The markets are in chaos approaching full panic as novel coronavirus, also known as COVID-19, and its fallout rankles markets, disrupts supply chains, and has politicians scrambling to contain the virus and appease the public. The S&P500 is down 10% over the past month; both the FTSE and DAX are down 20% in Europe; and Japan’s Nikkei 225 has fallen 17% while Korea’s KOPSI is down 11% and Hong Kong’s Hang Seng 8%. Oil has taken the hardest hit and trigged a massive sell-off in stocks when the commodity itself plunged 21% over one weekend in response to the collapse of OPEC talks and a new price war between Russia and Saudi Arabia. For investors, things just keep getting worse, and many see this as the time to exit the markets.

This isn’t the only downturn we’ve seen in the last two decades, and at least so far, the dotcom bubble burst and the 2008 Financial Crisis certainly hurt markets worse. In the last decade, there have been a few scares, such as the 2016 crash in China when investors were no longer allowed to remove their money. And for our crypto-investing readers, 2018 was certainly brutal. But capital markets haven’t contended with a deep decline for nearly 12 years when the Great Recession kicked off in 2007-2008.

But is now the time to invest? We think it may be prudent to wait a little while and see how the markets fare before jumping in to capitalise on the panic of the last few days and the slower descent of the last month.

All arguments and views in this piece are not to be considered financial advice, and it is very possible we are wrong on these predictions. This is “food for thought”, not “material evidence for investment decision making”. Please do not use our blog post as your only source of information for investment decisions!

1 – Markets are overvalued, and there is no margin of safety

Are the markets cheaper today, 10 March 2020, than they were last week or last month? Sure. But they’re not cheaper than they were a year ago. They’re still overvalued now, and they will be until they fall below their intrinsic values. Only then will there be the so-called “margin of safety”, wherein the market price is below the intrinsic value. And only then would most value investors consider them proper investment targets.

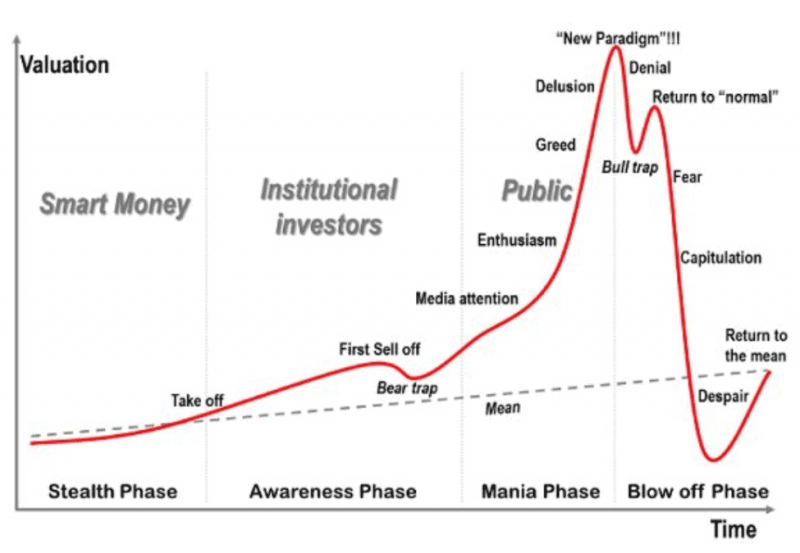

It is also instructive to ponder this graph of the Anatomy of a Bubble:

Since we have seen markets rise and rise and rise, it would seem we are heading into the “Denial” stage and are likely to see a rebound shortly after the panic hitting the markets today. That rebound is fuelled by investors that believe the overall situation is not that bad, the markets are not overvalued, and that the previous trend will continue its upward trajectory.

Whether we are in a bubble is always confirmed only after the crash has passed, but if you believe stocks are currently overvalued with historically high PEG ratios, then you may want to avoid buying into the storm for a couple weeks or months until after the real carnage takes place.

2 – Excess leverage and liquidity will evaporate as margin calls come in

The levels of leverage and liquidity have been high as investors and traders scrambled to generate profits from the longest-running bull market in recent history. Moreover, people are living longer and many millennials have started their investing journey with any excess cash in robo-advisors or other new-age solutions.

But all this liquidity, especially that which has been funded by leverage, will evaporate as panic sets in. Unleveraged investors may pull out of positions, but leveraged investors will be forced out as price drops of 10% in capital markets trigger margin calls. When a margin call is triggered, the capital to fulfil it must come from somewhere. It usually comes from the sale of assets held by leveraged investors, and that means stock prices fall even further – triggering further margin calls or at least adding downward pressure on prices.

3 – The massive inflow to passive funds will reverse

Money has poured into passive mutual funds over the past decade, leading some to believe index funds will lead to the next crash – among them the famous Michael Burry, the main character of The Big Short who predicted the collapse of the housing market before the Great Recession.

Fuelled by the prevailing attitude that the market always rises in the long run, many people in the 2010s parked their capital in passive index funds to take advantage of the wisdom. However, when large numbers and scaling are involved, things often become self-sustaining and even dangerous.

The flood of money into index funds, and particularly mutual funds, means such money was indirectly responsible for rising prices overall. If you’re not sure why, see our educational resources on various fund types. Now, many investors are prone to panic, even if the wisdom of the day states that Markets Inevitably Rise. The same thing was said of the housing market until it didn’t, after all.

Investors’ collective panic means the redemption of shares at mutual funds, by far the largest group of institutional investors. The passive funds have no directive to actively manage sales of stock – as their name would suggest they act passively – and this means selling stocks as they’re reflected in fund portfolios to repay investors. That puts strong downward pressure on markets, particularly as long-term investors start to panic and try to preserve capital.

4 – Cash flow, earnings and expenses, and valuation struggles

As consumer spending contracts, so too will cash flows. As companies succumb to insolvency due to poor cash flows, they will no longer pay suppliers, who will themselves start to struggle with cash flows. An early warning sign was Yes Bank in India, which collapsed just last week.

Valuations, too, will plummet as sky-high valuations are no longer acceptable to a frightened market. The WeWork fiasco demonstrated that companies are way overvalued right now, but with the possibility of a grinding slowdown of the global economy, we can expect valuations to fall even further.

Even if we don’t witness a spate of insolvencies, we are likely to see a drop in earnings. The tourism industry will be hit very hard and may take years to recover, particularly if capital and jobs vanish for those who enjoy travelling. But a wide selection of industries are ripe for a downturn in earnings, while crashing prices will bring PE and PEG ratios down considerably. So even though earnings will be falling, stock prices will probably fall faster, aligning ratios to a more historically normal level.

5 – Central Banks left without tools, but governments can still assist

Since the start of the Great Recession, central banks performed all the tricks at their disposal to stabilise and calm markets. And it worked, but they never recovered their tools to do it again for the next crisis.

One of the most powerful tools central banks wield is interest rate adjustments. But with historically low rates, lowering them further is not an option for the European Central Bank, and unless the Federal Reserve is willing to go negative, the United States has very little room to manoeuvre as well.

Moreover, China’s economy has almost quadrupled since 2007 and is now irreversibly enmeshed in the global community, adding another power player to the global stage and thus complicating the situation. The country is still authoritarian and the Chinese Communist Party (CCP) is perfectly happy to implement heavy-handed controls, which could be quite helpful, but it can easily spook investors if capital can no longer freely permeate the border, too.

While monetary tools are restricted, it is not all doom and gloom. Some fiscal tools are still available to governments, including tax cuts and bailouts. Of course, tax cuts implies less tax revenue and would normally imply less government spending at a time when spending should ramp up. But that’s always been a balancing act for governments. Bailouts could stabilise prices, too, but only after they’ve fallen much farther than the 10% or so they’ve taken in the past couple of days or even as they approach the range of 20% over the last month.

6 – Job losses and uncertainty could curb consumer and business spending

Job losses, partially attributable to weakening cash flows and strengthening expense controls, may exacerbate the situation as losses feed into lower consumer spending and cause even further cash flow issues. Regardless of whether jobs are lost, uncertainty and fear may lead many consumers to switch to saving instead of spending until the coronavirus stops spreading, which could be problematic for companies that are already highly levered via debt or barely containing other costs.

And B2B channels may suffer as B2C channels start to dry up or businesses look to cut costs by severing relationships with other companies until fairer weather appears.

A value investor’s strategy going forward

Buy later

Now is the time to wait, not jump in. Markets are likely to fall further, and few people are adept at catching falling knives. This is the time to preserve capital and avoid losing your hard-earned money as stocks continue to trend downwards. Even if a recovery persists, it is acceptable to lose out on the rebound. What most people cannot accept is watching their capital position deteriorate because they were deceived by the short-term recovery and bought into the Bull Trap, only to suffer even steeper market declines later.

Monitor for value

Of course, at some point the market value will fall below the intrinsic value, so be on the lookout for value opportunities with decent margins of safety. Be especially vigilant for “virus-proof” stocks, as they’ll probably drop along with the markets but they could earn “value status” long before others.

Short the markets

The value investing community is split over whether shorting stocks is “true valuing investing”, because the approach has traditionally taken a long position in undervalued stocks. However, overvalued stocks are also incorrectly priced, and shorting overvalued stocks is analogous to buying undervalued ones when we are seeking the intrinsic value. Thus, if you are comfortable with the risks of shorting and believe there is significant room for markets to move down, COVID-19 and the oil shock may be the triggers that set off deep losses for markets to start off the 2020s.

Seek benefactors

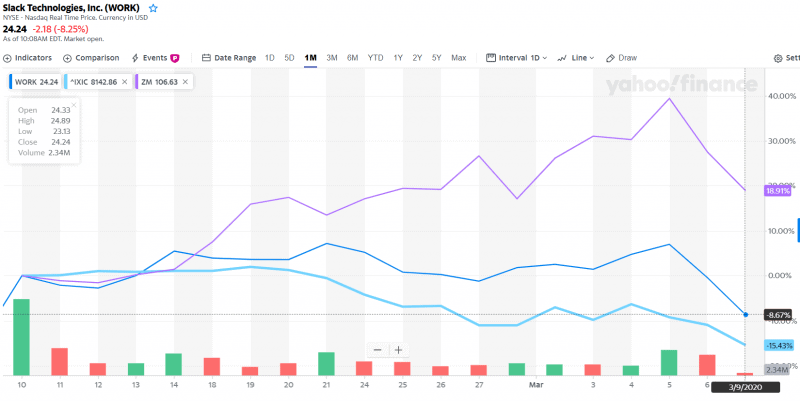

You might want to also pay attention to “new paradigm” stocks, like Zoom or Slack, which we discussed in our Value Investor meetups. If the COVID-19 pandemic continues, we may see a shift away from physical-contact working styles to a more remote style as employers need employees to work but governments or societies restrict movement. Slack and especially Zoom have outperformed over the past month against NASDAQ:

Source: Yahoo Finance.

Useful watchlists

At CityFALCON, our powerful watchlist tool is available for easy sharing. Below is a watchlist that can help you track COVID-19, market panic, and oil. You can simply click the link, even without signing up, and get the latest financial content on these topics.

Create your own watchlists and share it with your friends, coworkers, or family, too, or just send them the link below.

COVID-19 and Oil Price War Watchlist: http://www.cityfalcon.com/watchlists/194eeb30-a1a6-442c-94ad-d21505049255

Leave a Reply