Disclaimer & Disclosures

- Please do your own analysis before investing in any of these stocks.

- While we have taken care in collating the data, some errors may occur.

- Some of the listed companies may have low liquidity.

- Also, I and/or stakeholders of CityFALCON may have positions in some of the stocks listed below.

In continuation with finding value in this depressed market, we are looking for companies with stronger balance sheets than reflected in the market prices. You could also look at our article from last week “Popular stocks at 52 week low”.

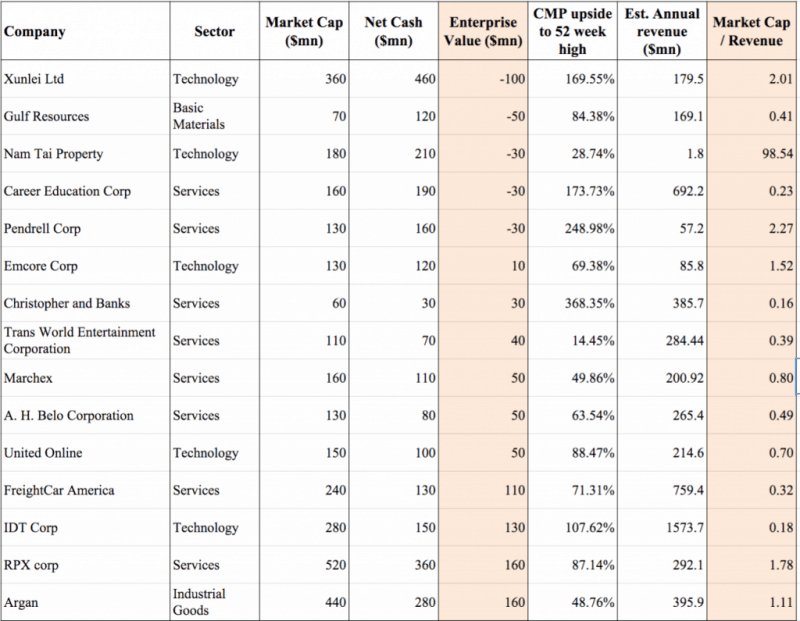

We have done a mathematical exercise below in identifying companies based on ratios and we’ll use it as a base to discuss at our next London Value Investing Meetup. These are companies where net cash (cash & marketable securities – long term debt) is very close or higher than their market capitalisation. Before making an investment in these companies we also need to look at other fundamentals of the company and also consider if they are burning cash, any management issues, etc.

There are several reasons why companies could be trading at a negative or relatively low Enterprise Value, but our focus is to find companies that have been beaten down just because of the overall decline in the market and those that don’t suffer from any fundamental issues.

We’ve added also a column showing upside from the current market price to the 52 week high. How you look at it depends on your view on the overall market. If you believe we are now in a bear market, ignore it. But if you believe we are just having a correction and the bull market will resume again, some of these stocks that have been battered down without any fundamental reason could scale to new heights in the future.

Here are non-financial and non-healthcare companies with negative or low Enterprise Value. We have excluded financial companies from this analysis as it was not easy to identify ‘free’ cash by excluded cash required by regulation. Also check out the market cap / revenue ratio for these companies. All data has been collected between 11-12 Feb, and we have had to make some assumptions for some of the figures especially annual revenue.

Source: Google Finance, FinViz, Nasdaq

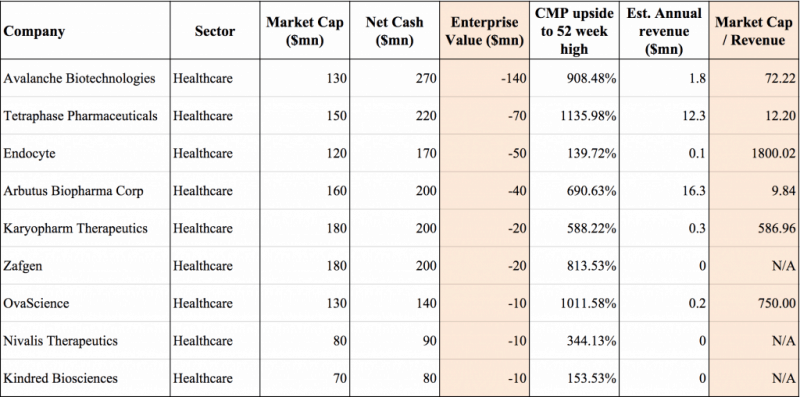

Here are some companies from the healthcare space, but most of these have low revenue and high cash flow burn rate. So watch out!

Source: Google Finance, FinViz, Nasdaq

Source: Google Finance, FinViz, Nasdaq

Happy Investing / Trading

Leave a Reply