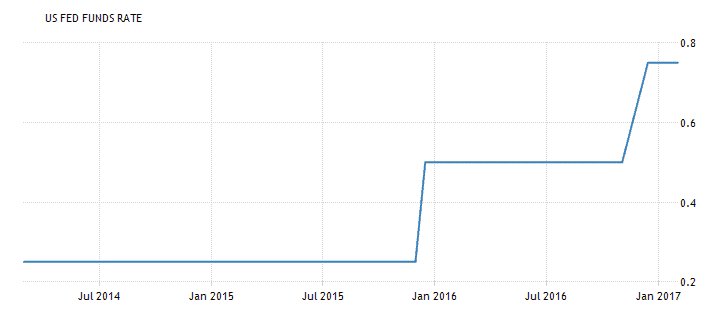

The U.S. stock markets have rallied since the presidential election in Dec 2016 on expectations that the fiscal stimulus proposed by President Trump will benefit the economy. 10-Year U.S. Yields rose from 1.86% during election day to 2.45% in Dec. 2016. Analysts are expecting the yields to rise to ~3% in 2017 as investors demand higher inflation risk premium for the rising inflation from increasing fiscal spend. Also, in response to expectations of global economic growth, the Fed hiked up the benchmark rate in December 2016 by 0.25% to 0.5%-0.75%, with projections of three more rate hikes for 2017. Further, there is talk about the Euro taper, with the ECB already planning to reduce monthly bond purchases from 80 billion euros to 60 billion in April of 2017.

All these events make one thing very clear – the ever sliding interest rates will reverse course. QE and easy money may no longer be the norm. After being subject to 8 years of a low-interest rate environment, how should investors adjust their portfolios to this changing scenario? The following strategies can be considered, however, remember that we are in unprecedented times with Brexit, Trump as the President and significant interventions by central banks.

Bonds

Bond prices tend to drop when interest rates rise. This is because interest rates and bond prices tend to move in opposite directions. This phenomenon is known as interest rate risk. This risk is common to all bonds, even U.S. Treasury bonds. But there are strategies to counter this risk.

Investing in Floating Rate Bonds

Floating rate securities can be an effective tool to hedge one’s fixed income portfolio against the interest rate risk. These securities help protect the value of one’s portfolio as they fluctuate in tandem with rising interest rates, by referencing a moving benchmark e.g. LIBOR or Fed Funds Rate and yield a return that parallels the rising rates.

While one can buy individual floating rate bonds, an easier way to include such bonds in one’s portfolio would be to invest in Floating Rate Bond ETFs (Exchange-Traded Funds). Investing in such funds can better provide the benefits of diversification and low trading costs as against holding individual floating rate securities.

Within the funds, an option could be to look into Bank Loan Funds. These funds invest primarily in floating-rate bank loans instead of bonds. What they do is buy the short-term, floating-rate loans given to companies that have bad credit scores, at a rate that is generally higher than the benchmark. These funds thus offer higher yields as they compensate the investor for the higher credit risk involved. These funds adjust systematically every 2-3 months, preserving the original price of the mutual fund in a rising interest-rate environment while producing a higher yield for the investor. In 1994, when the Fed raised interest rates 6 times, causing bond funds to drop an average of 3%, bank loan funds owners yielded a whopping 6.6% return. However, investors must note that bank loan funds can be volatile and face higher default risk due to sub-investment grade ratings.

Creating a bond ladder

Instead of holding a bond with a single maturity date, in a rising interest rate environment, creating a bond ladder by purchasing several smaller bonds with multiple maturity dates can protect one’s portfolio from interest rate risk. This is because creating a bond ladder helps in reinvesting cash at higher rates. As stated before, bond prices decrease when interest rates increase. Integrating an array of bonds into one’s portfolio with different maturity rates counterbalances this outcome because they are constantly maturing individually and can be reintegrated into the market at the current interest rates.

Equities

In U.S. the CPI, a measure of inflation, increased 2.1% YoY in December 2016, the largest rise in two and a half years. As mentioned earlier in this article, an important reason for the Fed to raise rates in December 2016 and project multiple hikes for 2017 was in response to expectations of higher growth and inflation owing to President Trump’s expansionary policies.

A rising interest rate environment is usually correlated with high economic growth. This period is typically characterized by increasing inflation, improving employment and consumer sentiment and a healthy housing market.

But historically, often, equities have gone down as interest rates go up. This mostly happens due to the increased cost of capital from the rising rates and its potential negative impact on corporate earnings. So while bondholders face interest rate risk, rising rates can also increase risks for stock investors. But, investors can actively seek to invest / or stay away from sectors depending on how the rising interest rates impact a particular sector.

Sectors with a potential upside from rising rates

Investing in banks, brokerage firms and insurance companies during these times can provide a higher return on investments. Rising interest rates help the banks in increasing their net interest margins (read profitability).These entities stand to benefit from the higher economic activity as it usually causes higher loan demand. Brokerage firms also stand to benefit due to increased investment activity resulting from a healthier economy. Insurance companies tend to benefit from higher interest on their debt investments as also increasing premium income driven by increased policy writing due to improving consumer sentiment.

Additionally, sectors like Industrials, materials, energy tend to gain from an increase in economic activity. Improving economy also can lead to tighter labour markets and drive investments in technologies to increase efficiency, thereby benefitting IT stocks.

Sectors with a potential downside from rising rates

Defensive sectors like utilities and telecommunications tend to lose in this scenario. These sectors usually remain stable in times of economic distress and thus have predictable cash flows that enable them to pay regular dividends. However, they have been shown to underperform in rising interest rate environments, because they don’t correlate highly with economic growth. In a rising rate scenario, yield hunters tend to abandon these stocks in favour of fixed income investments. Additionally, companies in this sector tend to have a large debt, which means that higher rates will enlarge their interest burden; making these dividend-paying companies a riskier investment option.

Irrespective of the sector, investing in companies with high debt during a rising interest rate environment is risky, as higher interest rate would increase the debt servicing burden for these companies, thereby impacting their profitability and share prices.

Currencies

Interest rate decisions usually cause significant movements in currency markets. As a country’s central bank increases rates, the yields on assets available in the currency tend to go higher, thereby increasing the demand for such assets and eventually the currency.

Given the Fed’s intent to increase rate three times this year, it is widely expected that the dollar will strengthen. However, given the political and economic uncertainty surrounding President Trump’s policies, there could also be increased volatility.

While there could be an opportunity to benefit by going long the dollar against weaker currencies, one can also consider investing in a broad basket of currency pairs to avoid over-reliance on a single currency pair.

Gaining exposure to emerging market currencies could help with this diversification. While these currencies do face a threat of capital flows from a rising dollar, their vulnerability is a lot less now than it was in the past, owing to a relatively lesser reliance on dollar-denominated debt. One can very well steer away from EM currencies with large dollar debt, but can also benefit from adding EM currencies with a focus on domestic consumption, low political risk, and a manageable debt burden.

Summary

A rising interest environment can be something to look forward to with the right preparation. However, irrespective of the interest rate environment, investors should remember that they have a choice to actively use multiple strategies to gear their portfolios to maximise returns or passively manage their investments.

Disclaimer: The opinions expressed here are those of the writer, are generic in nature and do not constitute investment advice or solicitation for a purchase of any security. While the sources of information are believed to be reliable, the accuracy or completeness of the same is not guaranteed. There could be a possibility of the markets having priced in the upward move in rates; a change in direction of interest rates should result in rethinking of strategy and this content may no longer reflect our opinion in a changing environment. This article has been written for educational purposes only. The reader is advised to do his own due diligence before acting on any information presented here.

Leave a Reply