Introduction

Securing the right investors is a pivotal step for startups and scaleups aiming to achieve growth in the competitive UK market. Identifying and approaching active investors can be a daunting task, but with the right resources and strategies, it becomes manageable. This guide is designed to help startups and scaleups navigate the process of connecting with active investors in the UK, leveraging tools like ‘UK Companies Insights’ from CityFALCON.

We cover the basics of investing and fundraising, including different types of investors (such as angels and VCs) and types of investments (like equity and convertibles). We also delve into determining funding needs, runway, and dilution from external funding. Then we explore various ways to find active investors in the UK, the useful tools to general good practices to keep up your network.

Let’s start with a short summary of those tools, then explore the basics of investing for those just starting out, and finally explore in depth the tools and other methods.

If you’re already familiar with the basics of startup financing, jump to our guide on finding active UK investors.

TL;DR Summary

For those that want to start right away with the tools, here’s our very short, non-comprehensive summary:

- Online platforms

- Equity Crowdfunding – Seedrs, Crowdcube, and StartEngine

- Debt (P2P lending) – Funding Circle, Zopa, RateSetter, and Lending Work

- Rewards-based – GoFundMe, Indiegogo, and Kickstarter

- Donation-Based (charitable causes) – JustGiving, GopFundMe, and Localgiving

- Angel Investors Network can help find angels

- Venture Capitalists can be found through the London Venture Capital Network

- Private Equity Firms are often connected to the British Private Equity and Venture Capital Association (BVCA)

- Family Offices that handle HNWI and family wealth

- Government Grants and Funds like the UK Startup Loans plus tax relief and grant schemes like EIS, SEIS, and the R&D Tax Credit

And our very own UK Private Company Insights, a powerful tool that extracts investors and companies from more than 25 million filings and gives you insight into who is investing where and how much. You can mine this treasure trove of data to find the right investor for your industry, funding stage, and terms.

Want more details on these and already know the basics of raising funds and identifying the right type of investor? Then skip to our tools and methods section.

The Types of Investors

Angel Investors

Angel investors are individuals who provide capital to early-stage startups in exchange for equity ownership in the company. They are typically experienced entrepreneurs, business professionals, or high-net-worth individuals who invest their own money in promising startups with the hope of earning a return on their investment when the company grows and succeeds.

Angel investors play a crucial role in the startup ecosystem by providing funding, mentorship, and expertise to help startups get off the ground and scale their businesses. They often invest in companies at the seed or early stages when traditional sources of funding, such as banks or venture capital firms, may not be readily available.

They can provide not only financial resources but also valuable insights, networking opportunities, and guidance to help startups navigate the challenges of building and growing a successful business. Angel investors’ investments have often been the determining factor for the success or failure of many startups in their initial phases.

If you are looking for Angel Investors in the UK, Angel Investment Network is a great place to start.

Venture Capitalists (VCs)

Venture capitalists (VCs) are professional investors who manage funds raised from institutional investors, such as pension funds, endowments, and wealthy individuals, to invest in high-growth startups and early-stage companies.

They provide funding to startups at various stages of growth, from seed funding for early-stage companies to later-stage funding for more established businesses looking to scale. VCs often invest larger amounts of capital compared to angel investors and may participate in multiple rounds of financing as the company grows.

Venture capitalists are known for their focus on high-growth-potential startups. They expect substantial returns, typically between 25% and 35% per year over the investment’s lifetime. Approaching VCs requires a well-thought-out strategy, including a compelling business plan, a clear understanding of the business’s unique value proposition, and a long-term vision. Their terms may also be more complex and more favourable to the investor than angels who often only ask for simple equity.

In addition to providing financial resources, venture capitalists offer strategic guidance, industry expertise, and valuable connections to help startups succeed. VCs typically take a seat on the board of directors of the companies they invest in and work closely with the founders and management team to drive growth and maximise the company’s potential.

If you want to know more about VC’s operating in UK, check the London Venture Capital Network.

Private Equity (PE) Firms

Private equity firms differ from VCs and angel investors by focusing on mature companies with stable cash flows, and they tend to take longer investment horizons (possibly years before they exit through a sale). The target firms are characterised by high risk, illiquidity, and finite investment durations. Since they target established companies rather than startups, they’re more suitable for businesses looking to scale further.

They typically acquire a significant ownership stake in the companies they invest in and work closely with management to improve operations, drive growth, and increase the value of the business.

PE often involves buying out existing shareholders, taking the company private, and implementing strategic initiatives for profitability and performance. They often use a combination of debt and equity financing to fund their investments and may employ different strategies, such as leveraged buyouts, growth capital investments, and distressed asset acquisitions.

The British Private Equity & Venture Capital Association (BVCA) has been a voice of private capital in the UK.

Crowdfunding Platforms

A crowdfunding platform is an online platform that connects entrepreneurs, startups, creators, and individuals seeking funding with a large network of potential investors, backers, and supporters. Crowdfunding platforms provide a digital marketplace where project creators can showcase their ideas, products, or initiatives and raise funds from angel and retail investors who are interested in supporting their projects.

Crowdfunding platforms like Seedrs, StartEngine, and Crowdcube offer this alternative route for raising capital. These platforms provide several benefits, including proof of concept, organic customer base creation, and free marketing. Successful campaigns on these platforms can attract multiple sources of funding without the need for traditional bank loans.

There are different types of crowdfunding platforms, including:

- Equity crowdfunding platforms: These platforms allow startups and early-stage companies to raise capital by offering shares or equity ownership to investors in exchange for funding, while the investors can participate in private company growth. Seedrs, Crowdcube, and SyndicateRoom are a few examples operating in the UK.

- Rewards-based crowdfunding platforms: These platforms enable creators and entrepreneurs to raise funds for projects, products, or campaigns by offering rewards, perks, or exclusive experiences to backers. Backers pledge money to support the project and receive rewards based on their contribution level. GoFundMe, Indiegogo, and Kickstarter are among the most famous.

- Donation-based crowdfunding platforms: While not for investing, these platforms focus on charitable causes through donations. JustGiving, GoFundMe, and Localgiving are a couple examples.

- Debt crowdfunding platforms: Also known as peer-to-peer lending platforms, these platforms facilitate interest-bearing loans between individual lenders and borrowers. Debt investors have different criteria and risk preferences than equity investors. Funding Circle, Zopa, RateSetter, and Lending Work are a few examples.

Crowdfunding platforms offer entrepreneurs a convenient and accessible method to secure funding, validate their concepts, and connect with a network of supporters. For the investors, they can back projects and contribute to the advancement of groundbreaking ideas.

Family Offices

Family offices are private wealth management firms that manage the financial affairs and investments of high-net-worth individuals, families, and family-owned businesses. Family offices provide a range of services, including investment management, estate planning, tax optimisation, philanthropy, and wealth preservation, tailored to the specific needs and goals of their clients.

Family offices adopt a long-term investment approach, often providing substantial capital and strategic guidance. Connecting with family offices can be challenging, but they offer significant benefits for startups and scaleups looking for patient capital. Some family offices may develop accelerators to find suitable investment targets, too.

Government Grants and Funds

Government grants and funds, such as those offered by Innovate UK, provide non-dilutive funding options. These grants are particularly beneficial as they do not require giving up equity, allowing startups to retain full control while securing necessary capital.

Other government programs may be dilutive of equity or laden the company with debt, but these programs can help provide capital during difficult times.

Innovate UK, Start Up Loans, Enterprise Investment Scheme (EIS), Seed Enterprise Investment Scheme (SEIS), R&D Tax Credits, Regional Growth Fund are just a few examples of government grants and funds available to startups and their investors in the UK.

Investment Instruments: Priced Rounds and Convertibles

Priced Rounds

A priced round refers to a type of equity financing in which a startup or company raises capital by selling shares or equity at a predetermined valuation or price per share. In a priced round, the company determines the valuation of the business, usually based on factors such as financial performance, market potential, growth prospects, DCF analysis, and comparable company valuations, and offers shares to investors at a specific price per share.

Priced rounds are common in venture capital and private equity investments, where investors purchase equity stakes in the company at a negotiated valuation. Crowdfunding normally requires a priced raise, too.

Since shares are sold at a set price, this is a straightforward method for raising capital. For example, if a startup sells shares at £1 per share and an investor invests £1 million, the investor owns 1 million shares in the startup.

The percentage of the company the investor owns is based on the number of shares. If our example company has a £5m valuation at £2 per share, then there would be 2.5m shares in the company. If an investor invests £1m in this priced round, the company would issue 500k new shares (£1m investment divided by £2 per share), and the total number of shares reaches 2.5m + 500k = 3m shares. The investor now owns 500k shares out of 3m, a percentage of 16.66%, and all previous investors are “diluted” with a lower percentage out of 3m than they had out of 2.5m shares.

Priced rounds provide clarity and transparency to investors and founders by establishing a fixed price for the company’s shares and determining the ownership stake and dilution impact for investors and existing shareholders.

Convertibles

Convertibles are a type of debt financing that can be converted into equity at a later date. This conversion usually occurs when specific conditions are met, such as a subsequent funding round or an acquisition.

Convertibles typically take the form of convertible bonds, convertible preferred stock, or convertible notes and are commonly used in venture capital and private equity investments. The investor gets the potential upside of equity – which can be multiples of the original investment – but the safety of debt, which usually carries sub-10% interest rates but has higher priority in any liquidation. Moreover, convertibles often carry other terms, such as an automatic discount to the share price in the next priced round or a “valuation cap”, which effectively limits the would-be dilution of the holder of the convertible.

For companies, convertibles enable raising capital without immediately diluting existing shareholders, and often provide incentive to entice investors who may be wary of the company’s future.

The UK Future Fund scheme was a convertible debt investment that matched funds by private investors with a debt bond that could be converted or remain as debt, and it was popular during Covid to help companies remain in business.

UK Investment Schemes

Tax incentives are another avenue for startups and scaleups to leverage. These may not directly raise money, but they can help attract investors to investments they may have otherwise passed on because they can reduce their tax burdens.

Seed Enterprise Investment Scheme (SEIS)

The SEIS offers significant tax benefits to investors, including a 50% income tax relief with a maximum claim of £100,000. To be eligible, companies must have fewer than 25 employees and must not have been trading for more than two years.

Enterprise Investment Scheme (EIS)

The EIS provides up to 30% income tax relief, with a maximum investment of £1 million per tax year, or £2 million if anything above £1 million is in “knowledge-intensive” investments. This scheme is designed to help companies raise money for business growth by offering tax relief to individual investors who buy new shares in the company.

Venture Capital Trusts (VCTs)

VCTs are listed on the London Stock Exchange and raise money to invest in young, innovative, and privately-owned companies. They offer generous tax reliefs to investors, including up to 30% upfront income tax relief, income tax exemption on VCT share dividends, and capital gains tax exemption on the disposal of shares.

The Steps Towards Investment

Determine Your Capital Requirements

In the early stages, figuring out the capital you need involves adding up initial costs, investments in equipment, employee salaries, and other startup expenses. By subtracting the capital put in by you from these costs, you can determine the external funding required. It’s important to create a detailed financial plan that lays out expected expenses on a monthly, quarterly, and annual basis.

As your business progresses to later funding stages, having a thorough business and financial plan becomes crucial in balancing revenue and expenses so you know how your funds will flow out before profitability. This evaluation, along with establishing the timeframe needed to become profitable (referred to as the runway), will guide you on how much you should seek from external sources.

It’s also essential to take into account dilution, as it can impact existing investors and potentially reduce ownership percentages to critical levels. For example, dilution could lower the combined equity of the founders below 50% or even below that of an external investor, risking the vision of the founding team.

Identify Suitable Investor Types

Identifying suitable investor types for your startup or business involves understanding the different categories of investors, their investment preferences, risk appetite, and alignment with your business goals. Here are some steps to help you identify suitable investor types:

Determine the amount of capital you need, the stage of your business (seed, early, growth), and the purpose of the funding (product development, expansion, marketing). This will help you identify investors who specialise in your funding requirements.

Matching investor types to your business stage and industry is crucial. Tools like ‘UK Companies Insights’ can help refine the search for suitable investors, increasing the chances of securing funding from active investors in the UK. See how to use this tool below. The stage of the company – i.e., Pre-Seed, Seed, Series A, etc. – and the size of the round play important roles here. Many investors will only invest in a certain stage or a minimum amount.

Research individual investors or firms within each category to understand their investment focus, industry preferences, investment size, geographic location, and track record. Look for investors who have experience in your industry or have funded similar businesses before.

Customise your pitch and investment materials to resonate with the specific interests and preferences of potential investors. Highlight how your business aligns with their investment thesis and how their expertise can add value to your company.

Finding a lead investor (the biggest investor in the round) can be critical too, because smaller investors, who may add up, may not join a round until a more sophisticated investor has vetted the target through due diligence.

How and Where to Find Investors

Utilising Online Platforms

In today’s entrepreneurial landscape, online startup funding platforms have become indispensable for those looking to turn their innovative ideas into reality. These platforms serve as bridges, connecting passionate entrepreneurs with potential investors eager to support new ventures.

Each type of online crowdfunding serves different purposes (business funding, projects, or charitable initiatives), and they have different terms associated with them.

For instance, those looking to fund their business with equity-based investment can look to Seedrs, StartEngine and Crowdcube to find equity investors for shares in their fledgling companies. Alternatively, companies that prefer to carry debt than give out a share of their equity should explore debt crowdfunding (P2P lending) on platforms like Funding Circle and Zopa. For more creative projects, Kickstarter and Indiegogo are popular. For charitable causes, notable examples are JustGiving and Localgiving.

Other Sources of Funds

If you prefer to have larger but direct investments – or to find a lead investor to bolster your credibility in a crowdfunding round – don’t forget venture capital, family offices, private equity firms, and wealthy angels.

In the UK, resources like the Angel Investment Network and the London Venture Capital Network further enhance opportunities for startups seeking angel investors or venture capital, find mentorship, and establish connections.

Finally, various government grants and schemes, such as Innovate UK and the Enterprise Investment Scheme (EIS), provide vital support for startups. With a plethora of funding options, including equity, reward-based, and debt crowdfunding platforms, entrepreneurs have never been better positioned to pursue their dreams and make a meaningful impact in their industries.

CityFALCON UK Private Company Insights

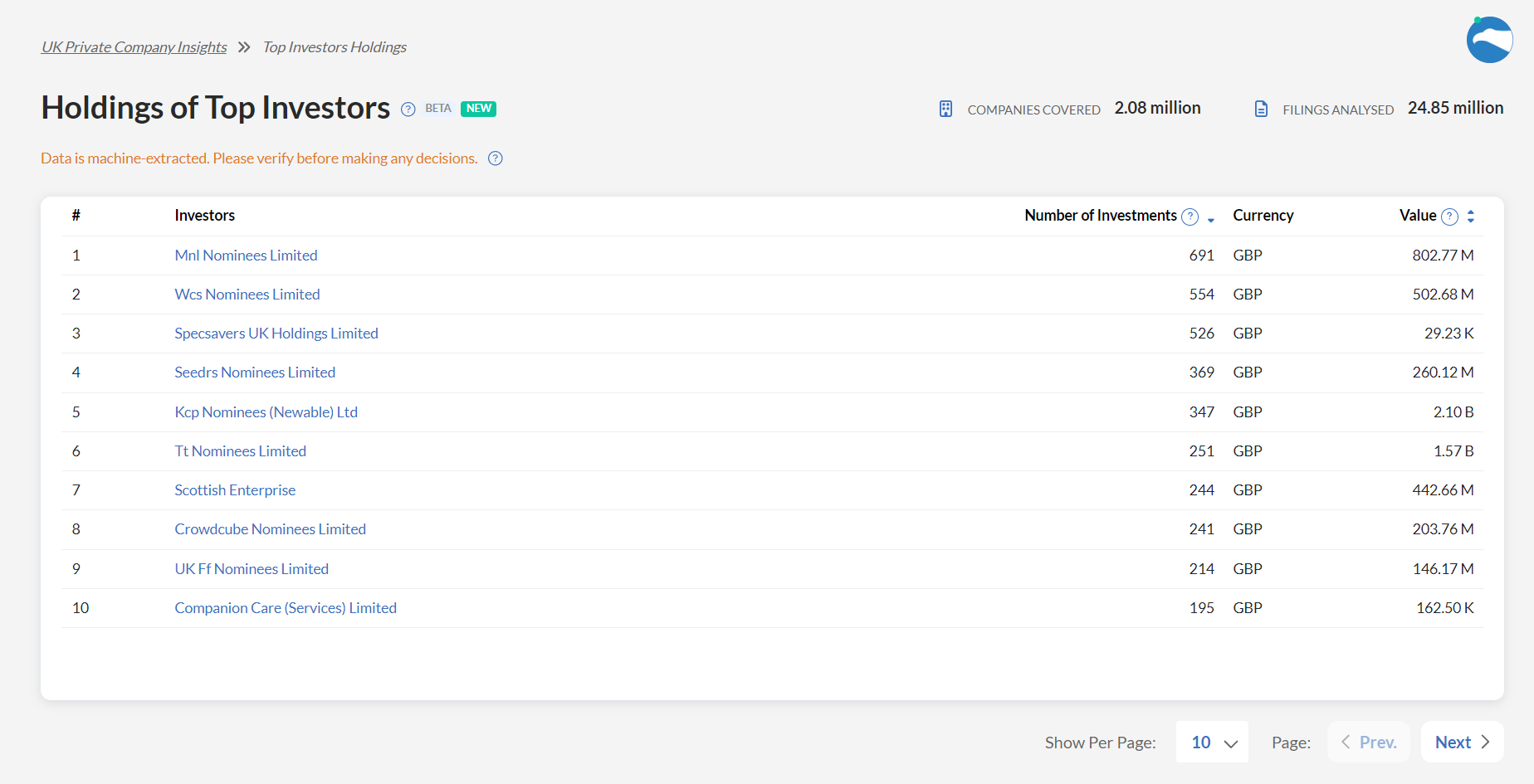

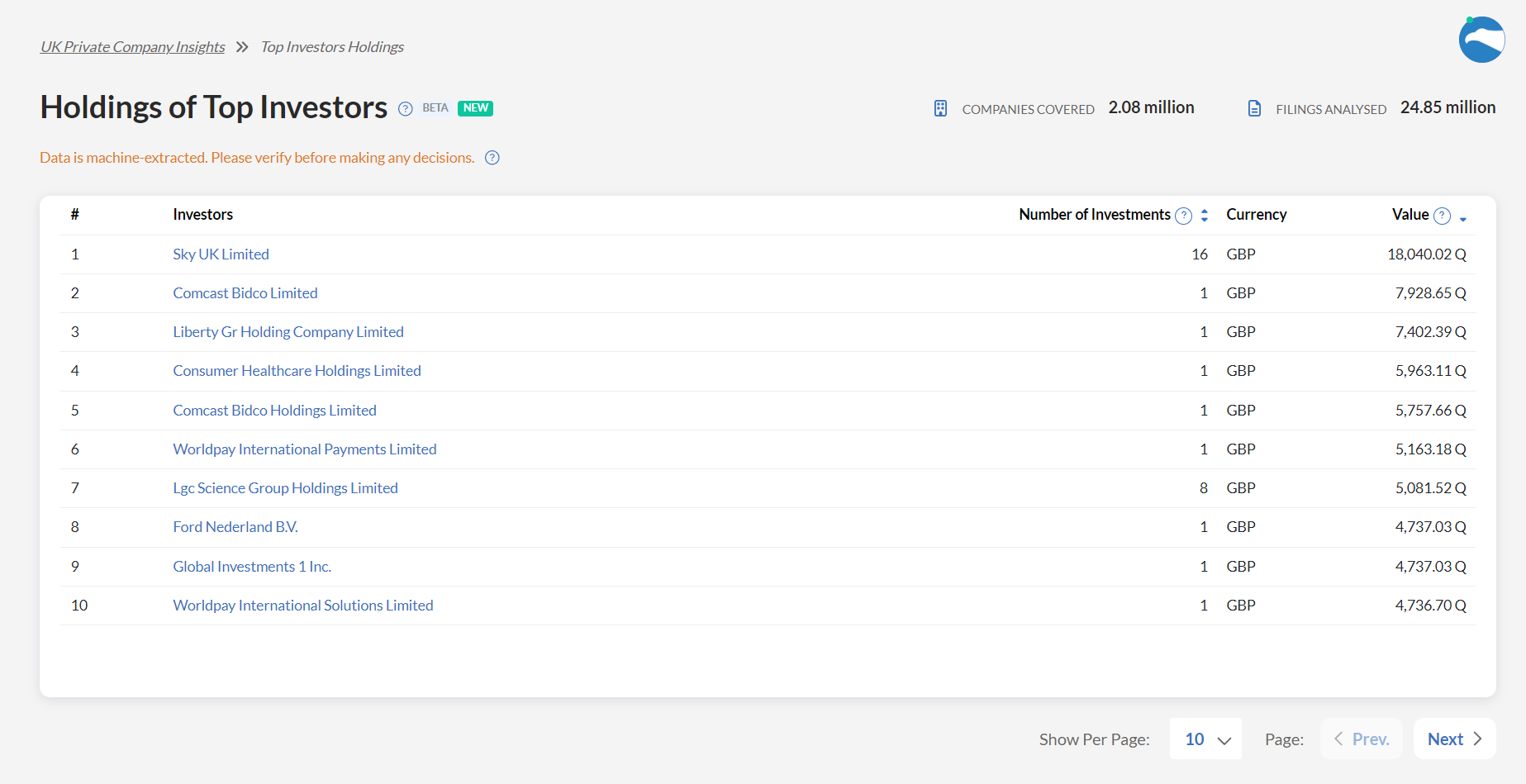

CityFALCON’s UK private market insights, powered by machine learning and NLP, is a strong source of investor information, too. This platform offers access to essential metrics and datapoints related to the UK private market, including top investors by amount and number of investments. These investors can then be further researched and contacted through the other tools above (like angel networks and LinkedIn) to start the conversation.

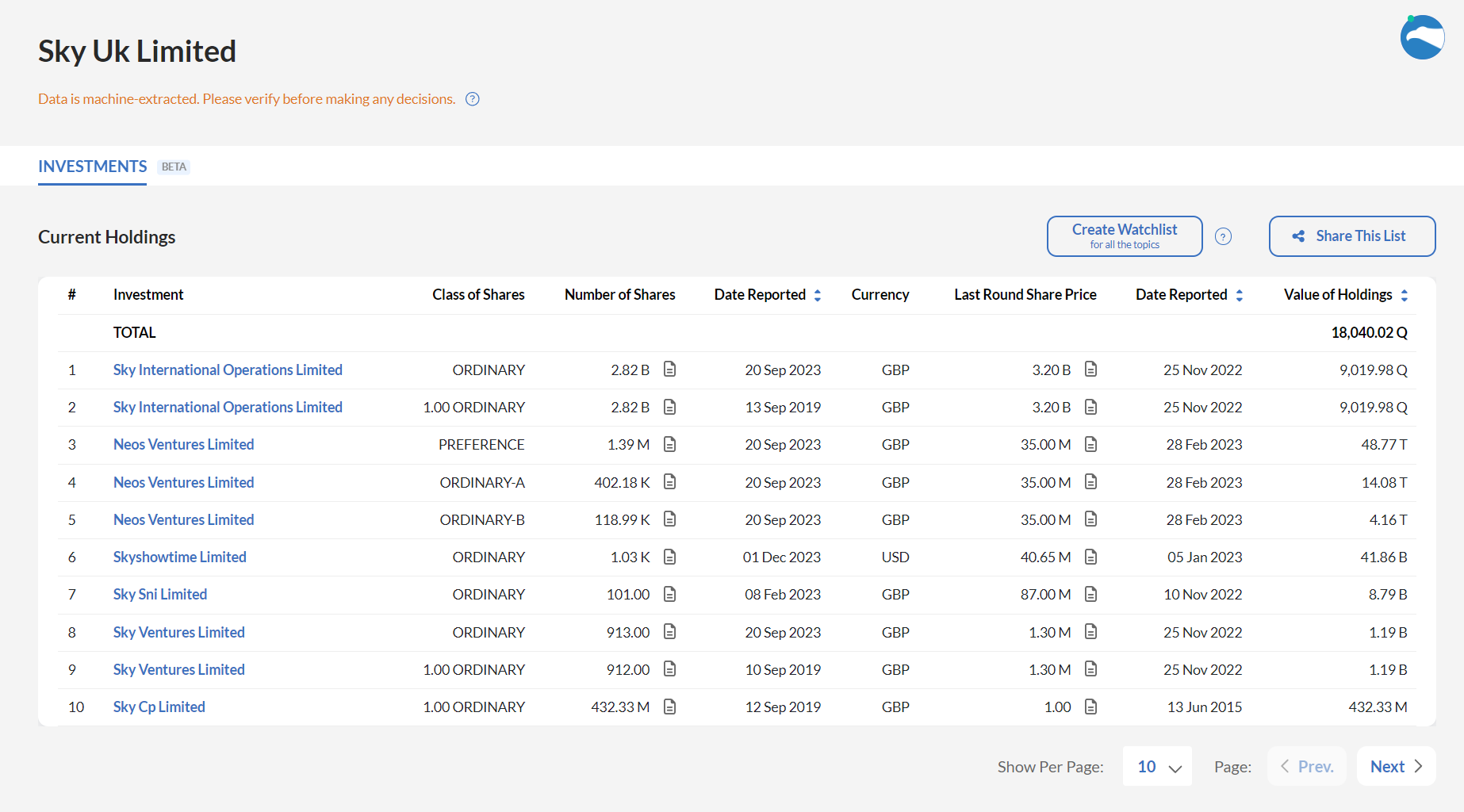

Investors have their own pages, where would-be capital-raising companies can compare their ideas and industry to the most common for that investor. The amount of investment in each company can indicate common cheque sizes for that investor.

Once a potential investor is found, you can drill down into the individual portfolio companies and, on the capital structure page, you can see whether that investor likes to take bigger or smaller stakes (as a percentage of overall share structure). Startup founders looking for capital can even see information about the stages (Seed, Series A, etc.) at which that particular investor invested to align further. If that particular investor is outside your stage or cheque size, there may be several other investors on that particular company’s capital structure page, and these can be investigated, too.

There are several avenues for finding investors with UK Private Company Insights. With this tool, startups and scaleups can powerfully augment their search for suitable investors and increase their chances of securing funding.

Attending Networking Events and Conferences

In-person networking is crucial for establishing connections through face-to-face conversations and reading body language. It strengthens relationships that can lead to future opportunities and collaborations, raising your profile and attracting attention to your startup.

For those on tight budgets or too far from events, it can be very helpful to still follow the events and compile lists of potential investors for their next trip.

Notable UK Events:

- TechCrunch Disrupt London

- The Business Show UK

- Angel Investment Network Events

There are many more formal and informal ways to meet investors face-to-face, including even meetups that discuss finance and at non-finance-related events. Founders looking for capital can benefit from talking to anyone and everyone, even tangentially, about their company and investment.

Leveraging Accelerators and Incubators

Participating in a startup accelerator offers a wealth of benefits. You gain mentorship from seasoned professionals who share their insights and best practices. It’s also a fantastic opportunity to network with fellow entrepreneurs, investors, and industry experts, which can open doors to partnerships and funding. Plus, being part of a well-known accelerator boosts your startup’s credibility, and being part of a strong accelerator alumni network means ongoing support and resources are just a connection away.

Accelerators may also provide office space and tools that help cut down on costs, and structured programs guide you in the business model, marketing strategy, and even workshop your finance and operations skills.

While accelerators offer great support, they come with challenges like equity dilution, significant time demands, competition among peers, a one-size-fits-all approach, and pressure to deliver quick results. These factors can make the experience stressful and may not suit every startup.

Demo days, where companies pitch their ideas to a room full of eager investors, can open the door to potential funding. Feedback from mentors and investors can help hone your products, too.

These programs provide valuable resources and connections to help startups and scaleups grow and succeed.

- Techstars London

- Seedcamp UK

- Entrepreneur First UK

- Wayra UK Accelerator

Engaging with Investor Networks

Importance of Investor Networks and Syndicates

Investor networks and syndicates offer numerous resources and connections that can help startups grow and become successful. They provide opportunities to gain exposure to potential investors, access exclusive deals, and stay up-to-date on industry news and trends.

Examples of Investor Networks in the UK

- UK Business Angels Association

- British Private Equity & Venture Capital Association (BVCA)

- Cambridge Angels

Being part of these networks can help startups and scaleups gain exposure to potential investors and make valuable connections.

Creating a Strong Online Presence

A professional website and active social media profiles are essential for startups and scaleups. A well-designed website provides an online presence 24/7, establishes credibility, and generates leads. Active social media profiles allow businesses to interact with their target audience and gauge customer involvement. By maintaining an attractive online presence, businesses can build brand awareness, showcase products or services, and expand their market reach.

Preparing a Compelling Pitch

A successful pitch should include key components such as an executive summary, problem and solution, market analysis, business model, team, financial projections, and ask. To deliver an effective pitch, adapt your message to your UK-based audience, research potential investors, and understand the current investing climate in the UK. Practise your pitch to build confidence and charisma, and be prepared to tell your story with passion and enthusiasm.

Building Relationships with Investors

Engaging with investors through social media, attending events, and holding in-person meetings is crucial for establishing trust and credibility. Effective investor engagement strategies involve being proactive, responsive, and transparent, providing regular updates on business performance and milestones achieved. By fostering a culture of open communication and transparency, startups and scaleups can build trust with investors and secure the capital they need to grow and succeed.

Seeking Professional Advice

Consulting with investment advisors, legal experts, and financial consultants can provide numerous benefits, including creating a customised long-term strategy, managing investments, and understanding complex laws and regulations. These professionals can assist in navigating the investment landscape by providing a holistic approach to your finances, identifying the best approach to manage and pay off debt, and mitigating risk.

They will often take a percentage of the raise rather than a large upfront fee, which makes them accessible to startups with low cash.

CityFALCON’s Success Story

CityFALCON’s success in raising £5 million through crowdfunding serves as an inspiration to startups and scaleups. The financial content platform, founded by Ruzbeh Bacha, has developed a machine learning and NLP-powered platform that provides financial and business news, sentiment, summaries, filings, extracted and structured data, and much more, including UK Private Company Insights.

This achievement is a testament to the power of self-funded business growth and the team is making it easier for other entrepreneurs to find the right funding sources in the UK through their tools.

Conclusion

With the right mindset and resources, securing investment in the UK is achievable. Securing investment from active investors in the UK requires a personal touch, determination, and a well-thought-out strategy. By utilising resources like CityFALCON’s UK Private Company Insights, entrepreneurs can enhance their chances of attracting funding. This includes reaching out to family and friends, private investors, and crowdfunding platforms, as well as engaging with online networks, attending events, and connecting with investor syndicates.

By utilising CityFALCON’s UK Private Company Insights, entrepreneurs can gain valuable insights into the UK’s investor landscape, refine their search for suitable investors, and increase their chances of securing funding. With persistence, preparation, and the right tools, startups and scaleups can overcome the challenges of securing investment in the UK and achieve growth and success.

Leave a Reply