Introduction

It’s been 10 rewarding years since I launched the company from my tiny London bedroom in a shared apartment in June 2014. As expected, there have been many ups and downs. My goal of building a cash-flow-positive sustainable business has been affected by inflation, Brexit, COVID-19, the Ukraine war, and the current economic downturn. However, I’m glad that we are still here, surviving and disrupting, and we should be able to achieve our goal of a sustainable cash-flow-positive business in the coming years, if not months.

I dedicate this post to all those who have supported us over the last decade – family, friends, employees, advisors, investors and clients, and most of these people continue to support us. The most notable are:

- Fred Becker, who helped me get started, invested in the first round and got his friends to invest.

- My ex-boss at KPMG, who was the first investor and signed big cheques in the first two rounds.

- Dr Zubin Sethna, who called upon his friends to invest in us when we were struggling with our first crowdfunding round on Seedrs.

- Matt Sant, my flatmate in London, who helped me out every time I was stuck debugging my code, helped us adopt machine learning, invested in the company and even loaned money when I couldn’t make the payroll.

- Angel investors, Stephanie Allen and Boris Bruck, who invested in the company early on, given the risks involved. I’m thankful that they believed and trusted in my vision.

- Mark Blandford, a successful entrepreneur, an angel investor and mentor, who supported us during COVID when our entire sales pipeline disappeared and has been supporting us since.

- Seedrs, the equity crowdfunding platform.

- Malta Enterprise, UK Government and Future Fund for supporting us with grants, R&D tax credits, and investment during COVID, respectively.

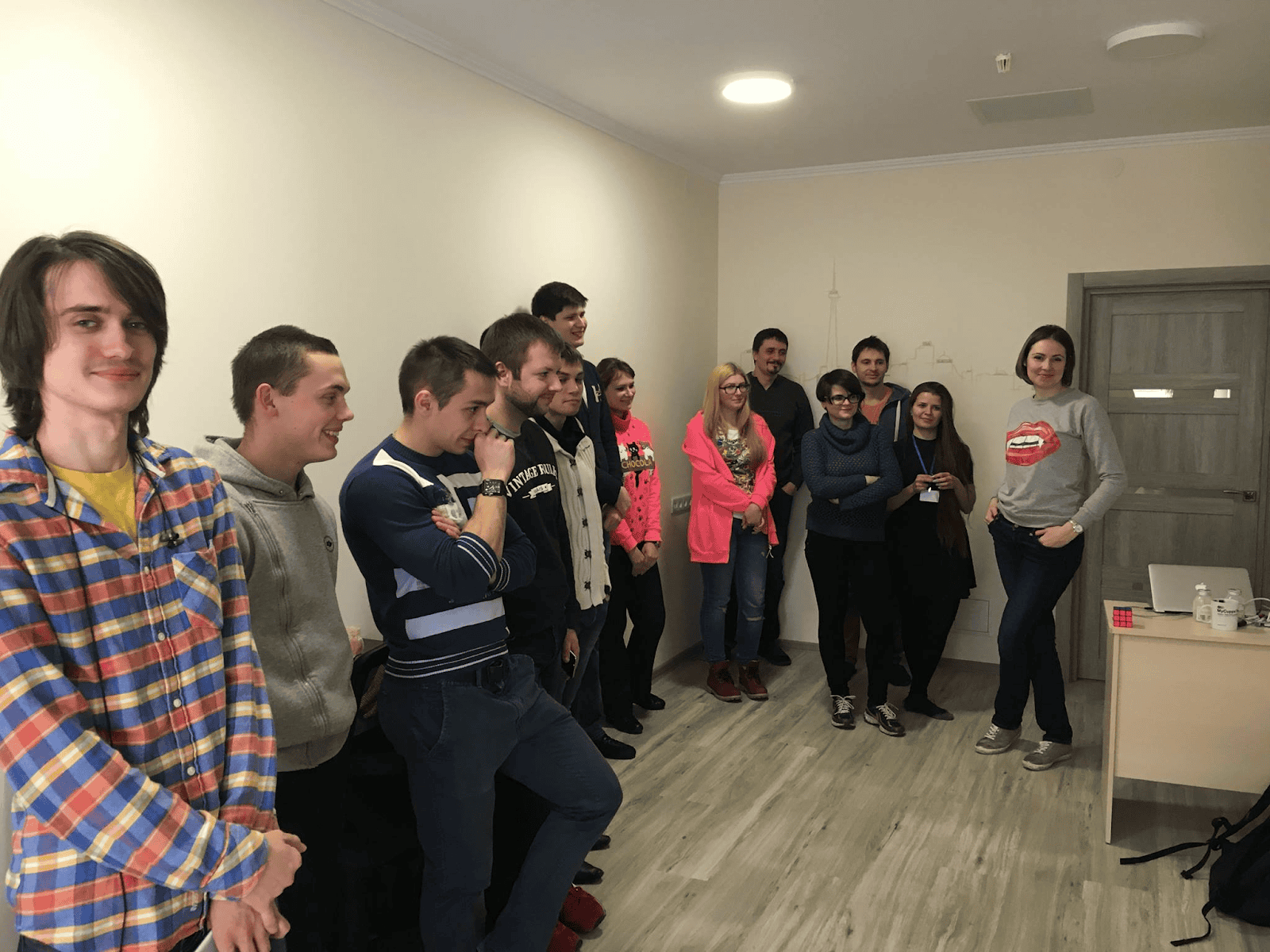

- Our ex-employees, Yaroslav Titenok, Taras Chemeris, Iana Shorova, and Maks Masalitin, who were instrumental in our company’s success, and I learned a lot from them about technology, productivity, and creativity.

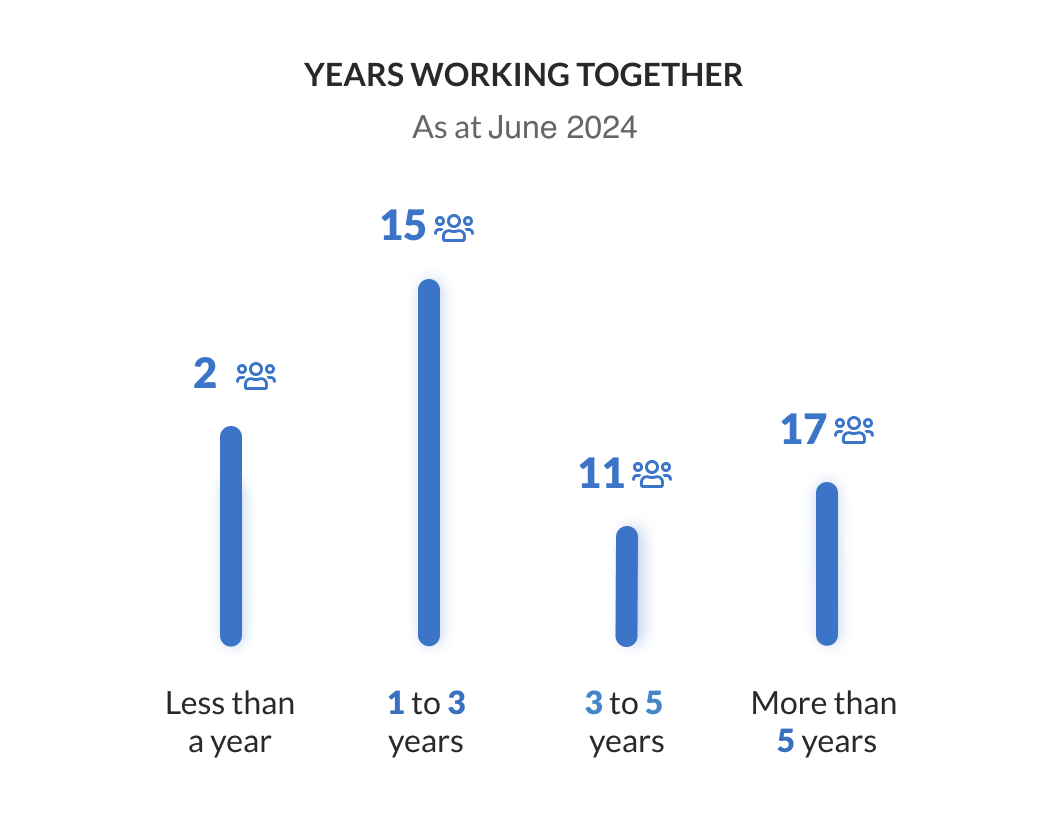

- The team members, especially those who have been with us for more than 5 years.

I am extremely proud that we have built a strong and loyal team, with most senior team members having spent more than five years with the company. We have allowed flexible hours and remote working since the very start, which has allowed people to have a good work-life balance.

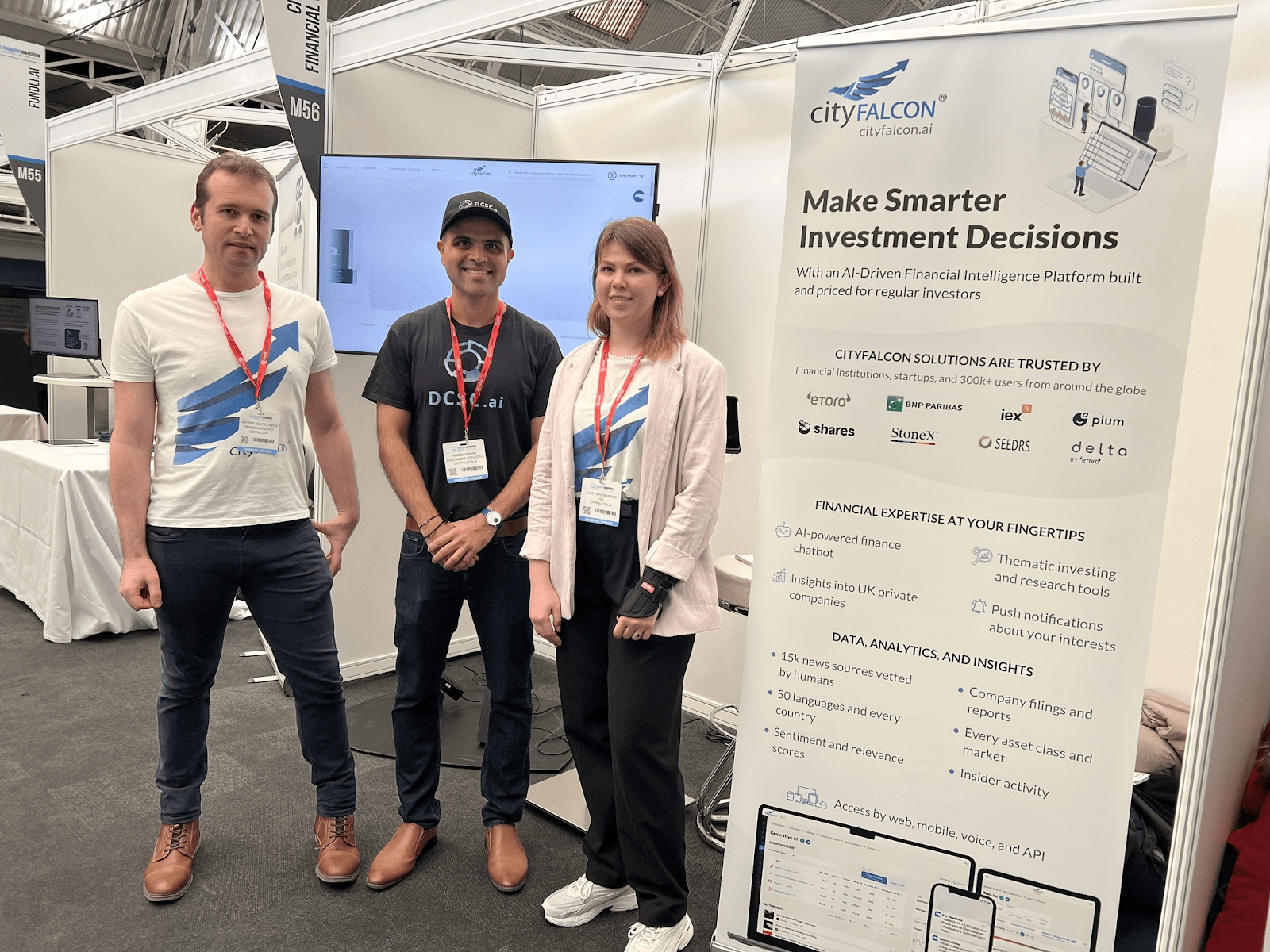

We are also delighted to serve prestigious clients such as BNP Paribas, eToro, Plum, StoneX, and several other FinTechs. Although we initially wanted to be a B2C business, most of our revenue now comes from enterprise clients.

Our business consists mainly of these products: news and other data aggregation and insights, such as sentiment analysis at CityFALCON, an industry-first Dynamic Company Sector Classification (DCSC.ai), an AI chatbot for financial audiences (FinPrompt.ai), and UK Private Company Insights.

Our platform’s core strength lies in leveraging advanced technologies like machine learning and natural language processing (NLP). These technologies enable us to analyse vast amounts of financial news and data, identify relevant information, and deliver personalised insights to our users. We continually improve our algorithms, incorporating feedback from our users and partners.

In this blog post, I’m sharing our story, the highs and lows, pivots, innovations, and vision for the future. We will delve into the challenges we faced and how we have continually adapted and survived difficult economic conditions. We’ll also explore our exciting new ventures, DCSC.ai and FinPrompt.ai, as we navigate the rapidly evolving landscape of artificial intelligence. You could also read my post about completing five years of the company – 15 Lessons I’ve Learnt From 15,000 Hours of FinTech Entrepreneurship

To celebrate our 10-year anniversary, we are offering 50% off monthly subscription for all our products with the coupon CF10ANNIVERSARY

The promo code is valid until the end of August 2024.

Sign up for the chosen plan for CityFALCON or DCSC and apply the coupon before checking out (detailed instructions here)

The Early Days

The Beginnings

The company today is not what I had envisioned at the start, and this is the beauty of starting a company. It’s like the analogy – jump off the cliff and then build a parachute on the way down. On the way down from the cliff, our clients, users, and the market shared with us what products we should build.

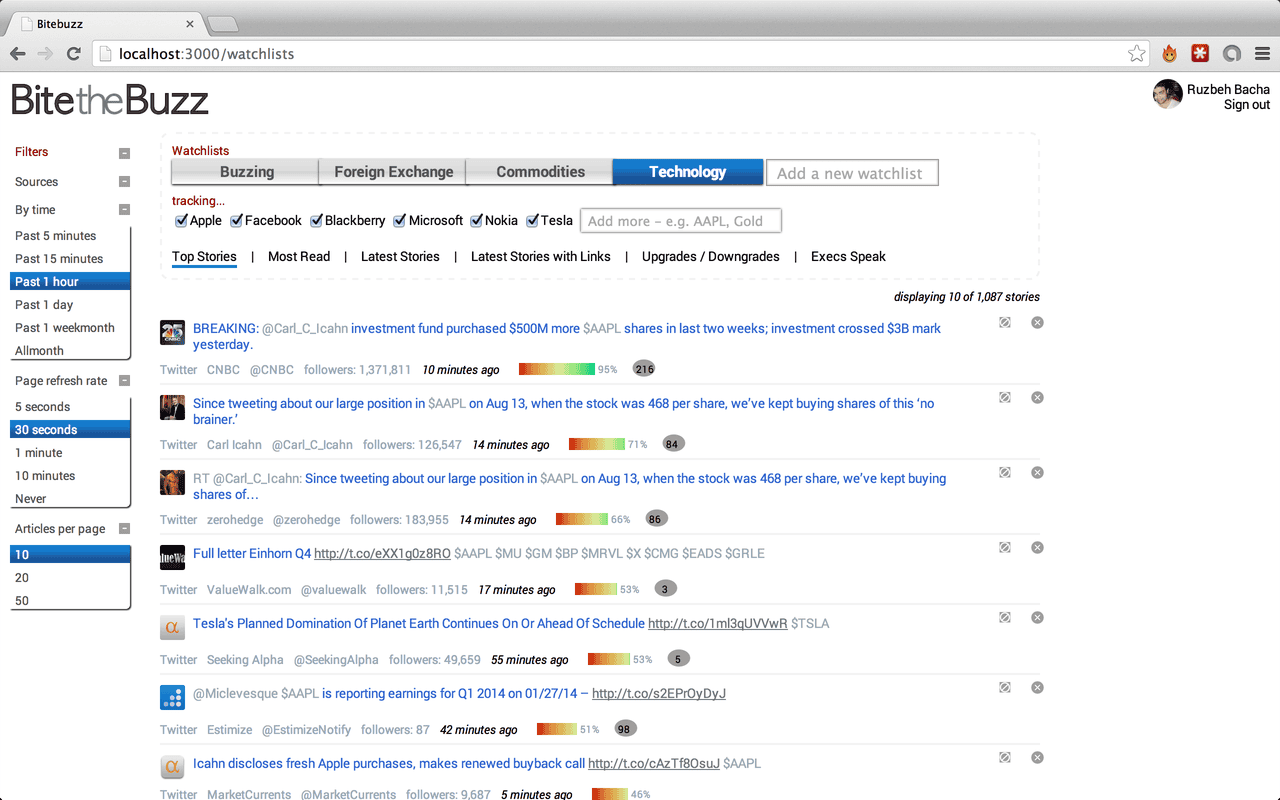

CityFALCON was born out of a simple vision: to democratise access to financial information. Back in 2014, the financial news landscape was dominated by large institutions that catered primarily to high-net-worth individuals and corporate clients. Retail investors and small businesses often find themselves at a disadvantage, needing to pay exorbitant fees to access timely and relevant financial news and data. Moreover, the latest technologies, such as machine learning and APIs, were rarely used in the financial services space.

I envisioned a platform that could aggregate financial news from thousands of sources, filter and personalise it according to user preferences, and deliver it in real time. This was the seed that eventually grew into CityFALCON.

I knew that if I wanted to work in technology, I needed to understand it and not depend solely on developers. After quitting my job at Skype (which was bought by Microsoft while I was there), I learned to code at Maker Academy. Apart from learning the fundamentals of building a website, an app, APIs, etc., I also know enough to manage hiring, working with developers, and discussing technology with investors and clients (including technical teams and CTOs). I’ve shared more about my experience with coding in this blog post for 2014 – From convenience to impact, from security to adventure.

2013, our team product demo (unrelated to CityFALCON) after 12 weeks of learning to code at Makers Academy

After graduating from Makers Academy, I spent 30 days almost nonstop coding (including over Christmas) to build the first version of the site. I then demoed this minimum viable product (MVP) to people in my network and was lucky enough to raise a seed round of £220k in 2014.

Early Struggles and Breakthroughs

The initial years were challenging. With limited funding and a small team, we had to be frugal and innovative. As a first-time entrepreneur without a (technical) co-founder, only some wanted to support me. I wrote about this discrimination in an article – Why Single Founder Discrimination is More Severe Than Gender or Racial Discrimination in the Start-Up World?

I couldn’t afford to build an entire team in London and had only 3-4 team members there. In 2014, I went to Ukraine with the knowledge of low costs of living (and therefore salaries), great talent, and the popularity of Ruby on Rails, on which I’d developed the MVP. After the Crimea annexure, most Ukrainians didn’t want to work for Russian companies and preferred to work with companies in the West. We managed to build a team of around 20 in Kharkiv and improved our product significantly. What I found very striking about the Ukrainians I met was that they were extremely diligent, productive, loyal and dedicated to holding onto a stable job. They loved documenting their work to prove that they had been working. They also have a very respectable habit of counting the productive hours and not just hours in the office.

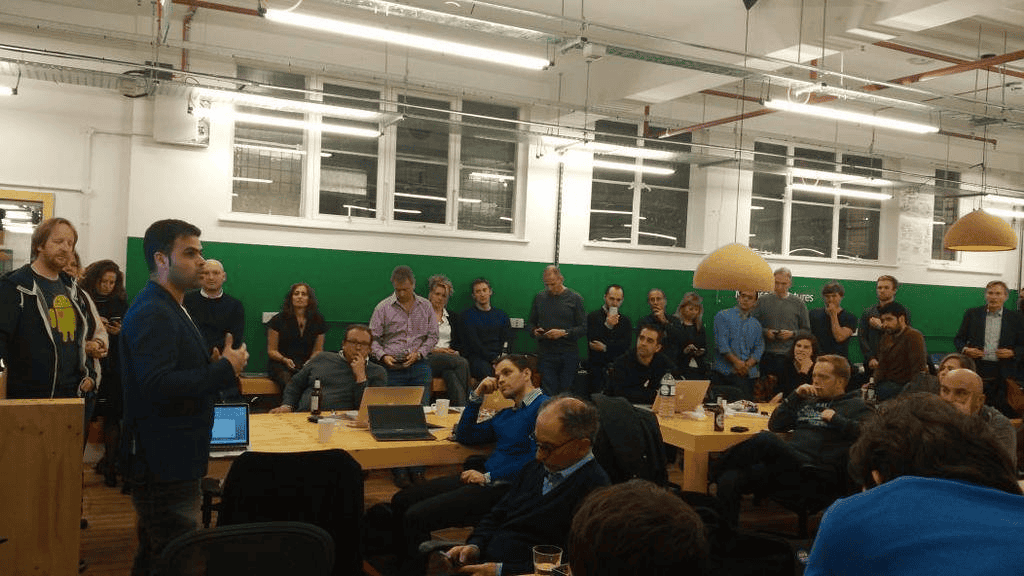

By October 2015, we still needed to understand our target audience better, so I launched the London Value Investing Club. It brought together individuals passionate about value investing. We have had 89 events (including online) since then, made some close connections, and several ended up investing in our company, using our products, and opening more doors to us. Some presenters even managed to get (better) jobs thanks to their public presentations at the meetups, and we even hired one of the presenters ourselves. We expanded this idea to other cities and now have 8k+ members in 6 countries. Our goal remains to create a vibrant community where members can share insights, strategies, and experiences in a collaborative environment. The club serves as a platform for discussing market trends, analysing investment opportunities, and developing a deeper understanding of value investing principles. Join us at our next event if you’re interested.

We had put our product out for free without any paywalls or advertising to get some feedback from the users. In 2016, one of the users who was working for BNP Paribas Wealth Management reached out requesting API access to our content, as they liked what we had built and were interested in integrating it. We didn’t have one, but we built one in time and integrated it into their product. I’m glad to say that they are still a client after all these years. Without the credibility of having such a strong brand as a client, we probably would have struggled to survive.

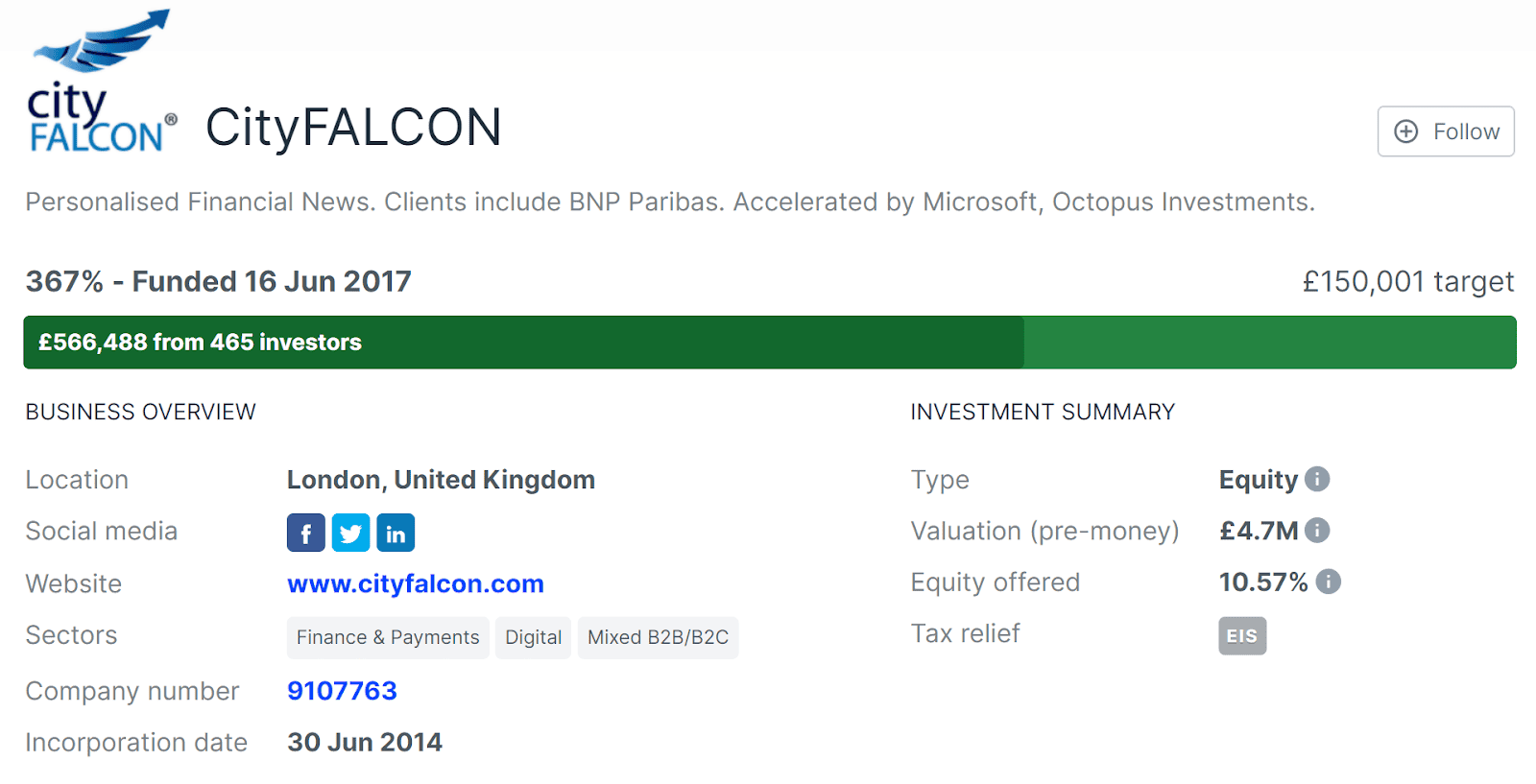

While I had confidence in what we were building and the market opportunity, I was barely able to make the payroll for a few months in 2015 and 2016. I was lucky to have the support of real angel investors who invested in us and got us through those difficult times – like the company’s guardian angels. In 2016, I ran out of angel investors to reach out to and decided to try out equity crowdfunding on Seedrs. The main risk was a failed raise, which could scare off any future investors, too: with a target too high, we would not reach the target and then get no funding. It was a tough month of talking to friends and potential investors to achieve the crowdfunding target. Thankfully, we achieved the target and got fully funded. Read more about how to ‘smash’ your fundraising target on equity crowdfunding in the article here.

We had only c. £800k of funding for the first three years, which is nothing if you want to build a product for enterprises that can compete with multi-billion dollar companies in financial services. By 2017, we had a bit of revenue traction with reputed clients, a better pitch, and a better relationship with the existing small investors on Seedrs. This led to our first major funding breakthrough, and we raised £550k on Seedrs. We didn’t have many investors lined up at the start of the round, so we put a modest target of £150k. To our surprise, as the campaign gathered momentum, money started flowing in, and we had to close the round not to dilute too much. These funds allowed us to expand our team, enhance our platform, and include more machine learning/AI-based tools.

I2017, Seedrs fundraising campaign. Read more here

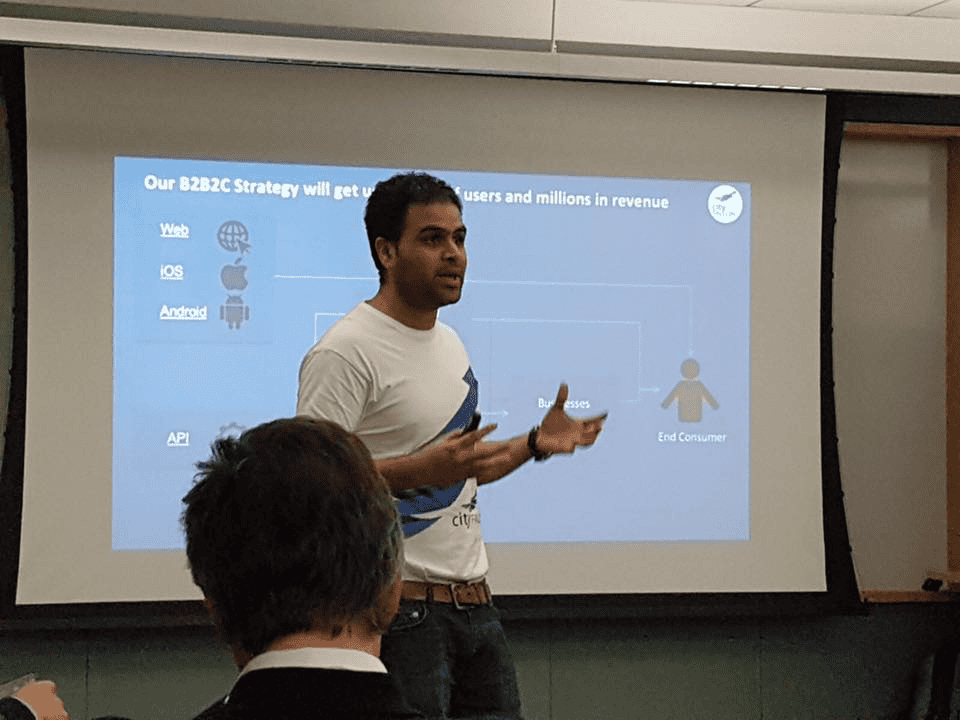

Accelerators, Competitions and Pitches

I didn’t know many people in the startup and tech space, so I was constantly looking for opportunities to gain visibility, money, or any other support to achieve my dream.

We embarked on our journey at Level39 in the iconic One Canada Square in Canary Wharf, London. Level39 has provided a comprehensive ecosystem that includes flexible office spaces and access to a network of industry experts, investors, and other tech pioneers. Through events, workshops, and forums hosted at Level39, we gained insights and built connections that were crucial for our advancement.

We got into accelerator programs—Microsoft Ventures, Octopus Labs Accelerator, Kickstart (by Digital Switzerland), Raiffeisen Bank Accelerator, and Holt Accelerator. We had also gotten into the KStartup Grand Challenge in Korea but could not attend both Holt and KGC. We took advantage of cloud credits from Microsoft, Google, and AWS. We are thankful to these companies for supporting us with resources and opening doors to potential investors and clients.

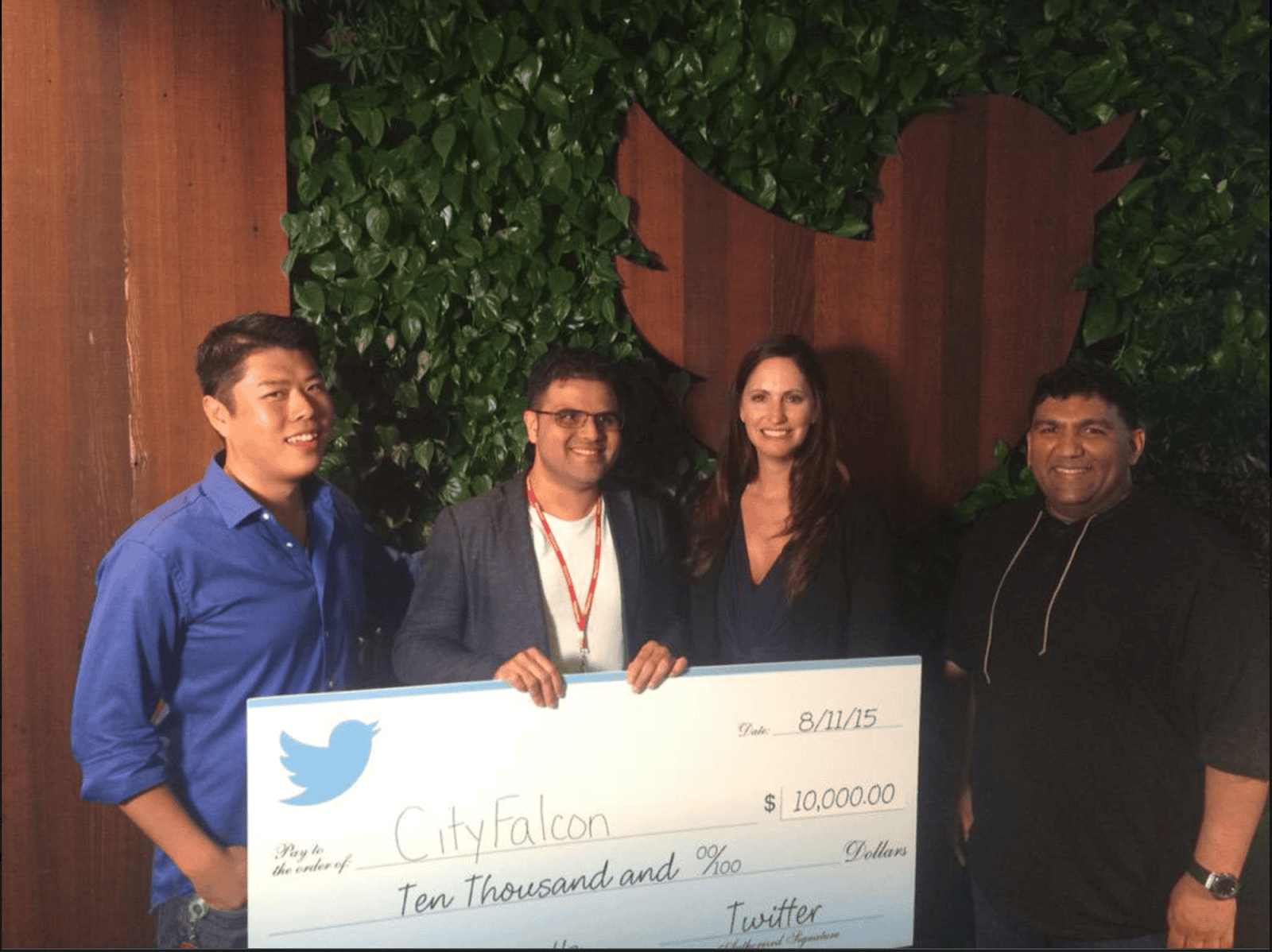

We participated in several competitions, including the notable Polar Bear Pitching, where you have to pitch from an ice hole. We won awards from Twitter, the Canadian province of Ontario, at a startup competition in Bern and many more. And, of course, we have been to several startup, fintech and other events and festivals.

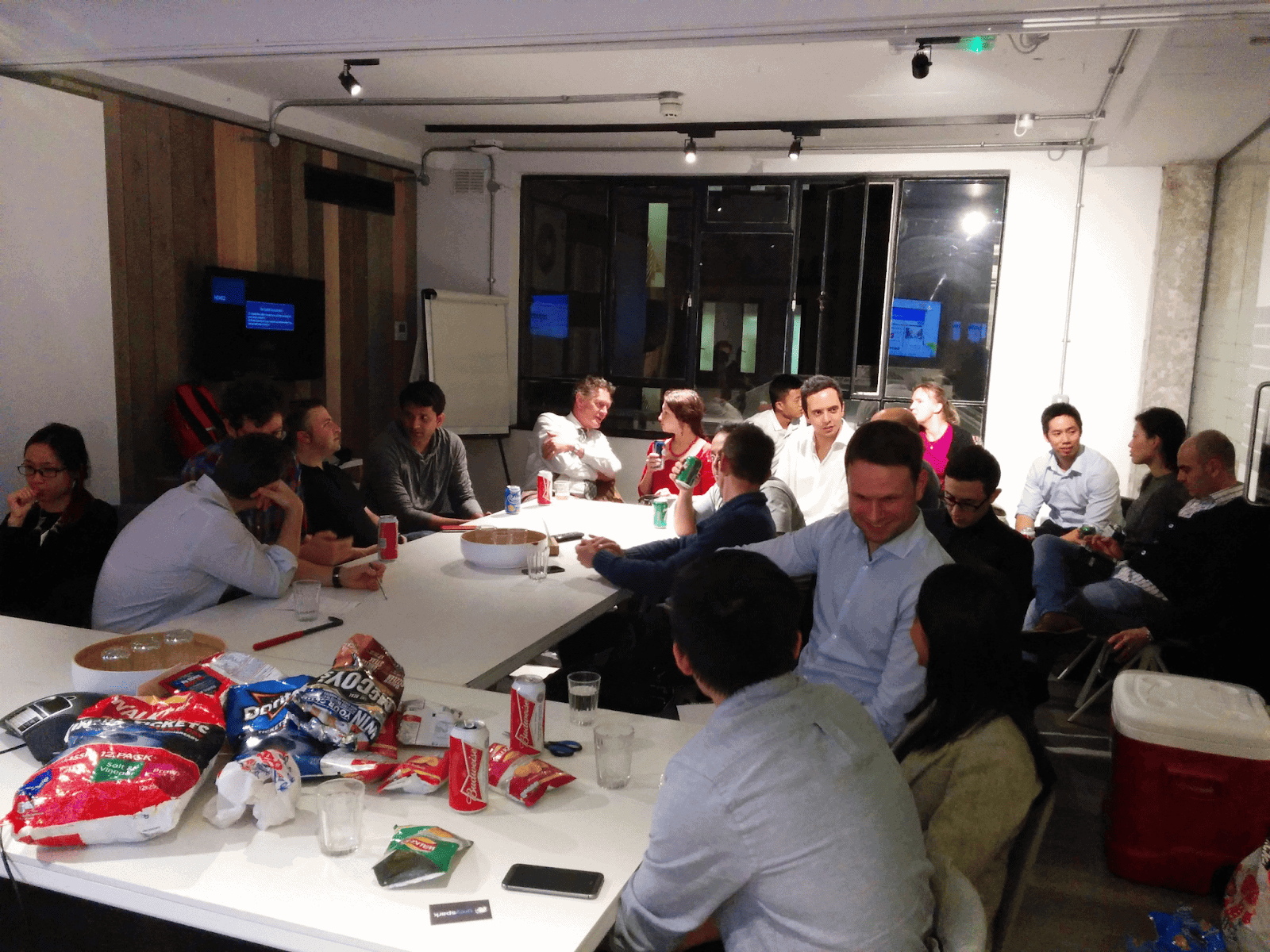

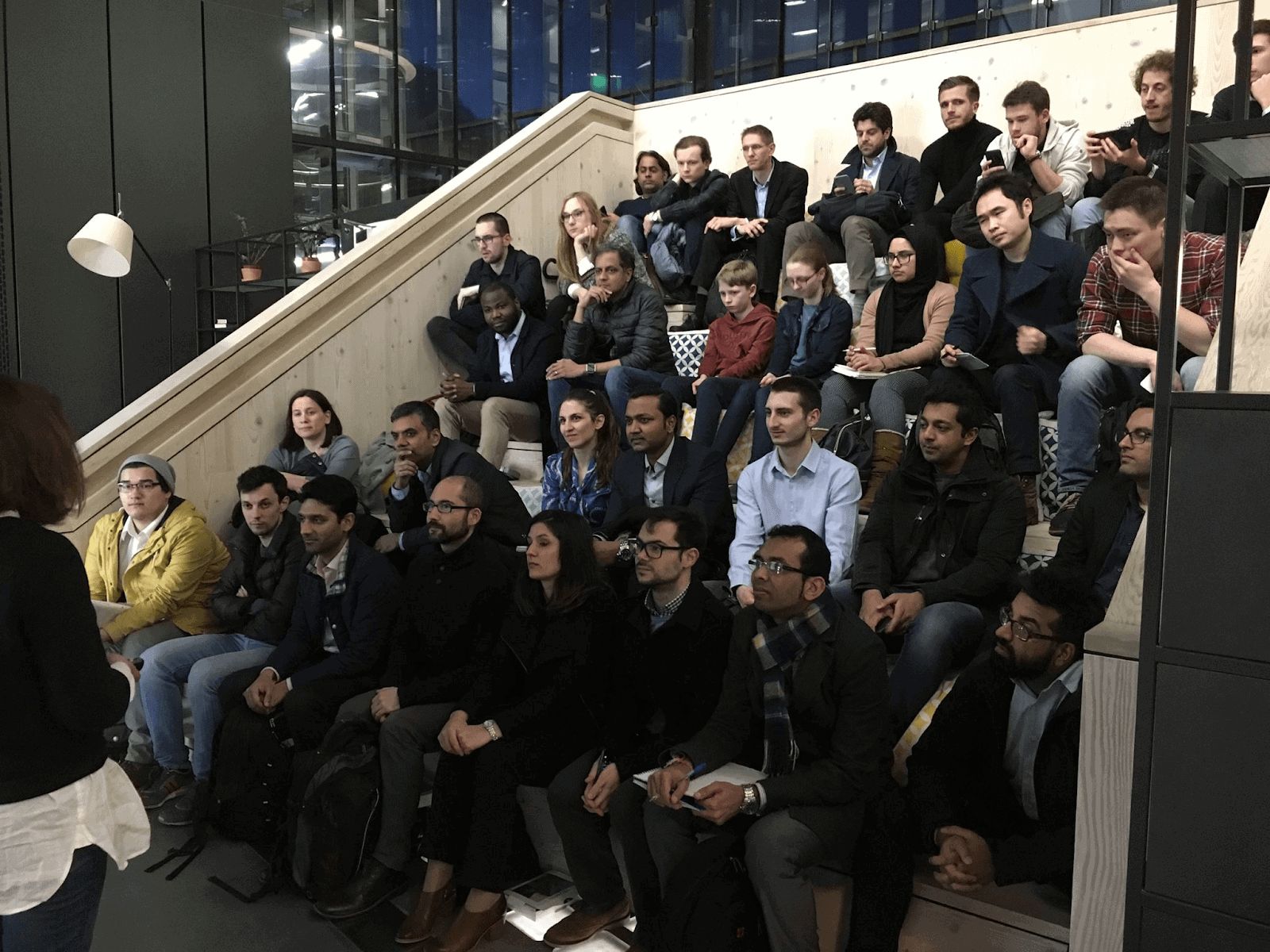

Below are some photos from events over the last 10 years:

2015, Microsoft Ventures Demo Day started with a dance. Read more and watch it here

2017 – Polar Bear Pitching, North Finland in freezing cold 🙂 Watch the full video here

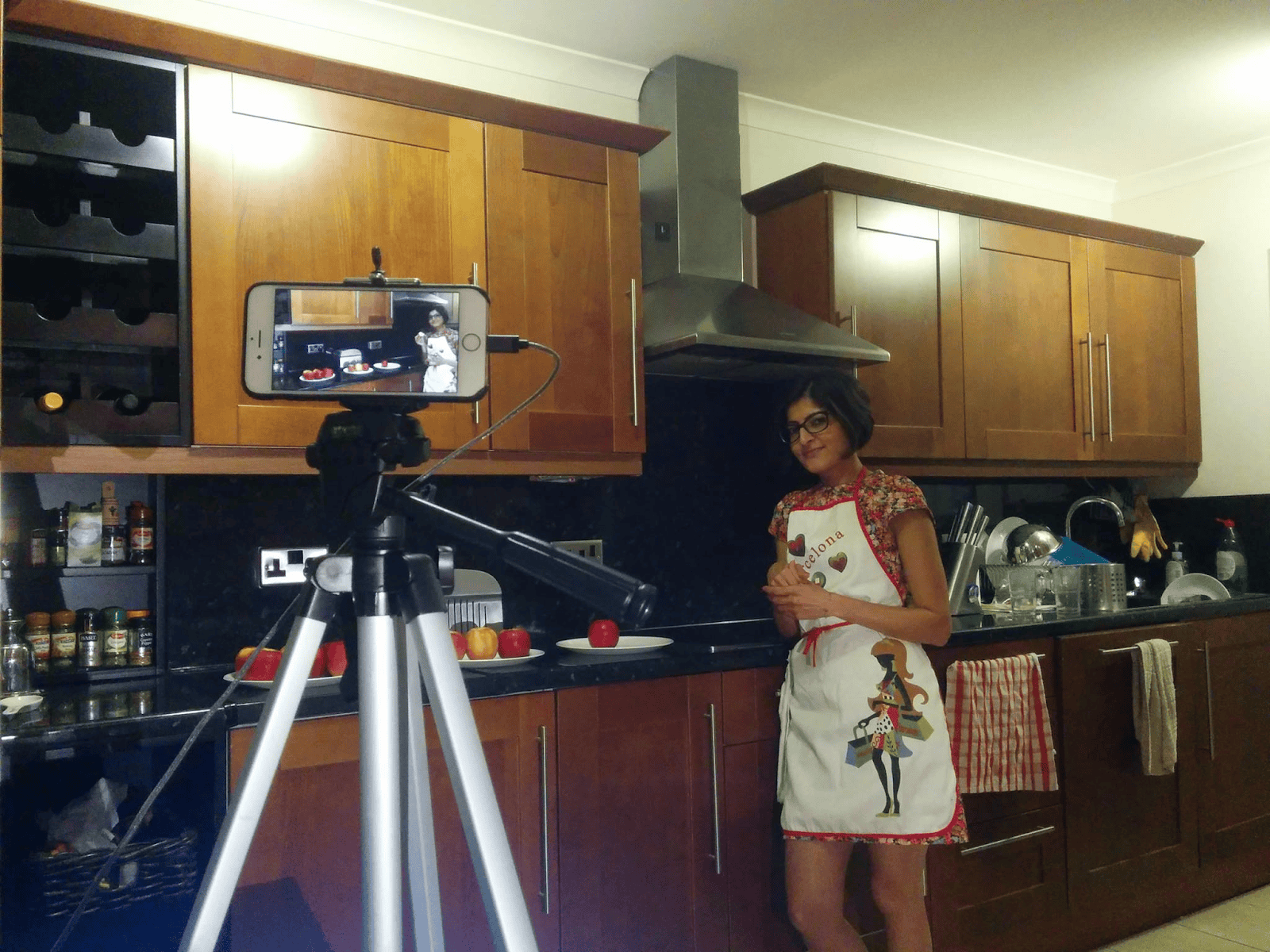

2017, shooting for our crowdfunding video. Watch the full video here

2018, Tedx, Portugal. Watch the full video here

2019, grants from Malta Enterprise. Read more here

Clients

Dec 2019 – We have been waiting for one of the top institutions in the UK to confirm that they will integrate us within their platform, but instead I got this message:

“Regrettably, we were not able to move forward with CityFalcon due to issues raised by our due diligence team around finances and revenue. Sadly, this would probably not have been an issue a year ago, but controls are tightening up a lot over recent months.”

We were gutted. We managed to beat the offerings of multi-billion dollar companies and convince the business teams that our product provides significantly better value to their clients. On the other hand, their compliance team was worried that we didn’t have a strong balance sheet. We didn’t have millions in the bank but had a runway of almost 18 months and support from investors. It’s 2024, and we are still here! This was one of the several moments on this journey when I had to remind myself that life is not fair and I will just have to suck it up.

A common question is how do you get clients as a first-time entrepreneur with a limited network? We have put ourselves out there, and we are lucky that our tech and products were picked up at fortunate times and are used by several reputed clients. Accelerators and fundraising and even a working product only bring so much credibility – that first client or two, especially bigger ones, are so important in making potential clients more likely to even give you a chance. More importantly, I’m glad that most of our clients open up our products to their end users, which makes me proud that I have been true to my original goal of supporting small investors and traders.

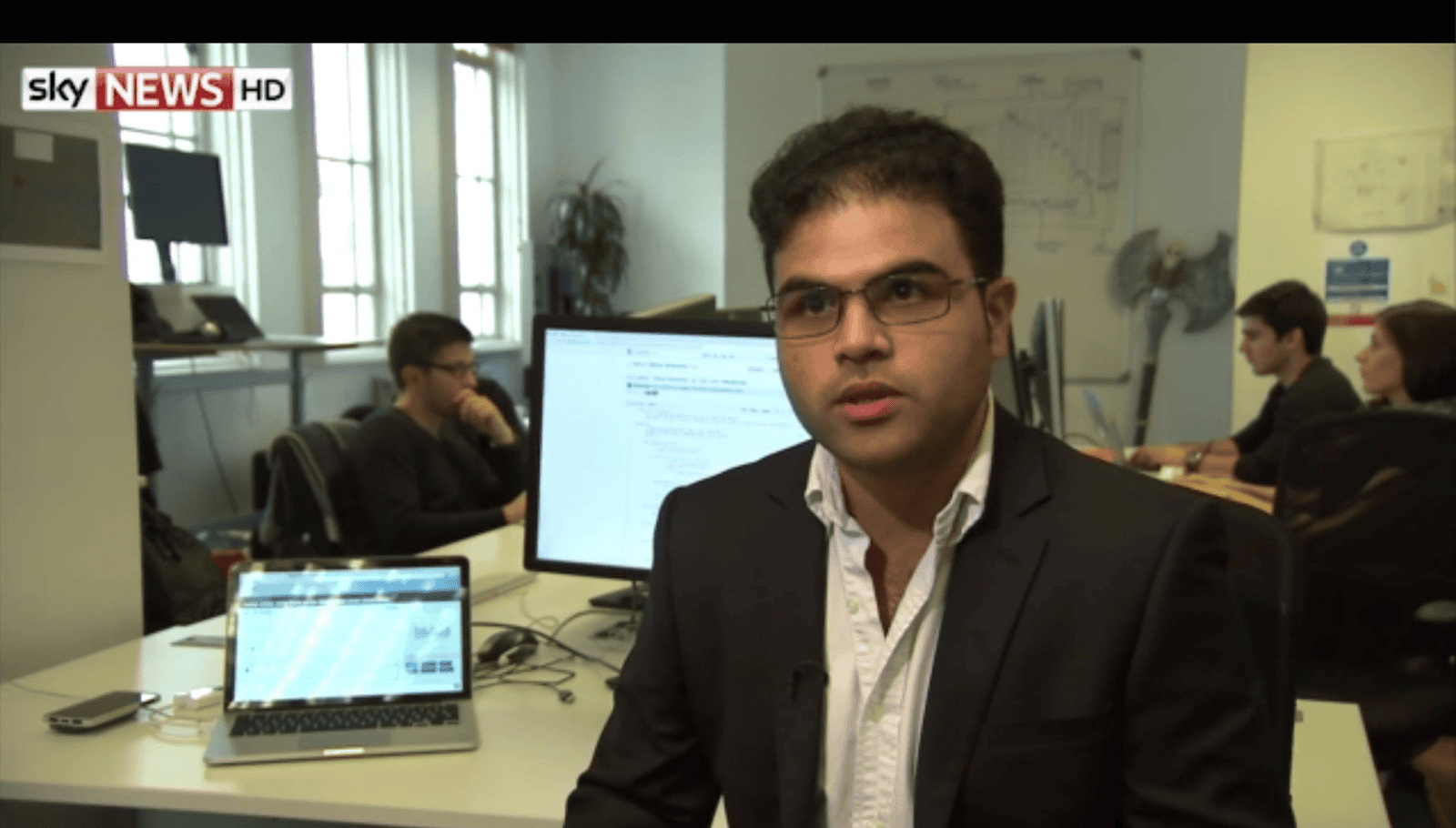

For us, inbound marketing, blogging, thought leadership, and crowdfunding have been the key ways to attract clients. Through inbound marketing, we attract potential clients by providing valuable and relevant content. Our blog serves as a platform to showcase our expertise, engage readers, and build trust. Equity Crowdfunding provided us with essential funding and boosted our visibility and credibility. These combined efforts have significantly helped us acquire and retain clients.

Team

Finding quality people is hard, and motivating them through the ups and downs is even harder. I feel incredibly fortunate to have a strong and loyal team by my side. Many of them have been with me for several years, thriving under the various challenges we’ve faced together. Their dedication, resilience, and unwavering support have been instrumental in our success. Together, we’ve navigated tough times, celebrated milestones, and continually grown stronger as a unit.

In the last decade, one of the major learnings has been hiring, managing, and even firing team members. We have had over 50 people at one time, and all spread across geographies worldwide. Each challenge has taught me valuable leadership and team-building lessons, ultimately strengthening our organisation.

We hire people fairly quickly, sometimes in just a few days. Still, we have built a thorough interviewing process—logical case studies, technical case studies and, code review where applicable, references, etc. We’ve accepted that to find real jewels, we must go through many rocks. We can now learn very quickly, in a few weeks, whether a person is a good fit for our team.

When hiring technical people like developers, data scientists, etc., a good developer’s impact is 10x that of an average developer. A good developer will plan, think about all the issues upfront, code properly with minimal bugs, and add tests and alert mechanisms to identify when something goes wrong. They will also document thoroughly, allowing other developers to look at the code 6-12-24 months down the line and easily navigate, improve, and catch bugs. An average developer might release something fast, but it may be riddled with hard-to-catch bugs, leading to poor customer experience, loss of revenue and plenty of unnecessary stress, and it takes ages, plus more work from them and/or good developers, for the feature to stabilise.

Hiring remotely presented its own set of challenges, from ensuring cultural fit to managing different time zones. However, it also brought diverse perspectives and skills that enriched our projects. Building a remote team taught me the importance of clear communication and trust. I share more of what I learned in the post – Lessons from outsourcing software development and hiring 20+ people remotely.

Managing a remote technical team requires using project management and communication tools like Slack, Atlassian Jira, and others. Slack helps us communicate in real time, facilitating quick discussions and instant feedback. Jira allows us to track project progress, assign tasks, and manage workflows efficiently. These tools keep everyone on the same page, ensuring that projects move forward smoothly despite the physical distance. Given the time differences and the flexibility we offer to the team members, we found it difficult to have daily standups like in most tech organisations. Instead, we require each team member to share in Slack daily what they did yesterday, the plan for today, the ETA for work-in-progress, and if they are facing any challenges. Also, having it all written down keeps everyone accountable and productive. This worked so well for the developers and technical team that we expanded it for all our employees, even those in other functions. If you would like to learn more about managing developers specifically, read my post – Engaging a Unique Species of Worker, the Software Developer.

Firing and laying off people is one of the toughest tasks a leader faces, but it’s necessary for the company’s overall health. It involves difficult conversations and emotional stress for both parties, which I’ve learned to manage over time. I’ve seen the impact that an unproductive team member can have on the rest of the team. In some cases, it has put pressure on the diligent employees, resulting in burnout and leaving the company. I, as the CEO of the company, take full responsibility and never delegate the task of laying off people. I try to provide transparent feedback and provide any support possible for them to reduce the financial impact. In a couple of cases, we could find them jobs through our network. Every week, during our team call, I provide an honest state of the business, including any challenges we may face in the coming months. Then, when we have the conversation about leaving with employees, they are not completely surprised and may already have a Plan B. We also work through personal improvement plans (PIPs) before firing anyone, and most employees who are in this situation tend to see the trajectory of their improvement (or not).

Culture, productivity, flexibility, and the other employee management techniques we follow have engendered a solid, loyal team. As an example of the solidarity of the team, in response to the financial strain caused by COVID-19, the employees supported our “Salary Sacrifice to Loan” scheme aimed at cutting costs and saving jobs. This innovative approach allowed employees to voluntarily reduce their salaries in exchange for interest-bearing company loans, which helped maintain cash flow and prevent layoffs during uncertain times. The initiative not only helped safeguard jobs but also strengthened the company’s resilience, enabling us to emerge from the pandemic with a dedicated and unified team.

In today’s competitive job market, retaining top talent often means offering more than just competitive salaries. One of the most effective strategies we’ve implemented is providing our employees with the flexibility to decide their own working hours, including nights and weekends, and the freedom to work from any location. This approach acknowledges that each individual has unique rhythms and circumstances that influence when and where they are most productive. By leveraging advanced project management software and maintaining disciplined practices such as daily written “stand-ups,” we ensure that productivity and communication remain seamless. This not only empowers our team members to achieve a healthier work-life balance but also fosters a culture of trust and autonomy. As a result, we have observed increased job satisfaction, lower turnover rates, and a highly motivated workforce that feels valued and respected. This flexibility is not just a perk but a core component of our commitment to our employees’ well-being and professional growth.

At our company, we believe in the potential of our employees and are committed to nurturing their career growth through role mobility. This philosophy has seen my personal assistants transition into thriving design and marketing roles, financial analysts move into project management and quality assurance positions, and our former copywriter ascend to the role of Chief Operating Officer. We cultivate a dynamic and versatile workforce by taking a chance on individuals who demonstrate the ability and motivation to learn. Our approach allows employees to explore their interests and develop new skills, which not only fulfils their career aspirations but also strengthens the overall capability of our organisation. Those who move positions bring a different perspective to the role but one contextualised by the product and company. This culture of internal mobility is a testament to our dedication to recognising and harnessing the unique talents within our team, ensuring that every employee has the opportunity to progress and succeed in their chosen path.

Mental and Physical Health

20 Dec 2020 – the day all hell broke through. Our main DB went down completely, and all our products and services were inaccessible. Our CTO gave me two options – do a temporary fix, which could enable us to go further for a few weeks, or conduct a full cleanup of the DB offline, which would give us a longer runway without any such issues, but the site and all products would be inaccessible for the entire time. We decided on a proper fix. This was 6 years after launching the company, and everything just disappeared – no data, no services, no login, nothing. It was the scariest situation I had been in for years, and there was nothing I could do personally; our CTO was working on it with limited sleep. It took us 4 long days, just before Christmas, to get it back up. Thankfully, it was during the holidays (less financial markets activity anyway), and thankfully, all the clients were patient and sympathetic. We didn’t lose a single client.

We have had challenges similar to those mentioned above, as we have a big development team and are constantly rolling out new features and technologies. It’s difficult for an entrepreneur to switch off, but it’s more challenging when you provide real-time services to clients. Any tech outages can damage the company’s reputation and, of course, its finances. I’m thankful that we have survived through most of these issues early on and now have better, though not perfect, solutions to avoid such situations.

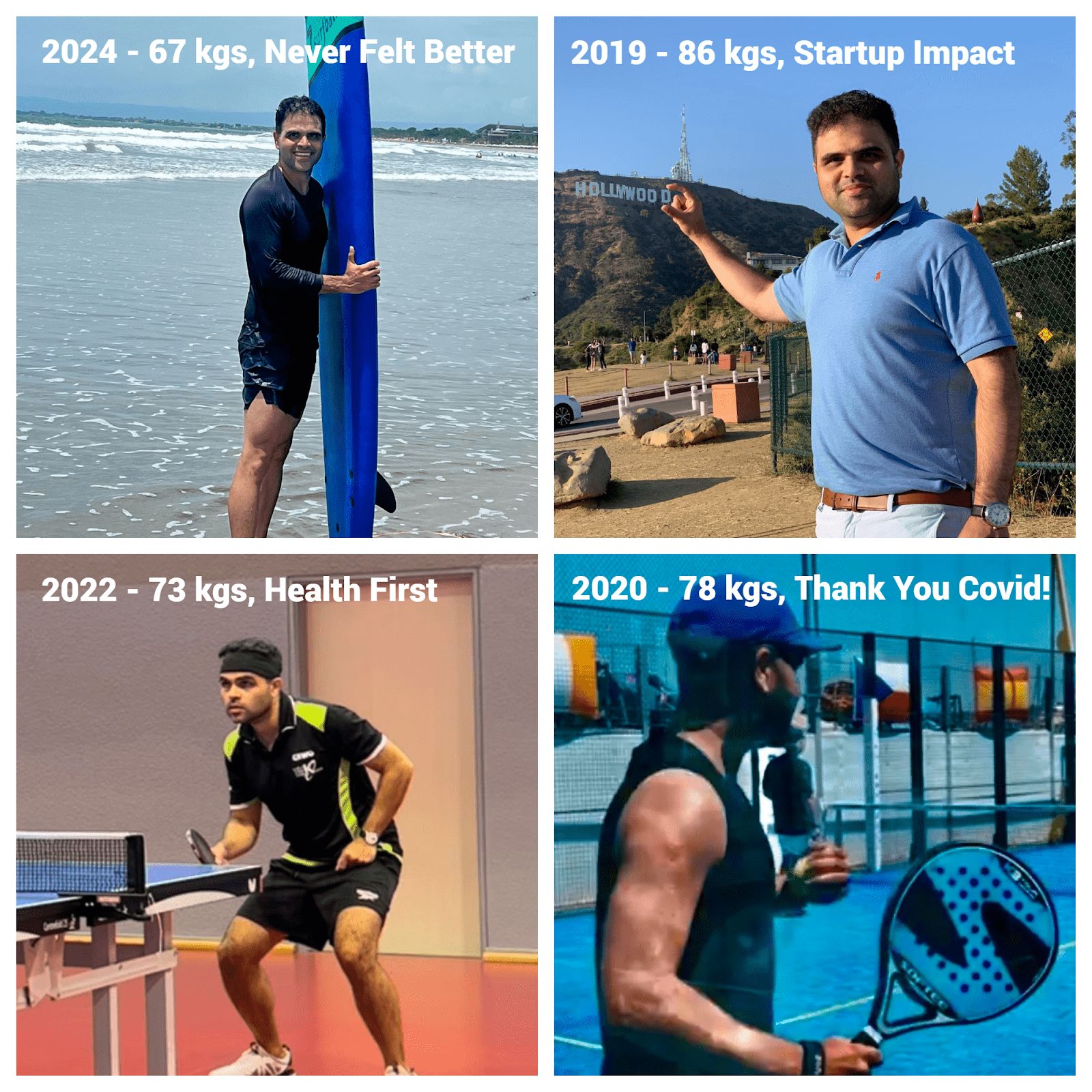

In addition, raising over £5m, managing a team of up to 50 people, and navigating challenges like Brexit, COVID-19, the Ukraine war, and inflation have all brought me to the brink of wanting to hide and cry. In 2019, I was in my worst physical health.

Moreover, the prospect of a company you founded failing is laden with significant fears and concerns, chief among them being the potential loss of jobs for our employees and the financial repercussions for our investors, including family and friends. The thought of our dedicated and loyal team members facing unemployment is deeply distressing, especially after they have invested their time, effort, and talent. Equally concerning is the impact on our investors, who have placed their trust and resources in our vision. This includes not just impersonal investors who expect some businesses to fail but also the personal stakes of family and friends, who have put their faith in me personally to grow their assets and certainly not lose their whole stake. These fears drive us (and definitely me personally) to continuously strive for excellence, innovation, and sustainability, ensuring that we safeguard the livelihoods of our employees and honour the commitment to our investors. The weight of these responsibilities inevitably affects my mental health. This ongoing pressure underscores the importance of mental resilience within our leadership team.

In the earlier years, I often neglected my mental and physical health for the sake of the business, and I know many other founders, especially earlier in their journeys, do the same thing. But the COVID lockdown made me realise the importance of prioritising health, which transformed my life. Now, no matter how crucial a presentation or meeting is, I never compromise on daily physical activity. Intermittent fasting, occasional alcohol, and limited caffeine have also contributed to my well-being.

Apart from managing my own physical and mental health, I am also responsible for the health of our employees. I felt like I did a decent job with it until COVID hit; that was my most difficult challenge. A few diligent employees were affected mentally by the pressures of the business and the rapid rate of change of the product, and they eventually left the company. While sometimes I work for 7 days a week, I do not expect and want my team to do the same. Very rarely do we have people working over the weekend (except when they voluntarily do a couple of weekend days for comp time later).

Fundraising

We have raised more than £5m to date from super angels, corporate VC, micro-VC, and the crowd. It is one of the most stressful things to do as a founder, and you need a bit of luck and timing. We have done 7 rounds on Seedrs and I’ve shared an article on how to raise funding on the platform – 7 Steps in 2 Years to ‘Smash’ £150K Equity Crowdfunding Target on Seedrs – the Process – the Great, Good, Bad and Ugly.

Despite the appearance of abundant start-up funding in the UK, not every entrepreneur finds it accessible. The media often highlights successful funding stories, but many start-ups struggle to secure the necessary capital. This disparity can be disheartening for founders who are trying to navigate the competitive funding landscape.

Many investors and funding bodies have recognised this issue, leading to initiatives aimed at supporting a broader range of start-ups. However, the process remains challenging, especially for those without strong networks or significant early traction. The reality is that securing funding often depends on who you know and the connections you can leverage.

In this environment, entrepreneurs need to be resilient and resourceful. Exploring alternative funding avenues, like crowdfunding, and continuously building networks can increase the chances of success. I’ve shared my experiences thoughts in these two articles: Abundance of start-up funding in the UK, but not necessarily for YOU and UK funding gap is killing start-ups and also creating a bubble

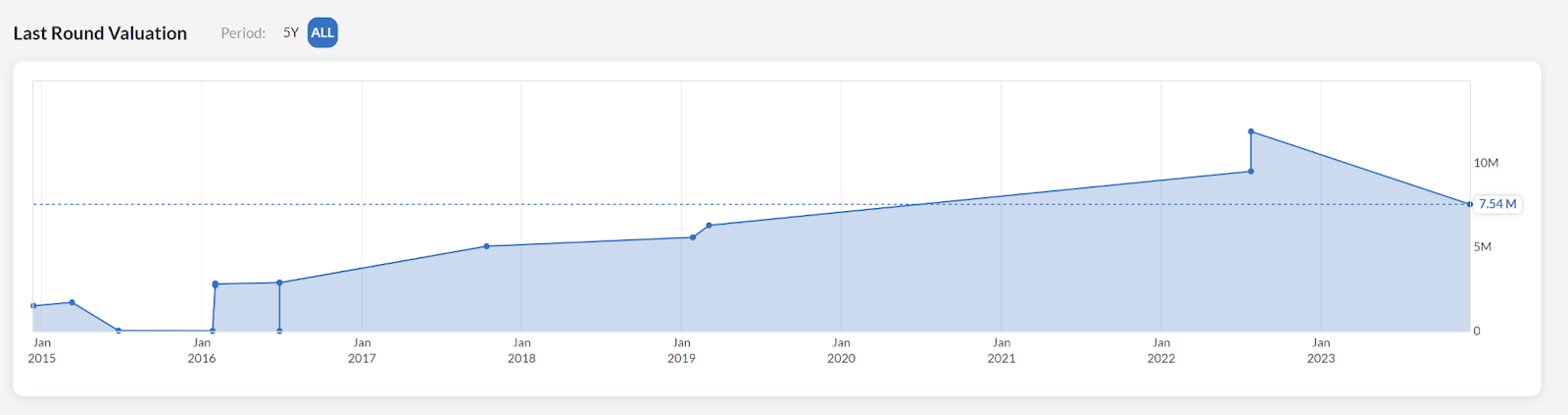

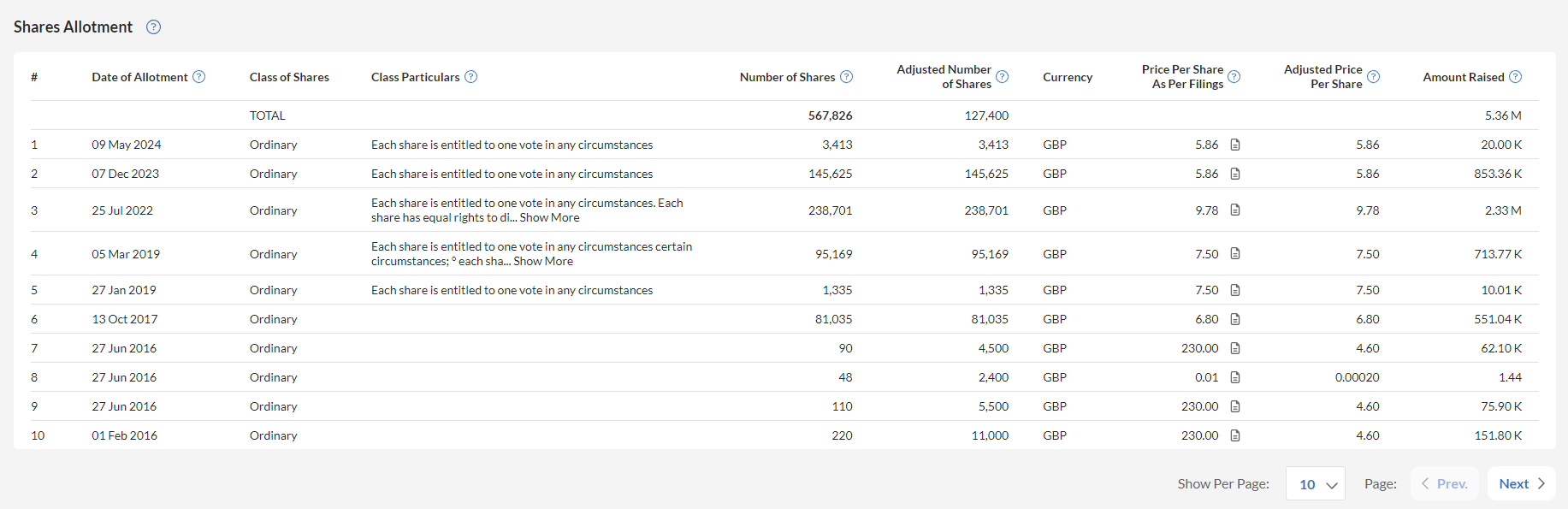

Our share price chart (generated by our UK Companies Insights product) Read more about our fundraising and capital structure here

Other Challenges

Brexit and Economic Uncertainty

It was early morning on 24 June 2016, around 4 am, when we learned the UK had voted for Brexit. It was unbelievable and shocking. The pound dropped by 30%, which meant our £20k a month burn rate suddenly increased by £6k. With our cash and some revenue in GBP and most of our expenses in USD, we were hit hard. I couldn’t stop crying and didn’t know what to do. This currency devaluation still haunts us. Now, we try to sign contracts in USD to protect ourselves, but that day taught us a tough lesson in FX risk management.

Brexit’s uncertainty also affected investor confidence, making it harder to secure funding and plan for the future. This is when we looked for a location outside of the UK to expand. The EU is an important and a big market, hence we opened an office in Malta. This also kept the second office closer to home while still keeping costs lower (than places like the UK or the US).

The COVID-19 Pandemic

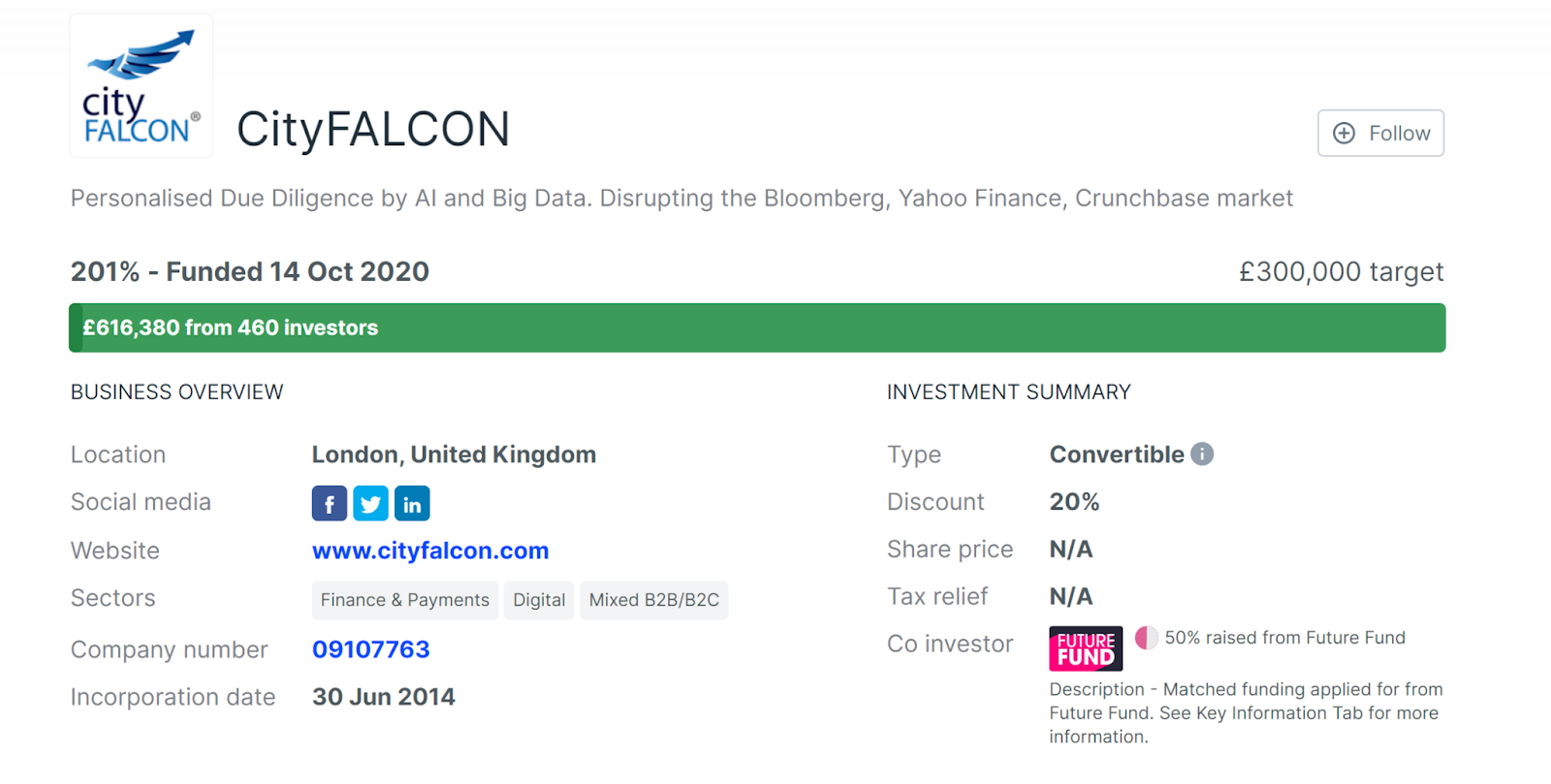

The COVID-19 pandemic was another major hurdle. As the world went into lockdown, our sales pipeline disappeared almost overnight. We had to adapt to the new reality quickly. Despite these challenges, we stayed afloat and even innovated, using the downtime to develop new features and improve our platform. We did an emergency funding round to extend our runway with the UK’s Future Fund program, in which the UK government matched any equity funding we raised.

Our funding round on Seedrs, 50% of which came from the UK’s Future Fund. See more here

The Ukraine War

Sunday, 20 March 2022, at 9 am, I got one of the biggest shocks on this journey. I got this message from our CTO, who was visiting his family in Ukraine and who had been with us almost from the start for 8 years:

“Good morning, Ruzbeh. I’ve got a request from the army, and starting Monday, I will be in training camp. Unfortunately, I won’t be able to work, but I think I can answer the questions in the evenings.”

This was a massive blow to the business, and even now, we haven’t found a worthy replacement for him. Also, he was working on some critical infrastructure work, which we still haven’t been able to complete due to its complexity. We have tried with several developers already. I lost someone who knew our tech stack inside out – and had essentially architected much of the backend – and I had to take on his role as no one else understands it from our team. Thankfully, he is alive and positive, and we hope that this war gets over soon and that he is back with us.

Most of our tech team is in Ukraine, and the last two years of the war have been very challenging. We had to support some of the team members in moving out of Ukraine due to physical risks, increase salaries to allow them to move to safer parts within and outside Ukraine, and manage with reduced productivity due to blackouts, sheltering during bombings, etc. Despite these difficulties, our team showed remarkable resilience, continuing to work under trying circumstances and ensuring that our platform remained operational.

The Economic Downturn of 2022

The economic downturn of 2022 posed yet another challenge. With tightening budgets and reduced spending across the industry, we had to find ways to do more with less. We focused on efficiency, cutting unnecessary costs, and optimising our operations to weather the storm.

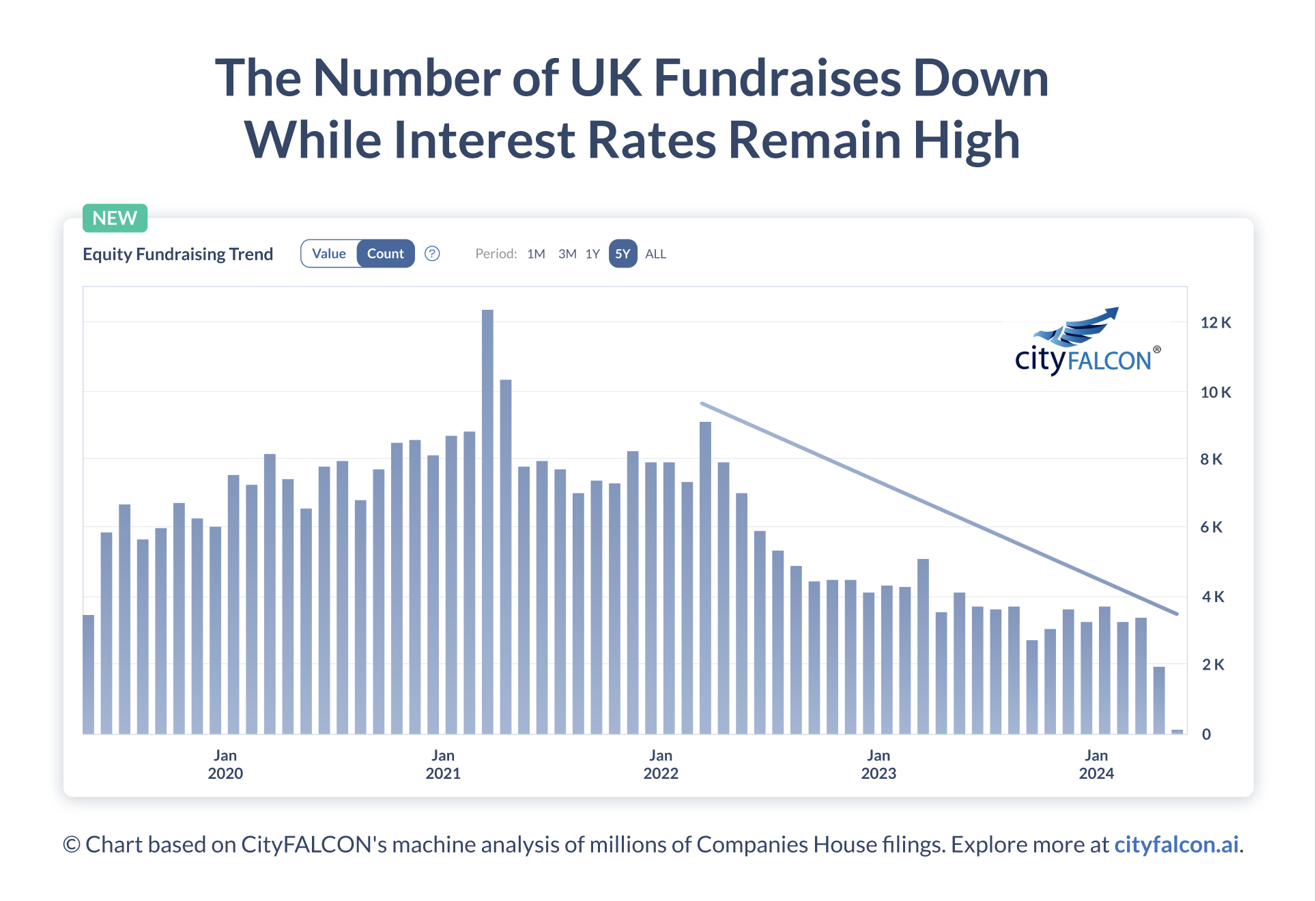

Inflation and higher interest rates are significantly impacting startups, including us. Rising costs for goods, services, and wages are squeezing tight budgets, making it more challenging for startups to manage their expenses and maintain profitability. Employees need more money to survive, while clients can’t afford to pay more as they themselves have been squeezed.

Higher interest rates increase the cost of borrowing, which can limit access to necessary funding for growth and innovation. This financial strain forces many startups to rethink their strategies, cut costs, and find more efficient operating methods. Additionally, investors are becoming more cautious and may prefer to invest in high-yielding bonds over riskier investments like startups. This shift in investment preference reduces the availability of venture capital and funding opportunities for emerging businesses.

We were very lucky to close a funding round just before the downturn started, allowing us to survive it.

Spiralling technology costs

In the era of big data and artificial intelligence, the costs associated with processing large volumes of data, running machine learning models, and conducting R&D with new AI tools in the cloud can escalate rapidly. While computing has commoditised and become less expensive, the models and processing needed for the latest advances has outrun the cost savings in the other direction. Initially, leveraging cloud services for these tasks might seem cost-effective due to their scalability and flexibility. However, as developers continue to add more servers, ingest more data, and increase processing power, the costs can grow exponentially. Our cloud costs have grown significantly over the years. On top of this, there is the additional expense of backing up all this data, ensuring that it is secure and retrievable in case of failures.

We conduct a thorough review of every monthly bill to identify and mitigate unnecessary expenses. This involves examining the usage patterns, identifying underutilised resources, and optimising storage and processing configurations.

Another thing – navigating the complexities of technology selection and integration has provided invaluable lessons for our company. One significant learning experience involved our initial choice of front-end framework. Early in the project, we opted for a framework that, in hindsight, lacked scalability and robustness. This decision cost us nearly two years of development time as we had to recode our front-end using a more suitable, scalable framework. Additionally, the eagerness of developers to incorporate cool new software into our tech stack sometimes led to unforeseen complications and increased costs. For instance, the implementation of Elassandra — a combination of Cassandra and Elasticsearch — required us to store more data and add additional servers, significantly driving up our cloud expenses. Compounding the issue, support for Elassandra was discontinued, necessitating a time-consuming and resource-intensive migration to the latest versions of Cassandra and Elasticsearch. These experiences have taught me the importance of scrutinising every additional tool or software proposed by developers before giving the approval – this also means I have to stay up-to-date on tech trends, at least a little. By prioritising simplicity and carefully considering the long-term implications of each technology choice, we can avoid unnecessary complexities and maintain a more manageable and cost-effective tech stack.

The Elon Musk Problem

Early 2023, Elon Musk acquired Twitter, and the landscape changed dramatically. We originally built our platform leveraging Twitter’s API during a time when Twitter was notably developer-friendly. One of his early moves was to increase the cost of accessing Twitter’s API by a staggering sevenfold for us while simultaneously reducing the available features. This sudden shift in pricing and access forced us into an untenable position, ultimately leading to the difficult decision to discontinue our tweets data. The years of development, innovation, and resources we invested were abruptly rendered obsolete, underscoring the volatility that can arise when third-party platforms alter their policies. This experience has been a challenging lesson in the importance of adaptability and the risks inherent in relying on external services for core product functionality.

The AI Race, ChatGPT, and the Pivot

30 November 2022 – ChatGPT launches, and the disruptors get disrupted. I was shocked to see how good it was and whether my 8 years of building CityFALCON were a waste. It was a stressful period for the next few days and weeks, with several sleepless nights thinking about whether we should continue working on anything. As we played with it and similar technologies, we realised that while it’s a great step forward, there are several challenges that generative AI needs to address – low accuracy, content licensing issues, and more. This made me relax a bit and even excited, and we decided to ‘embrace’ the newer technologies. We had to find innovative ways to leverage AI and stay competitive with limited resources.

It’s difficult for small companies like ours to compete against larger companies with big budgets for hardware and advanced technology. Developing and implementing AI solutions often require substantial investment in high-performance computing infrastructure. Additionally, the cost of hiring specialised talent and conducting extensive research and development can be prohibitive. While large corporations can easily allocate resources to experiment and scale their AI initiatives, smaller companies must be more strategic and innovative with their limited budgets. This disparity creates an uneven playing field, making it harder for smaller players to keep up with rapid advancements and gain a competitive edge in the AI-driven market. Hence, we decided that we have to leverage our existing strengths, specialise, focus on niche products, and be the best at them.

Launching DCSC.ai and FinPrompt.ai

In response to these challenges, we pivoted to focus on niche AI-driven products that can’t be easily disrupted by generic AI. We launched DCSC.ai, a new-age sector classification system that uses AI to calculate dynamic company-sector relevance scores and reacts to technological changes and the economy. The underlying data powers Smart Portfolios that enable thematic investment and Portfolio Classification (of existing portfolios). The relevance score uses 3 input components and, since one is news (one of our strengths), it updates frequently (hence the “dynamic” part). We also use our algos to identify when new sectors may be emerging and then use a human check to decide if it’s really a new sector, another one of our strengths of blending humans into the automated pipeline. We are looking to become the best sector classification product for anyone in business and financial markets to use.

Read up on the accuracy of sector classification with DCSC in another post, and look at how DCSC classifies Pfizer – not into a single sector but into multiple sectors with variable relevance.

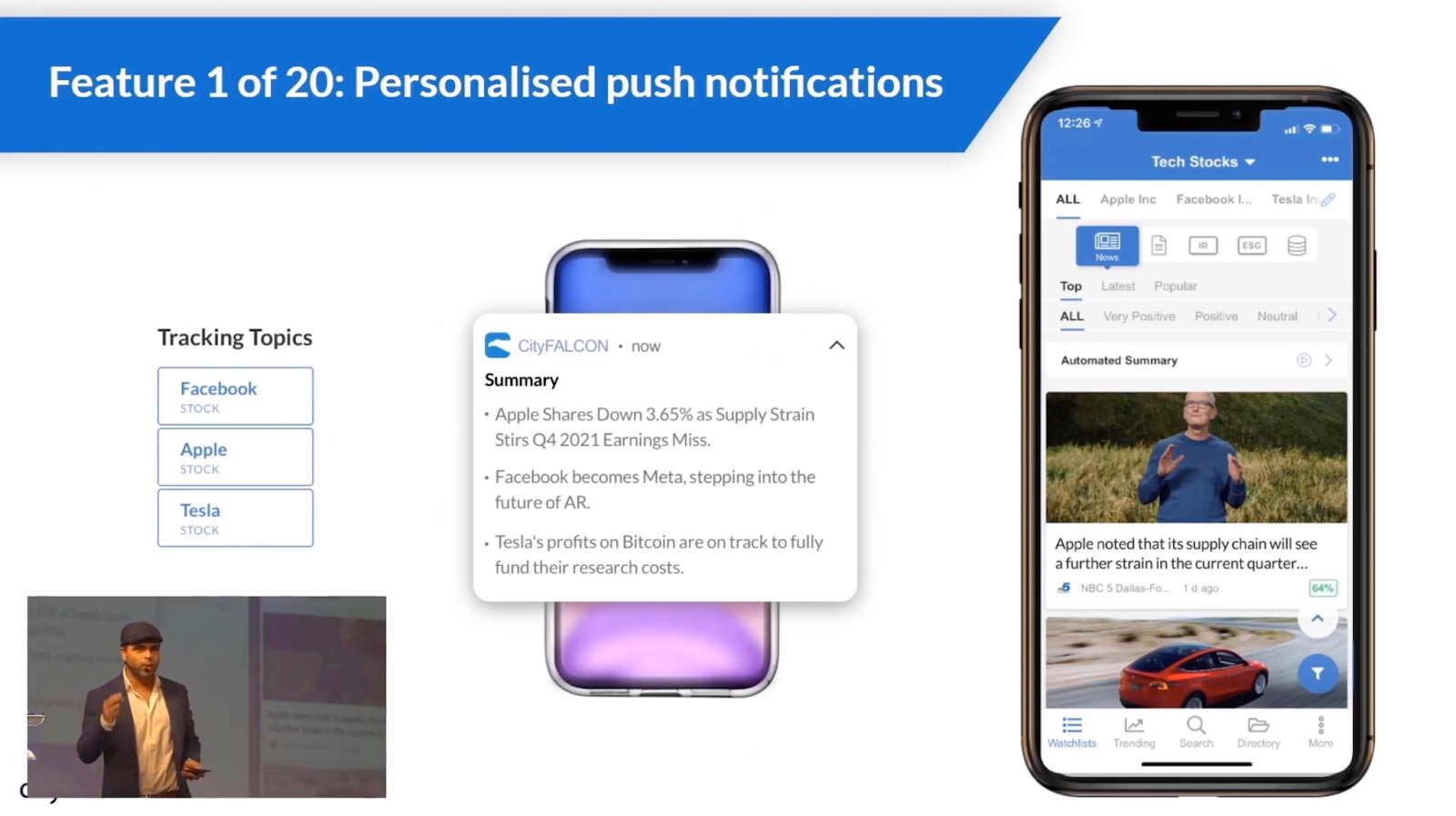

We also introduced FinPrompt.ai, a financial chatbot that leverages all of our data to improve accuracy over standard chatbots (that may hallucinate more), includes visuals, and gives updated information (i.e., no cut-off dates). The same infrastructure runs our AI Assistant that’s embedded in our CityFALCON platform, too. Watch the demo:

Introducing UK Companies Insights

In addition to DCSC.ai and FinPrompt.ai, we launched UK Companies Insights, which uses our filings data from Companies House and machine learning to extract share prices, capital structure, funding rounds, and more from millions of SH01s, giving a broad overview of the UK private companies market.

Chart of price per share based on reportable events. This may include options filings at prices different from fundraiser

The CityFALCON share price chart above comes from UK Private Company Insights, and the Shares Allotment tab is shown below.

The definition of SUCCESS

In June 2019, I received a call from a very senior executive from a multi-billion dollar company. They wanted to terminate the agreement that they had signed only a few months earlier. A team in another department of the company got nervous that we could be a serious competitor to their business and didn’t want to work with or support us anymore. We couldn’t believe it – an elephant fearing an ant in the jungle. While we were disappointed that we lost the partnership, we got the confidence that we could disrupt the industry and uproot some of the incumbents. Events like these have made this journey more rewarding, and even a million-dollar salary couldn’t compare.

Throughout my entrepreneurial journey, I’ve had to rethink what success really means. It’s not just about making money or seeing the business grow. It’s also about feeling fulfilled and learning from every step we take. To me, success now includes making sure my team is happy, our clients are satisfied, and we’re making a positive impact in our field.

We’ve faced various challenges – from technical glitches to global events like Brexit and COVID-19. These hurdles have taught me a lot about resilience and adaptability. I’ve realised that real success is about navigating these obstacles and constantly evolving. It’s about enjoying the journey and soaking in the lessons we learn along the way.

In the end, I’ve found that success is all about balance. Celebrating professional wins is important, but it’s equally crucial to take care of my health and happiness. Prioritising well-being has led to a more sustainable and fulfilling approach to running a business. This balance keeps me motivated and focused on the long haul, making the journey itself incredibly rewarding.

“It’s impossible to fail when your goal is to try and make an effort to improve the World“ – Eric McAfee

Advice for budding entrepreneurs

No book or degree can prepare you to become a successful entrepreneur. You have to live it. Embarking on the entrepreneurial journey requires significant life changes to prepare for the challenges ahead. One crucial change is developing a resilient mindset. Entrepreneurs must be prepared to face failures and setbacks, learning to view them as opportunities for growth rather than obstacles. This mindset shift is essential for sustaining long-term motivation and perseverance.

Another important adjustment is prioritising health and well-being. The demands of entrepreneurship can be intense, often leading to stress and burnout. By adopting healthy habits, such as regular exercise, proper nutrition, and mindfulness practices, entrepreneurs can maintain the physical and mental stamina needed to navigate their busy schedules and high-pressure situations.

Building a strong support network is also vital. Surrounding oneself with mentors, peers, and supportive family members can provide valuable advice, encouragement, and perspective. This network helps entrepreneurs stay grounded and focused, offering a sense of community and shared experience that can be incredibly beneficial during the ups and downs of the entrepreneurial journey.

You could read more about it in this article – 10 Life Changes That Will Get You Ready for Entrepreneurship

Would I do it all again?

Honestly, my answer depends on the day and the moment. The startup journey is filled with highs and lows, and many factors influence my perspective. During particularly challenging times, such as when cash flow is tight or unforeseen obstacles arise, the idea of taking this journey again can seem daunting.

We, as founders, can’t afford to pay ourselves a market salary. Unlike our peers in established corporations, we forego the security of health insurance, pensions, and other corporate perks. This decision isn’t just about sacrificing financial stability; it’s about embracing uncertainty with every step. The opportunity cost is significant, as companies are eager to offer lucrative salaries for individuals with our background and experience. Yet, despite these alluring offers, we choose to invest our time, energy, and expertise into our startup, driven by a vision and the hope of building something meaningful from the ground up. Balancing this passion with personal financial pressures is one of the toughest parts of the entrepreneurial journey.

The dynamic and rapidly evolving landscape, especially with the upcoming AI race, also excites and motivates me. The potential for innovation and impact in this space is enormous, and being at the forefront of such advancements is incredibly rewarding.

Ultimately, my decision is shaped by a mix of passion, resilience, and current circumstances. While there are days when the challenges feel overwhelming, moments of great achievement and excitement remind me why I chose this path in the first place. So, depending on the situation, I might just say yes to the startup adventure all over again.

However, I would change some things based on what I’ve learned on this journey. If I decide to start another company, I plan to shift my focus towards a service-oriented company or a low-product development startup. This strategic pivot is driven by a desire to minimise the extensive time and capital investment typically required before generating revenue. Unlike the traditional Silicon Valley approach, which often involves significant upfront development and fundraising, my goal would be to establish a business model that can achieve early profitability and sustain growth with leaner operations. By prioritising services that address immediate market needs or developing products with shorter development cycles, my second journey should bring investors returns faster and more reliably, and our team would be faced with less uncertainty about their medium-term future.

In addition to focusing on a service-oriented or low-product development startup, I would focus more on future-proofing. The rapid advancement of AI poses a significant threat to businesses that rely on easily replicable processes or products. To safeguard against this, I would prioritise developing unique, high-value services or products that leverage human creativity, complex problem-solving, and personalised customer interactions—areas where AI currently struggles to compete. I would aim to create a competitive moat that generic AI cannot easily penetrate.

Conclusion

As we celebrate our 10th anniversary, I am filled with pride and gratitude for our journey. From our humble beginnings to our current position, I believe that CityFALCON’s story is one of innovation, resilience, and transformation.

Looking ahead, we remain committed to our mission of democratising access to financial information. We will continue to innovate, adapt, and strive for excellence, guided by our lessons and vision for the future.

Thank you to our team, investors, partners, and users for their unwavering support. Here’s to the next decade of CityFALCON as we continue to break new ground and shape the future of financial information.

To celebrate our 10-year anniversary, we are offering a 50% off monthly subscription for all our products with the coupon CF10ANNIVERSARY (The promo code is valid until the end of August 2024).

That includes CityFALCON, any of our plans, and DCSC, which can help you build a new portfolio or rebalance your current one for better sector exposure. Simply sign up on CityFALCON or DCSC, choose your plan, and apply the coupon at checkout (detailed instructions here).

With DCSC and CityFALCON, market participants can better understand their investments and the markets. That’s been our mission for 10 years and will be our mission for the future.

Leave a Reply