Brexit Overview

On June 24th, 2016, the geopolitical landscape in Europe shifted in such a way that plunged global markets into chaos. The United Kingdom held a referendum on whether or not to leave the European Union (EU), and it was recently announced that the “Leave” movement won with 52% of the national vote, and that the UK will be officially withdrawing from the EU. The referendum turnout was 71.8%, with more than 30 million people voting. It was the highest turnout in a UK-wide vote since the 1992 general election.

Market Impact

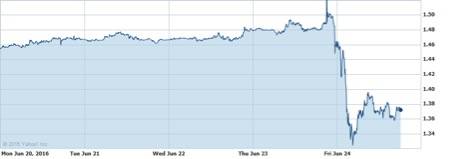

As it became more clear that the “Leave” movement would win, the GBP continued to plummet down to its lowest level since 1985. Between 9:45PM and 5:00AM, the GBP depreciated from 1.50 to 1.34 against the USD – leaving investors panicking and rushing into safer assets (USD, JPY and GOLD).

GBP/USD Exchange Rate, June 24th @ 2:07PM EST (Source: Yahoo Finance)

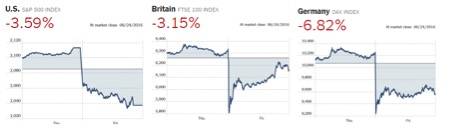

On Thursday June 23rd, the FTSE 100 closed at 6,334.63 GBP. At market open on June 24th, it opened at 5,926.40; representing a 6.4% drop overnight. This was not exclusive to Great Britain. Germany’s DAX Performance Index was slaughtered overnight, going from 10,247.06 EUR to 9,237.62 EUR, an overnight depreciation of ~10%. Looking broader, the impacts of Brexit were felt across the globe, with the S&P, TSX and many other financial markets depreciated substantially during the night of June 23rd. The reason behind this selloff stems from the uncertainty that the Brexit introduced into markets. The process of leaving the EU is extremely vague as it is described in the Treaty of Lisbon, and this means that nobody is 100% sure what the new agreement between the UK and the EU will be; nor are they sure when the actual split will take place.

Source:Reuters

Avoid Catching a Falling Knife

Catching a falling knife is defined as the tendency for investors to look at an industry of stock that has depreciated substantially in a short period of time, and wish to invest, thinking that it can’t depreciate any further and that it is a highly-undervalued play. While this is sometimes the case, there are also many cases where the falling knife asset simply keeps depreciating until it has really low or zero-value (in the case of a corporate bankruptcy.) There is little risk of the FTSE or S&P ‘going bankrupt,’ however there is still far too much uncertainty following the Brexit vote to even consider making a big jump in this early.

“What uncertainty are you talking about? The worst is over, it can only go up from here!” As much as it would be nice for this to be the case, a simple referendum isn’t enough to remove the UK from the EU. There is a lengthy and vague negotiation process which needs to take place between the UK and the 27 other member states of the EU before any formal exit can be accomplished. This two year period of limbo terrifies investors, as nobody is sure what could potentially happen over that period to send markets into further turmoil. Therefore, investing immediately following the referendum would be premature – as the uncertainty surrounding the Brexit has only just begun.

Post-Brexit Value Investing – Overview

Value investing in a post-Brexit world will change substantially as well, as we progress through the two-year period of uncertainty. With markets depreciating across the globe, new and unheard-of value plays will become apparent, however many of these markets will continue to face extreme volatility in the near-term. Therefore, the goal of value investing at this point is to find strong and well-diversified companies, not to find the more undervalued stock. Looking at companies with well diversified operations, both by geographic location and by revenue base, strong management, a relatively strong balance sheet and effective Forex hedging strategies will provide you with the safe asset base sought by investors to secure their positions during the Brexit aftermath.

Pay Less Attention to Valuation

In times of economic uncertainty, equity valuation multiples (P/E, EV/EBITDA etc.) flatten across the board, therefore trying to choose a stock based on its valuation becomes similar to trying to find a ‘needle in a haystack.’ As a result, value investors need to focus on the secondary pillar of value investing, company fundamentals. Selecting a company with attributes that would allow it to weather the post-Brexit storm is the new goal, and this will likely be the focus of value-investors going forwards. Secondly, we recommend averaging out your investment purchases, purchasing 20% at a time, and then buying on dips provided your fundamental investment thesis remains in-tact.

Attributes of a ‘Brexit-proof’ Company

When going through the stock-screening process, you need to first think about the sectors which will be hurt most by the Brexit vote. It is pretty common knowledge that discretionary/luxury sectors are hurt the most during periods of uncertainty, and therefore we would recommend avoiding them altogether. Defensive sectors such as Consumer Staples, Pharmaceuticals, TMT, Utilities and Natural Resources become more appealing, as they tend to have lower correlation with overall market performance. Within these sectors, the ideal companies become those with strong diversification, forex hedges and management teams.

Diversification is an important attribute during periods of economic uncertainty, as no one market can be relied upon to support company performance. Volatility is rampant across global markets, and therefore attributing all company revenue to one specific market is equivalent to placing “all of your eggs in one basket.” As an investor, this is an extremely scary prospect in a post-Brexit world, and therefore the successful value investor will look at companies that have their revenue diversified both by geographic location and by customer base.

Forex hedging strategies are critical during black swan events like this, where the actions of a particular nation cause ripple-effects across global forex markets. Looking at past financial statements, investors should analyze how effective the company in which they’re analyzing has been at hedging forex risk in the past; looking at Gains/(Losses) for Foreign Exchange to determine whether future volatility in forex markets is likely to inject risk into their investment. Companies that have natural hedges e.g. most of revenue and costs in the same currency will obviously suffer less from forex fluctuations.

Finally, a strong management team can be the difference between a good and bad investment during periods of investor uncertainty. Operating during economic downturns takes strong financial know-how and years of industry experience, two factors which should be sought in the management teams of any potential investment. While these factors can’t be directly quantified, and it is impossible to say with 100% certainty that one management team is better than the other, looking at past experience, education, and press releases can give investors a better idea of who is expected to strategically lead the company through the post-Brexit years.

If you’re in London, join us at London Value Investing Club to work together on this and other investment strategies.

14/12/2016 at 2:40 am

Would love to perpetually get updated great web blog!

15/12/2016 at 10:38 pm

Hi, i read your blog occasionally and i own a similar one and i was just curious if you get a lot of spam remarks? If so how do you reduce it, any plugin or anything you can advise? I get so much lately it?s driving me mad so any assistance is very much appreciated.

30/12/2016 at 10:40 pm

I have been checking out a few of your stories and i can state pretty nice stuff. I will surely bookmark your site.