through brokers in an expensive process.

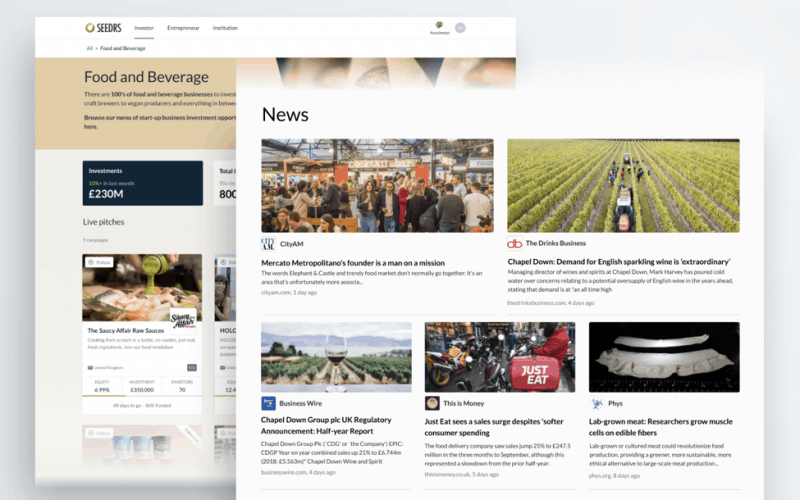

Financial news on Seedrs, powered by CityFALCON

How CityFALCON Complements Them

While it is relatively easy to find information on public companies – there are plenty of places to find news, company filings, and press releases, including most large company’s own websites – it is much more difficult to find relevant and important information for private companies. These companies may still have official filings, but they’re not so conveniently accessible, often requiring investors to look to poorly-designed, confusing government websites for the information. Furthermore, even for public companies, it is not easy to find alternative data and analytics like sentiment analysis, simply because the industry is slow in adopting and legitimising these data points.

The private company situation changes with the launch of our filings feature, which processes companies filings from multiple sources, including LSE (RNS feed) and Companies House in the UK, with the US SEC on its way. We’ve also recently made our sentiment analysis feature available, and we’re in the process of incorporating alternative data and other analytics. Side note: these features are only available via API for now, but we will be releasing a consumer front-end version in the future.

By delivering filings, sentiment, metadata, and news through our API, we make it much easier to distribute that information to customers or to automate due diligence based on filings, alternative data, and analytics.

Seedrs then provides this information to potential investors on their platform. From Joel Ippoliti, the Chief Product Officer at Seedrs:

Our ambition has always been to bring the liquidity and the transparency of the public markets to the private equity sector. Today’s partnership with Seedrs alumni company CityFALCON, a provider of professional grade market intelligence to institutions and investors, sees us move a step closer.

Our goal is for investors to come to Seedrs and discover new opportunities just as easily as they might on Netflix and to conduct a level of pre-purchase research just as conveniently as they might on Amazon. This is just the beginning of our journey beyond crowdfunding.

We’re glad to be helping them out on their mission, as they’ve been instrumental in providing a platform for our own funding and therefore survival.

For WiseAlpha, we will also be providing distributable data to them so they can pass that along to their customers, simplifying the due diligence process for bond investors. From WiseAlpha, concerning their integration with us:

WiseAlpha built the first digital marketplace in the world for investors of all sizes to earn radically better interest from some of the UK’s largest companies. We’re partnering with CityFALCON to bring our members the latest news about the companies they invested in.

How You Can Partake in the Due Diligence Revolution

Enterprises are already able to use our API with these features, and our most affordable plan is accessible for dedicated traders and investors (US$50/month for personal use, with a costless version coming soon). So if you want to start benefiting from our aggregation, curation, processing, and distribution, you can already do so via API.

We will be launching filings, analytics, and alternative data for our website- and mobile-based consumer plans in the future, which are even cheaper than our API subscriptions, so keep checking back for those. Or better yet, sign up for announcements using the form on this page so you know when they go live.

Summary

All three companies – WiseAlpha, Seedrs, and CityFALCON – are on missions to democratise the financial world for regular people, levelling the playing field so the average investor can participate alongside institutional and wealthy investors.

We’re now working together to achieve our goals, and the future of finance looks bright for the average market participant.

About CityFALCON:

CityFALCON provides personalised financial content for investors, traders, and anyone requiring access to relevant, high-quality financial information. We convert unstructured data into structured content and provide insights using natural language processing (NLP) and machine learning. Clients and users can also enjoy a hands-free experience using our voice and chatbot technologies.

CityFALCON covers over 2,000 quality content sources from around the world including public, paywalled and non-public news, company filings, sentiment, analytics, and alternative data. Our coverage of securities, topics, sectors, locations, people, and products is growing rapidly and currently stands at 250,000. We plan to simplify due diligence of every major public and private company around the world, at a fraction of the cost charged by current providers.

About Seedrs:

Seedrs allows all types of investors to invest as little or as much as they like in businesses they believe in and share in their success. And it allows ambitious businesses in all sectors to raise capital and build community through an efficient, online process.

Seedrs has funded over 900 deals to date and has had over £720 million invested on the platform. All investments made through Seedrs offer voting shares to investors and use professional grade subscription agreements. This ensures that investors get the same level of protection that angel investors and venture capitalists enjoy.

Seedrs is backed by Augmentum Fintech PLC, leading European Venture Capital firms as well as over 2,500 of its own customers. Seedrs is authorised and regulated by the UK Financial Conduct Authority.

About WiseAlpha:

WiseAlpha is the first digital marketplace in the world where investors of all sizes can access the multi-trillion-dollar market of institutional corporate bonds.

We are building WiseAlpha because we believe in a fairer investment world, where everyday investors are not shut out by the financial elite from accessing the best investments.

WiseAlpha offers investment accounts for individuals and corporates to access online or via our app, as well as APIs that enable other platforms to connect into our unique marketplace.

Leave a Reply