There are literally tens of millions of stock market and private investors today. The personal investing revolution has enabled anyone with a few hundred dollars to trade stocks. But we don’t have millions of great investors. Only a select few will ever be bestowed this title. So, how can you try to be one of them? You can emulate the people who were – or still are – the greatest. Below is our list of 8 of the greatest investors of all time. Let us know in the comments below if you think we’ve missed out on any important names.

This list was compiled based on inputs from our members of Value Investing Clubs in UK, France, Belgium and Austria, and from our users at our FinTech company CityFALCON. Our focus at the Value Investing Clubs and CityFALCON remains on long-term fundamental investors who are looking to go through research to buy, hold and sell financial assets to generate strong higher than inflation returns.

Warren Buffett

We will just start off with the obvious case: Warren Buffett. Who doesn’t consider him one of the greatest, if not the greatest investor? Born just in time for the Depression (1930), Warren Buffett was born in Omaha, Nebraska, whence he eventually took his nickname “The Oracle of Omaha”.

From an early age, Buffett was interested in making money. His father was a stockbroker with libertarian leanings, so this may have had some influence. He worked a paper route for extra cash and bought the land of a farmer when he was just 14. If you want to be like Buffett, you may have to go back in time. Anyway, Buffett studied under Benjamin Graham (another mention on this list), and he returned to Omaha in 1956. Along with Charlie Munger, he purchased a textile mill that was not doing well. This mill was named Berkshire Hathaway.

He used the profits from the mill to take on other holdings, which eventually turned into the gargantuan Berkshire Hathaway of today (they don’t make textiles anymore, though). His strategy to build up the company is to find undervalued companies that have good management. He doesn’t want hyped companies, and he doesn’t want to manage them himself. He actually often buys whole companies and lets the management continue doing what it was already doing. He did this with Dairy Queen and GEICO, among others.

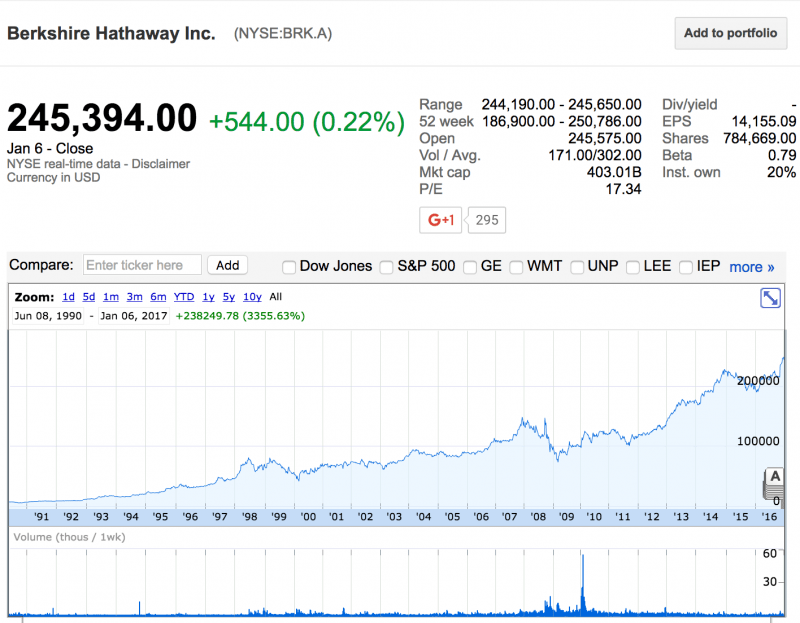

Berkshire Hathaway Inc today quotes at a market capitalisation of £400bn, and has a provided an annualized return of 14% compared to 7.37% return in the S&P500 over the last 26 years, nearly double the market. You can track major stories about the stock here.

The takeaway from Buffett: find good companies that don’t have a lot of attention. Make sure the management does its job well, and just let them handle everything. You are an investor, not a manager, so you put up the money and let the people trained in their job do it. If you’re 14, maybe buy a farm from your savings.

Recommended Reading:

NOTE: Each book linked here is written directly by the investor and any co-authors. These are not books about the investors by other people, but by the investors themselves.

Benjamin Graham

The next entry on our list is the man who taught the Oracle of Omaha. He is regarded as the father of value investing and security analysis. Growing up in New York City in the early 1900s, his father died when he was just 9 years old, and the need for financial security followed him throughout his life.

He went to school in New York (Columbia) and went on to work on Wall Street, quickly becoming a partner. He started lecturing in finance just 12 years after graduating from the university, and this is when Buffett became his student. Graham wrote two of the most influential books on investing, both of which are still used at university today. The Intelligent Investor and Security Analysis.

These two books are great reads for anyone interested in Graham’s style, which basically states that companies should be undervalued when purchased but their fundamentals should be strong. He was a big believer in fundamental analysis and sought out companies with robust balance sheets, little debt, and/or good cash flows. To get a feel of whether the company is under- or overvalued, one should look at the price-to ratios (P/E, P/B, P/S, P/CF). His other point? The market is often wrong, and you can take advantage of herd mentality. This is especially true in our time, when technology has enabled all individuals to be investors, whether they know what they’re doing or not.

Recommended Reads:

Walter Schloss

I’m putting Schloss here because he was also a student of Graham’s, and he even worked for his firm. He claims a 20% annual average over 50 years! That is a very long time to beat the market. He must be doing something right. He is another value investor, meaning he looks for stocks that seem to have low values compared to their prices. This often meant ignoring the people and looking simply at the numbers. It is said he didn’t use computers or algorithms – while that may be true, it is certainly much easier to use computers for data mining today.

In 1994 he outlined what he thought were the fundamental principles of investing in 16 “Golden Rules”. They’re freely available on the web, so I won’t reproduce them here. They espouse things like being patient, using the valuation numbers but not forgetting it is a real business, and maintaining your confidence and composure. You would do well to find them on the web, as they are very simplistic principles. They seem common sense, but you need to use all of them all the time to succeed.

Investing 101 – Let’s get you started in the stock market.

Peter Lynch

The next man on the list is Peter Lynch. Lynch is the man who headed Fidelity Magellan and steered it from a $20 million fund to a $14 billion fund over just thirteen years. His annual average return was 29%, and he beat the S&P 11 out of those 13 years. Not a flawless record, but nothing short of amazing.

To give you a little hope if you aren’t going to school for finance in New York City, Lynch studied history, psychology, and philosophy in Boston. He served some time in the military, but eventually he did study business. He built up his career working at a firm and was appointed manager of Fidelity Magellan in 1977. That’s when he started to show his true strengths.

One of his strengths: a relentless work ethic. He generally worked all the time, and life was business. He was interested in what management had to say, and he would listen to them at any time of the day. Considered a “chameleon”, his investment strategy was not glued to one style but would change depending on what worked at the time. He did, however, publish a list of 8 rules that are also freely available on the Internet. They include knowing what you know, using fundamentals to seek out good businesses (again stocks aren’t just numbers on screens), and staying flexible. Flexibility is key for any investor or trader – market conditions change, and your strategy needs to change with them lest they run you over.

Recommended Reads:

John Jack Bogle

Bogle is the founder of Vanguard, that bulwark of stability. He is championed for his ideal of putting the client first and even criticizing the fund industry for not being client-oriented. His main way to make money is a passive investment scheme that keeps costs to a minimum. Often funds and other managers will have lots of hidden fees that kill the return, but Bogle’s ideal was to keep the costs as low as possible. That often meant low holdings turnover, so picking the right assets from the beginning was important.

Unlike the other investors here, Bogle tries to mirror the movements of the market rather than trying to beat it. That implies a breadth of assets that can accurately track the market. It doesn’t give him as high returns as others here, but it gives him low costs. He doesn’t like to rebalance, he doesn’t like to invest abroad (meaning outside the United States), bonds are the best way to diversify, and make your portfolio simple such that tracking and understanding it doesn’t give you a headache. Bogle likes simplicity, and it has served him well over the years.

Recommended Read:

The Little Book of Common Sense Investing

Bill Gross

Bill Gross founded the Pacific investment Management Company, otherwise known as PIMCO. Another investor to have served in the United States military, he originally studied psychology before getting his MBA in California. PIMCO is currently the world’s largest fixed-income management company. Since 1987, the company’s annualized return is over 8%. Not massive by any means, but this is the bond market we are talking about.

His main principle is to look to the medium-term of 3 to 5 years. This keeps the investor from becoming emotional and getting caught up in panic selling or irrational exuberance. However, one should still take advantage of short-term pricing irregularities by structuring them into the portfolio. You may use leverage, but you need to do it with low cost leverage. He also has no problem investing overseas, so don’t worry about staying within the country.

Recommended Read:

George Soros

One of the more controversial figures on the list, Soros is our first non-US-born investor on the list. He left Hungary in 1947 to go to England, and eventually he made his way to the United States in the 1950s. He worked as an analyst and manager in New York until 1973, when he started his own company. It was originally named Soros Fund Management, but it later became the renowned Quantum Fund. Quantum Fund is renowned because of its spectacular returns, supposedly more than 30% a year, with two years being over 100%. That is the kind of return many investors only dream about.

He was a speculative investor through and through, making huge bets on macro-economic trends. His perhaps most well-known bet was that against the Bank of England, where he bet against the GBP. He reportedly made $1 billion in one day, with the entire trade netting $2 billion. Those are huge numbers for a single trade. He is also thought to be an important factor in the Asian Financial Crisis of 1997, as he had a major position against the Thai baht. After his GBP bet, many took him more seriously, causing more pressure on the baht.

His main principle is that the markets are chaotic, made up of the thoughts and actions of all the investors. That includes both the professional investors and the unprofessional ones. Hence, the psychology of the market as a whole is extremely important. In contrast to the others on this list, he was a short-term trader, so psychology is arguably more important than fundamentals at that level: the noise is caused by the masses, so knowing how those thoughts coalesce into action is more important to making money off the noise than understanding the supporting assets.

He claims he has a physical reaction to knowing when something is going to happen, so it is not so easy to emulate his strategy. Only he knows where he is going and how he feels about any single trade. Regardless of the truth of the claim, he is one of the wealthiest investors in the world and now he uses his wealth for philanthropic purposes.

Recommended Read:

Peter Thiel

Peter Thiel is different from the other investors on this list. He doesn’t deal with the public markets, which means a lot of what he does is not accessible to the average investor. He is a venture capitalist and entrepreneur. He co-founded Paypal (with Elon Musk), Clarium Capital, and Palantir Technologies, among others. Both Paypal and Palantir are multi-billion dollar companies. He was also an early investor of Facebook, so he is squarely in the Silicon Valley thread. The man currently funds research into the edges of science, especially aging science.

He was born in Germany but emigrated to the United States at the young age of one. His father was a chemist, and Thiel was brilliant at mathematics and chess. His career is diverse, having been a derivatives trader, a securities lawyer, and a political speechwriter. He was always in finance, though, because he founded Thiel Capital before his founding of Paypal and its subsequent sale to eBay for $1.5 billion. He was the first outside investor in Facebook, putting up $500,000, which netted him over $1 billion in real terms, as he sold a majority of his shares in 2012.

His personal philosophy is highly individualistic and libertarian, and his business strategy is to strive for monopolies. He thinks imitation of desires is what causes conflict, and competition is only good if the object of the competition remains the end. Once competition itself becomes the end, the system becomes too chaotic. Hence monopolies are a good place to invest: there’s no competition. But big monopolies are less appealing than companies that have found a niche and are working to monopolize it. These investments are the golden opportunities. Such companies would be Google or Facebook – before them, there was not much in their niches or there was only a scattering of poorly implemented designs. Now they are behemoths many cannot live without.

Recommended Read:

Zero to One: Notes on Startups – this one is more on startups than investing, but an interesting read nonetheless

More heavy hitters in the investment world

Certainly some of you would add others to the list. We didn’t want the article to get too long, but there are some people whose name you should know. They are as easy to research as any of the other people on this list.

Charlie Munger – another big name from Omaha, this is the man who bought that textile mill with Buffett. He has his own partnership (Munger Partnerships), and from 1962 to 1975 he averaged a return of 20% while the S&P did only 5.2%.

Seth Klarman – joining the list of native New Yorkers, Klarman built Baupost Group, one of the biggest hedge funds in the world. He is now a philanthropist, though he still runs his firm. He is another value investor for those keeping score. His book, Margin of Safety, is the “cult classic” of investing, and you can pick up a 1st edition copy for a somewhat large chunk of cash.

Joel Greenblatt – Greenblatt had a very impressive run of 40% annualized returns over a 21 year period (1985-2006). He got his start with bonds, and he has published The Little Book that Beats the Market, which is supposedly a “magic formula” for investing. Since that book is old and more difficult to come by, you can pick up his sequel The Little Book that still Beats the Market instead. He has the same ideas as most: good companies with high earnings yields and high returns on capital.

Mohnish Pabrai – our first Indian-American, he started his first firm with just $100,000 and eventually sold it for $20 million. He also made an impressive 517% return on investments from 2000-2013, while the S&P only went up 43%. That’s 517% after fees. His publication is The Dhandho Investor.

Jim Simons – one of the “quant” guys, Simmons is a mathematician who started the quant hedge fund Renaissance Technologies. He was a codebreaker during the Vietnam War, and he went on to use his computer and maths knowledge to look for arbitrage opportunities before it was popular.

Conclusion

These are some of the greatest investors of all time. Many of them are value investors, but there are a couple short-term guys and even a venture capitalist here. There is also a lot of reading material here. All of the listed books are authored, at least in part, by the man under whom it is listed. If you are just starting out, Lynch’s publications are just for you. The classics are the two books published by Benjamin Graham. Soros expounds his theory that markets are just thoughts and views of the public. Regardless of where you start, if you want to emulate the best investors, it is a good idea to read their thoughts. All of these guys have conveniently published them for you to do so.

If you are looking to track relevant financial news for your portfolio or watchlist, try out our platform CityFALCON, and let us know what you think.

Leave a Reply