Hello again Falcon Readers! We are happy to have completed another successful quarter after a strong year (notwithstanding the Covid chaos). Our dream to expand beyond English has blossomed further than ever, and our previous technological development now supports new features like Summarisation and Sentiment Analysis.

Read on to see what we’ve accomplished and released for you in Q1 2021. Click on the arrows ↓ to jump to that section.

SUMMARY

- See the last update from Q4 2020 for older information

- ↓ Advanced NLU coverage of 21 languages, adding German, Chinese, Polish, and Balkan languages this quarter. Now we process these languages on client content through our NLU named entity recognition (NER) service, too.

- ↓ Our source count has exceeded the 10,000 milestone (11k, actually), with over 1,000 Premium publications that are advertising-free and paywall-free on select content. See partial list of Premium publications.

- ↓ Summaries that condense 1000s of stories into a few bullet points for quick, easy reading are now live for news feeds. Enable them via the News Feed Layout filter. Learn more about the tech.

- ↓ Investor Relations documents, including 10-Ks, 10-Qs, company presentations, earnings calls and transcripts, and press releases, are available for most major companies. Check out Apple’s.

- ↓ Our Price Charts have been augmented with Advanced Charts for the traders and those that use technical signals or follow price action closely. Try it for Tesla or Bitcoin.

- ↓ Sentiment filters available for mobile now, too. Get the iOS and Android apps!

- ↓ Our webinar on Essent Group and Netflix fundamental analysis, by two guest presenters that both claim to consistently beat the S&P500, is available to watch in full.

- ↓ Several updated and new videos, which we’ve weaved into the sections and summarised at the end

- Some press: our own thoughts on crypto investing, plus two interviews with our CEO at TechRound UK and Startup.Info

NLU LANGUAGES – 21 AND COUNTING

In January we launched Chinese, German, and multiple Eastern Europe languages on our NLU model. Adding these to our previously covered languages like Spanish, Russian, and French, we count 21 languages in total. Keep in mind these are the languages we performed advanced NLU processing on, while we source content in 60 languages already.

This is a proud moment for us as we start to break the language barrier without automated translation or huge teams of people.

We have also launched a page that shows which languages are available for which CityFALCON features (sentiment, summarisation, etc.):

10K NEWS SOURCES

We’ve surpassed the 10,000 mark for number of reliable news sources, too. More precisely, we have more than 11,000 sources and still counting! These are in more than 30 languages and from countries all across the world, giving our users a truly global perspective. With our collaborative R&D project with the University of Malta, we plan to expand to 90+ languages in the future using transfer learning.

This is a long way from the 200 sources we had back in 2014 when Ruzbeh started the company, and our financial analyst team has worked hard over the past 6 years to make this competitive advantage into a reality.

In addition, we do have 1,000 sources that provide content free of advertising and paywalls, while the original contained paywalls and/or advertising. See a partial list of those sources here and see how to enable them on desktop or on mobile.

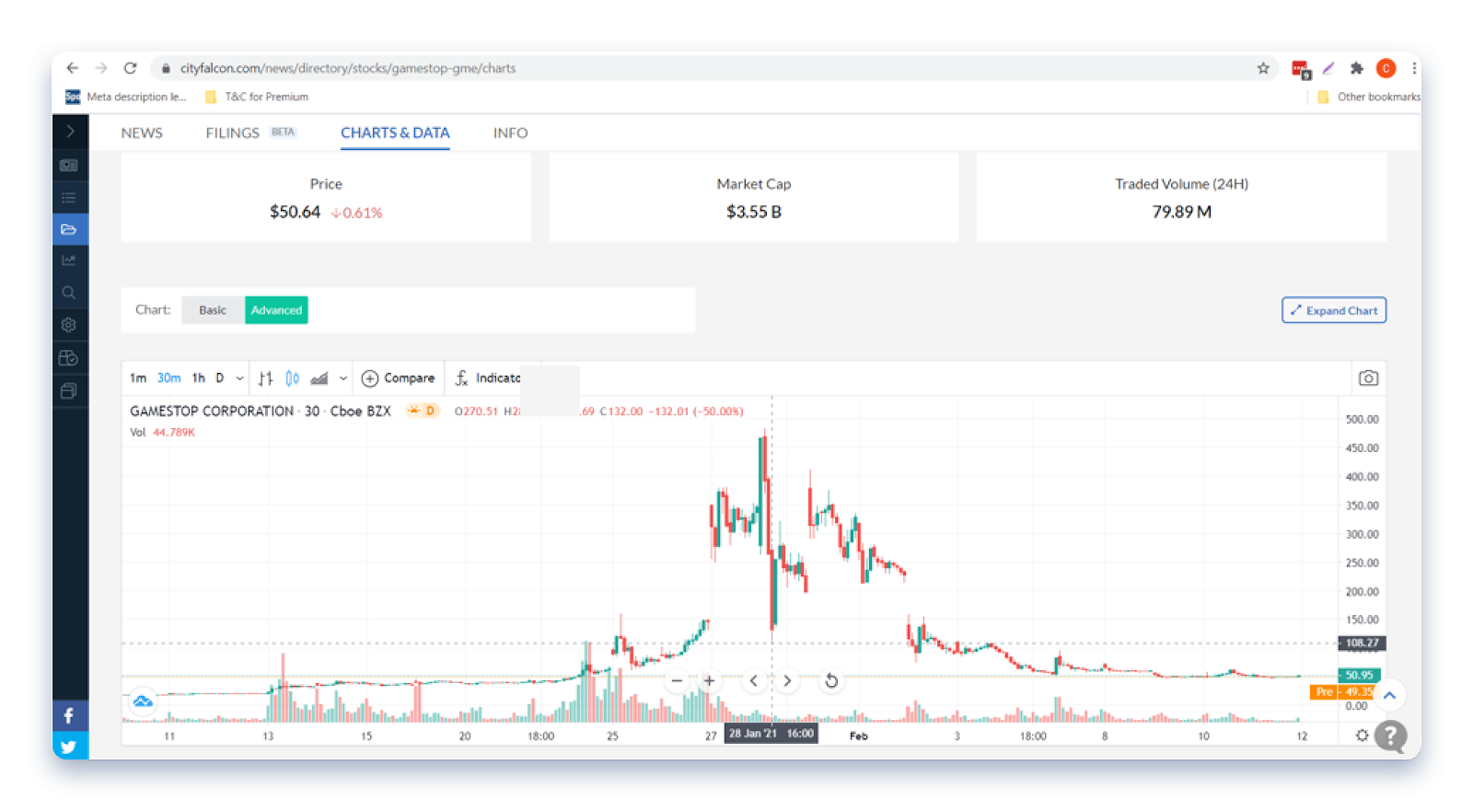

ADVANCED CHARTS FOR TECHNICAL ANALYSIS

We now offer advanced charts on our public companies, indices, crypto, forex, and commodities pages. Using the Basic View, you can check the asset price and volume data plus get news for those time points. If you are more interested in price action and not news, switch to the Advanced View and see TradingView’s embedded chart:

Our basic charts of course still exist and allow you to match news and price action at any point in time. We updated our videos for this feature for desktop and for mobile.

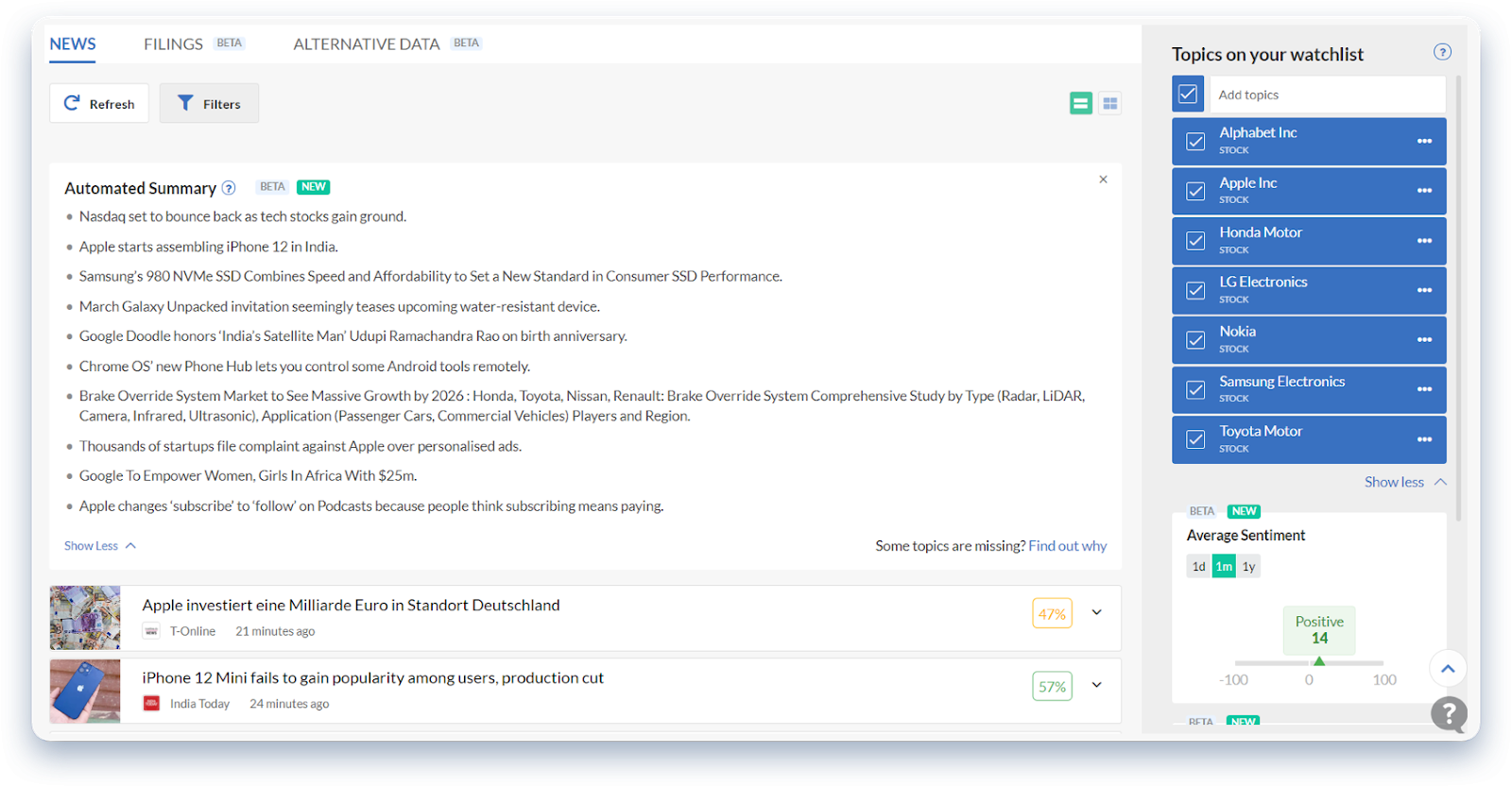

EASILY DIGEST 1000S OF STORIES AT ONCE

Summarisation condenses hundreds or even thousands of headlines and stories into a few easy-to-digest bullet points, giving you back your time and providing a broad overview in just a few sentences. Our machine-learning based algorithm incorporates prior tech work in similarity, too, so we’re happy to see continuing dividends from previously-developed tech.

Summaries are available for individual topics and locations or for entire watchlists:

To see a summary, first you need a Gold subscription (as little as $14/month, includes paywall free content). Then simply navigate to any news feed, click on filters, and enable summaries under the New Feed Layout filter.

Learn more about summaries in our Knowledge Base and watch the videos for mobile summaries and desktop summaries.

INVESTOR RELATIONS DOCUMENTS & COMPANY PRESENTATIONS

Adding to our breadth of data, we launched a new tab with aggregated investor relations content collected from company investor relations pages, providing a direct line to official corporate information. On the Investor Relations tab you will find 10-Ks and 10-Qs, other annual and quarterly reports, press releases, company presentations, and other relevant documents. This data is also available by API for any readers interested.

Currently we cover the major US and UK companies, but we are working to cover all 50k of the listed companies that we currently track – of course, dependent on the existence of an Investor Relations page.

For companies not currently covered, don’t forget we have filings from the SEC and in the UK from LSE RNS, Companies House, and the Gazette. LSE and Companies House filings are full-text, available right on the CityFALCON platform without additional click throughs. Filings are available on watchlists with US and UK companies and on individual pages.

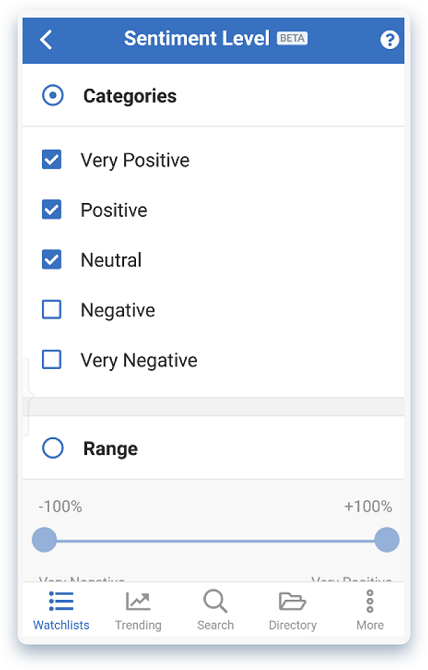

SENTIMENT FILTERS FOR MOBILE

We released the sentiment filters for mobile this quarter, too, so you can filter news based on your investment objectives (ride the positivity wave or go contrarian or something else). Both categorical and numerical filters are available, just like on the web:

WEBINAR – CONSISTENTLY BEATING S&P500 + FUNDAMENTAL ANALYSIS

We hosted a webinar with two guest speakers who discussed their fundamental analyses of Netflix and Essent Group. The Netflix presenter is an infrastructure finance manager and the Essent Group presenter is an Elite Popular Investor on eToro with 1500 copiers. Both claim consistent returns above the S&P500.

Watch full webinar here and watch out for the next meetup on our Meetup page.

NEW VIDEOS

Our video production team has been busy this quarter, and they have a lot to show for it. Here are all the videos from above plus a few that did not fit.

General:

- Explore the Stocks Asset Class

- Explore the Cryptocurrency Asset Class

- Customisable Layouts and Similar Stories Grouping

For Desktop:

- News and Price Charts – Desktop

- Summarisation – Desktop

- Paywall-free and Advert-free Content – Desktop

For Mobile:

CATCH UP ON CITYFALCON PRESS

- TechRound UK interview of Ruzbeh, the CEO, about the company’s journey, challenges, and growth

- Startup.Info interview with Ruzbeh about competitors, challenges, Corona, and more

- Startup Gateway Malta article as a finalist in the Malta Startup Space competition

- Crypto investing/speculating blog (our own thoughts on crypto markets)

Leave a Reply