Summary:

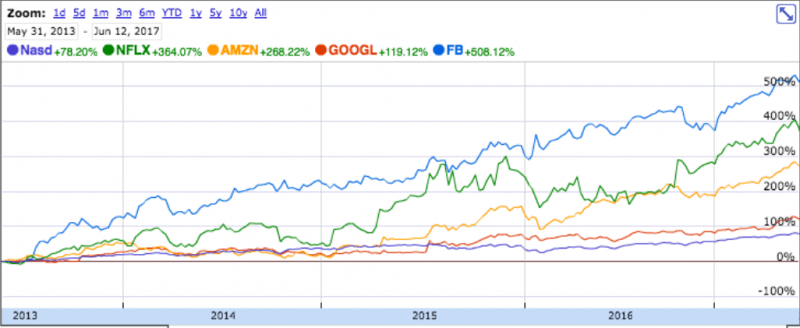

- FANG Stocks (Facebook, Amazon, Netflix, Google/Alphabet) have rallied a few times over the last 4-5 years. This seems to be the case with other tech stocks as well.

- The rise in the tech stocks has not only been because of the wider rally in the markets but is also supported by the rapid pace of innovation and product launches by these companies.

- However looking at the PEG ratios, most of these stocks seem overvalued. As Warren Buffet says, stay fearful when the markets are greedy.

- You can track real-time and personalised news for these companies on CityFALCON here.

As you can see in the graph below, FANG stocks have had a strong rally over the last few years.

The PEG ratio

One of the ratios I use for analysing growth companies is the PEG ratio. I had shown in my article from 2014 how the best time to invest in Apple and Microsoft was when they were trading at very high P/E multiples; see the full article here. For example, I don’t mind paying for a company at a P/E ratio of 100 as long as I believe it can grow for more than 100% over the next 2-3 years. This means the PEG has to be below 1.

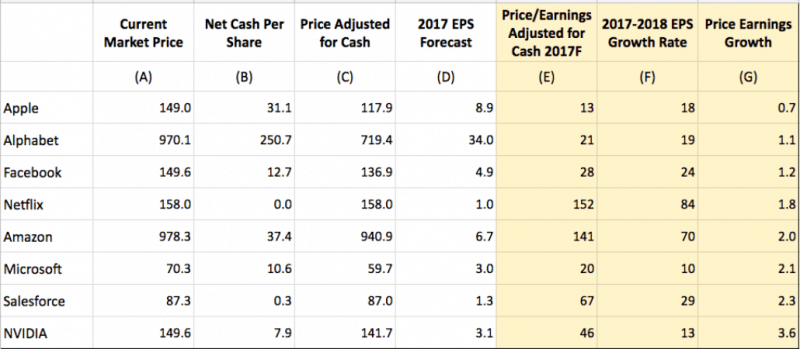

Below is my quick computation of the PEG ratios of FANG and other tech companies. I’ve added the growth rate column, but it’s only from 2017 to 2018. You need to decide for yourself whether these growth rates are high or low depending on the fundamentals of the business over the next 2-3 years. Also, since some of these companies have high net cash balances, I’ve adjusted the price for the cash per share in the books.

While Apple may seem to be the cheapest at the PEG ratio of 0.7, the underlying assumption of 18% growth may not be sustainable. At the same time, NVIDIA may outperform the 13% growth rate mentioned in the table above. Google and Facebook seem less expensive than other companies. Amazon, Microsoft, Salesforce and Netflix are great companies, but the PEG ratios of c. 2 put them in the significantly overvalued category for me.

I see limited value in growth stocks that are trading at a significantly higher PEG ratio than 1, and I’m staying out for now because as Warren Buffet says, stay fearful when the markets are greedy.

You can track real-time and personalised news for these companies on CityFALCON here.

Leave a Reply