Interest rates are a prime factor in any borrowing decision, and modern financial capitalism encourages responsible borrowing for the expansion of businesses and consumerism. That means interest rates affect everything across the economy, and the prices of assets are no exception.

During the financial crisis, interest rates plunged to record lows and remained there for quite some time. Some central banks even moved into negative territory. These drastic measures were designed to help economies recover by encouraging borrowing and spending, which would eventually spur the economy. Now, as the global economic recovery has enjoyed consecutive years of growth, central banks have been slowly increasing interest rates to make sure the economy does not overheat and lead to excessive inflation. This is the balancing act of central bank interest rate policy.

This article will take a look at how rising interest rates affect stocks, bonds, gold, and a new addition this century, cryptocurrency.

The Bond Market

The easiest market to analyse in regards to moving interest rates is the bond market, because the asset class is entirely dependent on interest rates for its valuation. The well-known relationship between bonds and interest rates is an inverse one: as interest rates increase, bond prices decrease. Why is that?

One reason is that higher prevailing interest rates mean new bond issues will be more attractive to investors, which means the demand, and hence prices will fall for existing bonds. So the bond market, which will overwhelmingly consist of already-issued bonds (as opposed to new issues) will fall, and the overall market’s prices will fall.

A simple example may help to illustrate the point: a pure coupon bond paying 1% on a face value of $100 will pay $1 per period. Interest rates rise to 2%. New issues will pay $2 per year, rather than $1. Investors would rather earn $2 for lending $100 than $1, so they sell their 1%-bearing bonds to buy the 2%-bearing bonds. The falling price of the 1% bond will make its yield more attractive to new investors (who will pay less than $100 for it), but those already holding the bond will not be able to recapture lost capital.

Another way to look at interest rate impacts on bonds is through the interplay between corporate bonds and government bonds. For many major central banks (Fed, BoE, BoJ, and the like), their bond issues are considered risk-free. For that reason, when the interest rates on their bonds rise, corporate bonds are less attractive in general. Why take more risk on bonds whose yields are now not as rewarding when the stability of government bonds can satisfy your income needs? You wouldn’t, and thus higher-rate government bonds are detrimental to current corporate bonds. Of course, future corporate bonds will have to be issued at higher rates to entice investors back from the government market, and existing government bonds are negatively affected by the new, higher-rate government issues.

The conclusion? Existing bonds are negatively impacted by rate hikes, and existing corporates are at a particular disadvantage against new government issues. The rising interest rate will reduce the ability of corporates to take loans which will reduce investment and the resulting inflation which is what central banks want.

The Stock Market

The stock market is a bit more complex because interest rates do not directly affect the valuation of stocks. However, because interest rates do eventually affect everything in the economy, stocks are impacted as well (often the impact is immediately priced in, even if the real impact will not occur for some time).

The allure of the bond market is one reason stocks may fall as interest rates rise. Usually, the immediate impact of a rate-hike announcement is that stocks fall, partially because the bond market is suddenly more attractive. New bond issues will yield more income while stocks are just as risky as before. The same questions from the government-corporate interplay arise: why invest in more risky assets like stocks, which do not guarantee any returns if sufficiently-high interest rates can be found in stable, less-risky assets?

Revenue Side Reasons

A fundamental economic reason for the fall of stocks as interest rates rise is an expected fall in earnings. This expectation is baked into the current price, which is why markets react before the fall in earnings has actually occurred. Why are earnings expected to fall? More expensive borrowing and lower consumer spending.

Higher interest rates mean consumer spending is impacted in two ways. First, consumers will delay borrowing until interest rates fall again. Big purchase funding, like mortgages and auto loans, will be more expensive and consumers may purchase cheaper options or simply not purchase at all. And if they need to purchase in a rising-interest-rate environment, their loan payment bills will be higher, decreasing their residual income for other purchases. Existing adjustable rate loans will also impact some consumers, even if they do not apply for new credit. All of this leads to less consumer spending, lower revenues for companies, and ultimately lower earnings.

A further consumer-driven reason for falling stock prices is lower disposable income means less money for investment. Whether investors sell their assets for cash or simply delay entering the market, the demand for stocks diminishes and prices go along for the ride.

Cost Side Reasons

But businesses are squeezed from the cost side, too. The bond market will demand higher interest rates, so companies turning to the bond market for funding will be spending more on interest. Just like consumers, they will also be more conservative in how much they borrow, since it costs more to borrow funds. Less borrowing can dampen the borrower’s expansion and growth, so earnings will not be as high as previously expected.

If the company does not utilize the bond market for borrowing, it may turn to banks, which will also be charging higher interest rates. The financial institutions are borrowing from central banks and each other, and they will pass those costs on to the consumer. Moreover, as prevailing rates rise in the bond market, lending institutions will increase their rates because borrowers are forced to pay more, anyway.

Which leads to a common exception: financial stocks. As interest rates rise, financial institutions can charge their customers more. Some of the higher interest rates can be directly attributable to banks’ borrowings from central banks, but banks themselves tend to have huge reserves of capital for lending as a virtue of being a bank. Thus the increase in interest rates across the economy and the markets lead to higher interest rates on lent-out capital, increasing earnings for financial firms in the process.

When Stocks Rise Anyway

The stock market does not always fall as rates rise, though. One indication of a strong economy is a slowly rising interest rate, and if overall economic growth is sufficient, stocks will continue to rise along with interest rates, because increased earnings will outweigh increased costs from borrowing or any dampening effect from consumer spending.

There are no hard-and-fast rules for how the stock market will react in a rising-interest-rate environment because the variables affecting stock prices are wide-ranging. There is also the fact that different companies will weather the same scenario differently. If you’re invested in a particularly robust company, the price will likely continue to rise regardless of what interest rates are doing.

A Charting Analysis

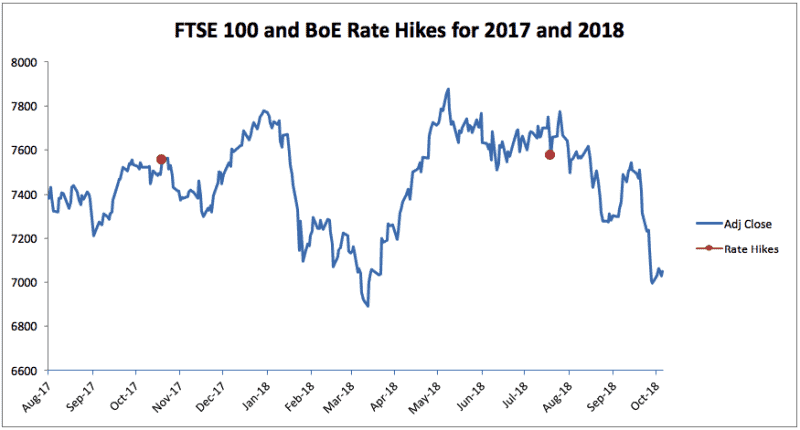

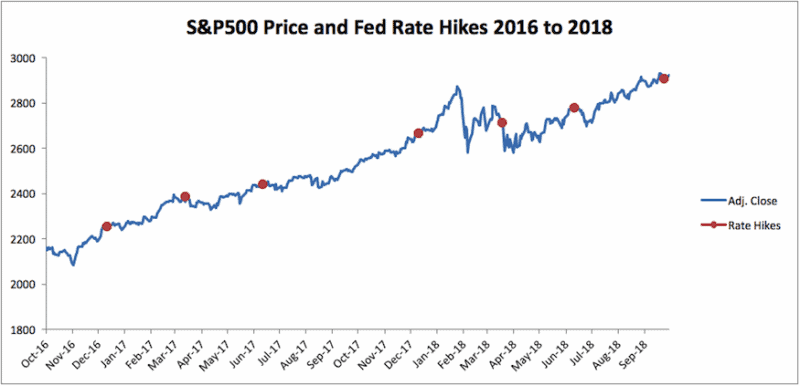

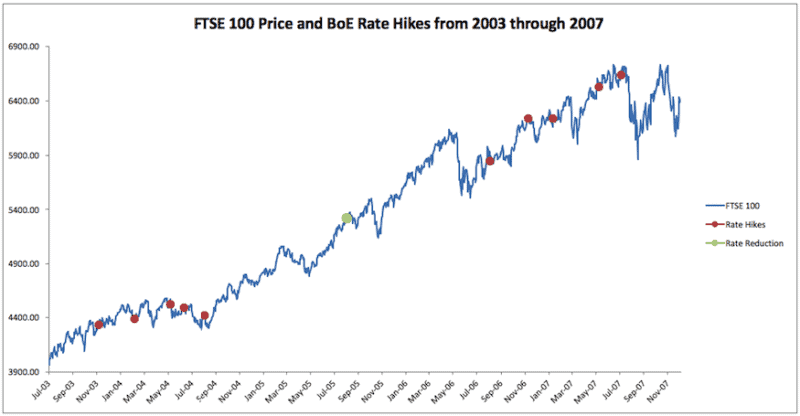

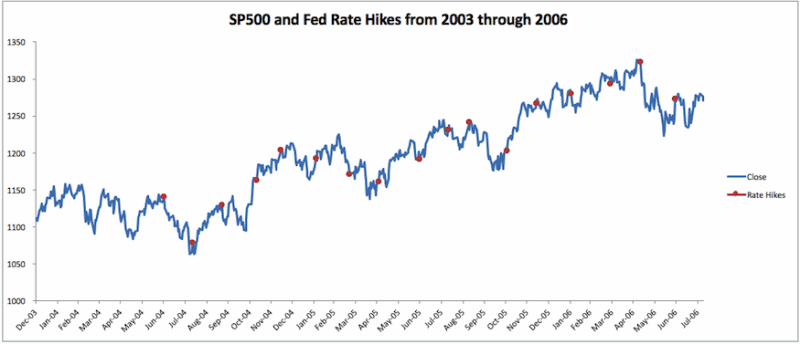

These four charts reflect the changes in the S&P 500 and FTSE 100 indices as the Fed and BoE changed their rates, which are all increases in these charts. The dots are placed at the price level of the index on that day. There seem to be slight price declines in the medium term for both indices after a rate hike in the host country, though the overall trend for both before the crisis is certainly indicative of a stronger economy leading to higher prices and higher interest rates since the declines are minimal. For the periods before the crisis, the rate hikes, at this resolution, seem to be lost in the day-to-day noise of the market.

A more fine-grained investigation, such as the hourly charts for prices on the days of the announcements, may reveal a more established pattern, but it is hard to come by such data freely and we certainly aren’t storing it at CityFalcon.

The charts exclude the time between 2007 and 2015 because the interest rate environment was either rapidly declining or mostly holding steady. In fact, between 2009 and 2015, there was only a single rate change (up or down) by the Fed, and no changes at all by the BoE. We exclude European stocks, as the European Central Bank’s rate has been zero or negative since 2012, and the ECB has been lowering its rates since mid-2011.

Sources for the underlying data are Bank of England Official Bank Rate History, Wikipedia Historical Actions of Fed (links to Fed Statements), Yahoo Finance for the SP500, and The London Stock Exchange for the FTSE data.

Gold, the World’s Backstop

Much is said about gold’s role as a bastion of safety in tumultuous times. Gold is always in demand, or so conventional wisdom goes. At least, the supply of gold changes relatively slowly, so if demand remains similar, the price will remain similar. That is one reason prices skyrocket during expected downturns: the demand spikes on the anticipation of the downturn and money floods into the gold market.

So if rising interest rates mean lower earnings, stock prices, and bond prices, what happens to gold? That’s dependent on what’s happening in the economy.

If interest rates are rising due to strong economic growth, that means stocks will continue to grow and bonds will yield more returns. Investors buy gold for many reasons, but “safe-haven status” is one of the most prominent. That safe-haven status does not carry an expectation of capital appreciation; it only carries an expectation that capital won’t depreciation significantly. So when other investments are yielding more likely and higher returns, investors move their capital out of gold to those other investments. The outflow of capital translates to higher supplies on the market and thus lower prices.

On the other hand, if interest rates are rising quickly because a government must entice investors, as happens when governments need money quickly but they are not trusted by the international investment community, investors in the affected country will move to gold as a safety backstop, increasing global demand for gold. Another possibility is that a major central bank might overshoot in its attempt to slow down overheating economies and push a recession, which might push investors into the gold market on speculative trades – once the economy starts to stall, others will move to gold and push up the price, leading to capital appreciation for existing gold owners.

Which way gold goes is not easily predictable from interest rates, with different trends arising through the last century. Gold’s valuation is less dependent on interest rates than stocks and certainly less dependent than bonds.

Cryptocurrencies

How about the newest asset class, cryptocurrencies? Some people have even claimed that the preeminent crypto Bitcoin may replace gold in the future. Of course, there are plenty of detractors, but that raises the question: how do cryptos react to changes in the interest rate?

One problem is that cryptocurrencies have only been around for a couple decades, they’ve only become more feasible in the last decade, and they’re only become popular (with the deluge of information that accompanies popularity) in the last couple of years. That doesn’t give much time-series data to work with, and Bitcoin debuted around the time of the outbreak of the global financial crisis in 2008 when interest rates plunged and either remained low or very slowly increased. We had reviewed 400-year history to understand new emerging asset classes including cryptos here.

Another problem is that crypto is not jurisdictionally-bound. Influential central banks wield far-reaching power, but ultimately their power is only projected to the currency and economic ties of the host country. Cryptocurrencies are generally decentralized and outside the control of national treasuries or central banks. Therefore, Bitcoin and the cryptocurrency market, in general, seems to mostly be self-contained, unaffected by changes in interest rates.

However, as Bitcoin trading standardises somewhat in products like futures, the price of the relatively-fixed-supply currency will fluctuate depending on demand. If interest rates fall, more cash flows around the economy, and consumers and investors have more money to spend and invest, Bitcoin might become more affected by interest rate shifts from the influential central banks. For now, though, Bitcoin (and its relatives) are in a world of their own.

My personal belief is that while blockchain will change the way we work and live, Bitcoin may not be the dominant cryptocurrency and will eventually go to zero.

Final Thoughts

Interest rates drive much of economics across the world. That’s what makes interest rate policy one of the primary tools of central banks to corral the economy in a favourable direction or limit the fallout from the inevitable setbacks. How interest affects the economy differs across asset classes, from the direct and immediate impact on bonds to no effect at all on cryptos. Also, with the proliferation of high-frequency trading and algorithmic trading, the movements in most of these markets could be exaggerated.

It is essential to keep these kinds of relationships in mind when investing, or really making any kind of major financial transaction (buying a house, moving to a new country, etc.). Finance, like supply chains, connects every part of the local, regional, and international economy, and the influence of interest rates cannot be overlooked.

10/04/2019 at 8:00 am

Thanks to clarify,how the rising interest rates will affect stock,bonds,crypto, and other markets.The rising interest rate will reduce the ability of corporates to take loans which will reduce investment and the resulting inflation which is what central banks want.Interest rates eventually affect everything in the economy; stocks are impacted as well.It is essential to keep these kinds of relationships in mind when investing, or really making any kind of major financial transaction (buying a house, moving to a new country, etc.). Finance, like supply chains, connects every part of the local, regional, and international economy, and the influence of interest rates cannot be overlooked.