2022 is giving 2020 a run for its money: Russia invaded Ukraine and the spillover is wreaking havoc in markets and geopolitics; Zero-Covid policies in China continue to crush the global supply chain; inflation is pressuring central banks to raise rates rapidly, causing swings in normally-placid FX pairs; and crypto markets – well crypto is crypto but even so Bitcoin dipped below $20k, far from its nearly $70k all-time high.

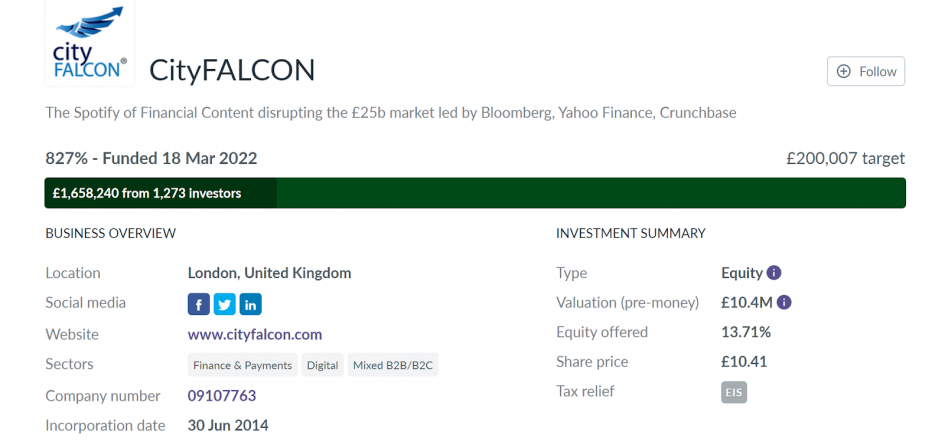

In spite of all of this, the little fintech CityFALCON – that’s us – raised £1.65m (~$2m, ~€1.9m) from a client, a fintech fund, a private investment company, and over 1000 independent small investors to bring improved products to market faster and to market more widely.

See mainstream coverage of the fundraise on Yahoo Finance.

CityFALCON Malta Team at Work

Another fintech raising money easily?

What you read in the startup press almost daily is how companies are raising 2-20-200 million with ease. Untrue! Or at least heavily skewed by survivorship bias. Fundraising has always been difficult and now in these economic conditions, it’s getting worse.

When we started this round, we had less than £100k in commitments, and it was a stressful period for us. Russia invaded Ukraine, and market turmoil ensued. Currencies fell precipitously against the USD, and risk appetite dried up. How would we pay for the salaries for a team of 40 and then we have data and cloud expenses?

Seedrs and equity crowdfunding have been game-changers

Apart from being able to accept investments from £10 onwards, Seedrs also acts as an administrative platform to collect all the investment interests in one place. As potential investors see progress in the campaign, they are more likely to invest. This is what worked for us.

Signing up big clients like eToro and others, and a significant jump in annual recurring revenue, brought us a strong interest in the campaign from angel investors.

We first launched the campaign to our existing shareholders and selected potential investors who we had already discussed the round with. Before this round, we had 2000+ existing investors on Seedrs, and we kept them updated with the progress of the company each month. Several of them invested with some of them signing much larger cheque sizes than expected. These also included serial entrepreneurs with one of them having sold their last company for £500m. The first stage of the campaign took us to around £250k.

Last year, we were a part of a fintech accelerator program by The Holt Xchange, a global early-stage VC firm and platform in Canada, and they joined the round at this early stage, too.

As Seedrs marketed our campaign to their userbase, we saw a slow and steady increase in the campaign. We saw investors who were initially unsure deciding to take a plunge as they saw the campaign progressing well and our runway increasing.

Institutional investors moved much faster than expected

Our original plan was to raise as much money as possible through equity crowdfunding on Seedrs and then raise money from the institutions.

eToro, the social investing network with over 27 million registered users globally, was impressed with the added engagement on their platform and took a small position in the company. eToro powers its News tab with CityFALCON content, providing a quality contextual newsfeed to inform investment decisions and increase engagement. Since we had been discussing and working with eToro for several months, their due diligence process was very quick, and we were able to agree on the value and terms of investment without long discussions.

After eToro and Holt, the final institutional investor, a private investment company, Terance Butler Holdings (TBH), reached out to us about joining the round. They seem to have been following our progress for some time and saw this as the right time to invest in us to scale the business.

Cheque sizes started getting bigger

As we crossed major milestones – £500k, £1m, £1.5m – we saw investors who had already invested in the round increasing their stakes, and the eToro announcement and last-minute deal with TBH brought on more credibility, leading to massive overfunding of the £200k target.

On the success of the raise, Seedrs’ Kirsty Grant, chief investment officer, said “CityFALCON’s raise far outstripped their original expectations and shows the investor demand for opportunities even amidst the current economic climate. We are happy to have been able to support them in their journey”.

Transparency

One final note: Over the years we’ve practiced lean cash management and have been transparent about events impacting the company. Undoubtedly this has afforded us a positive reputation in the equity crowdfunding world, where investors may more easily be conned. This transparency helped us gain investor trust and boosted the round, too. To all of our returnee investors topping up their portfolios this round, thank you!

FUTURE FUND CONVERTED

The last fundraising round, back in 2020, was a convertible debt round. The latest equity round that raised £1.65m was a Qualified Financing event, which triggered the conversion of that debt. This entailed the issuance of further shares but realigned our capital structure to carry almost no debt once again.

We thank the Future Fund and the Seedrs team for this support and assistance throughout the process, and we are grateful to our lead investor in that round for believing in us even in a very scary time (late 2020 was only a few months into the pandemic, even before vaccines were ready).

HOW WE PLAN TO SPEND THE MONEY

We regard investor money as precious and practice lean cash management. Investor funds will be allocated for people, technology and data, product, and marketing, in that order.

People

We’ve built a team of over 40 and many have been with the company for over 5 years. In an industry where people are constantly poached on better terms, this is an accomplishment in loyalty. We have rewarded our loyal employees and will scale up the team in the coming months. Inflationary pressure across every aspect of the economy has forced our projections higher, but we are confident in containing costs without sacrificing quality.

Technology and Data

Processing and storage make up our biggest expense after our team. While we constantly look for ways to make our technology usage more efficient, there is a limit to how little we can spend, and there is always a tradeoff with performance. To improve performance and allow us to serve more clients while retaining strong SLAs, we will spend some of the funds on infrastructure and processing costs.

Another major cost is data, particularly around licensing Premium content, which we display to users for no extra cost than our Gold subscription. Currently, we have selected content from 1000 publications, and as we start marketing, we will explore more partnerships for major publications for more appeal.

If you’re already a Gold user, check out our Premium section now.

Marketing and Sales

All leads and sales have been inbound, driven by our strong SEO ranking. We believe our product is now mature enough for more aggressive marketing, and so we will start marketing and advertising digitally this year. Part of the funds from this round will be used for this purpose.

Most of our revenue so far has been sourced from enterprise clients, and we will continue to service such clients. We still maintain our mission to democratise access to financial content and therefore we expect a major portion of our revenue in the future to be sourced directly B2C. The marketing will bring this closer to fruition.

In Summary

Despite the war in Ukraine, inflation responses, and a general pullback from risky assets, we managed to raise £1.65m from a diverse group of investors through good timing of onboarding a major client. It was not all strategy and execution, though, as luck and timing played a part in the success. Our track record of transparency and lean cash management probably also helped to bring back existing investors and support a good reputation that new investors liked.

Leave a Reply