An idea is worthless until someone is willing to invest in it. When someone puts money into a business, that business has some value.

In a past article I gave examples of high fundraises from unicorns from the UK. Zoopla raised £1.5 million, Transferwise raised £0.9 million, Funding Circle raised £0.7 million, for example. Why is it that some startups raise millions in their seed rounds, while others are forced to value themselves at less than a million?

Although I’ve worked in finance, held strategy and M&A roles, have an ACA and MBA under my belt, my understanding of how to look at startups and their valuation changed only after going through the fundraising process for my startup, CityFALCON.

I’ve met with at least 80 investors; including angels, VCs, family office, corporate venture teams, etc, and needless to say, I’ve learned a lot.

I’ve also learned to look at parallels in the public markets. My understanding of which has improved a lot by helping newbies get started in the markets as part of the London Value Investing Club.

What determines the value of a startup or any financial asset?

You’ll often hear, “A startup should value itself at its fundamental value, irrespective of tax benefits, or anything,”. Why then is a flat built with the same materials in London more expensive than a flat in rural India? Why is Gold trading at $1900 in one year and $1200 in another?

The value of any asset – be it stocks, bonds, Gold, or startups, depends on two factors: DEMAND & SUPPLY. It’s simple, but something that often gets forgotten in all the conversation around startups. Of course, this is only true in a free market, and value may be affected by regulations in a controlled market.

The one cost most people ignore when looking at investment or other opportunities in life – OPPORTUNITY COST

A potential investor said to me once, “if your startup fails what will you lose? I’ll lose my money while you’ll get a job”.

CityFALCON is my baby. I’ve been told she only has a 10% chance of surviving, but I’ll do whatever it takes to keep her alive. My strive to keep my startup afloat has sometimes come at the cost of my health, my relationships, and every other facet of my personal life.

If you’re not obsessed with your startup you’re wasting your time.

You could get a corporate job, and with the way salaries are ballooning in the tech world, you could have quite the luxurious life indeed. A startup is a five, six, or seven year long play. You can see this from exits that have already happened, and from reverse vesting terms that VCs add to your term sheets. So when your investors are giving you money, don’t forget that you are also contributing. You’re committing, at least, the next 5 years of your life, your blood, sweat (and sometimes tears) to your startup.

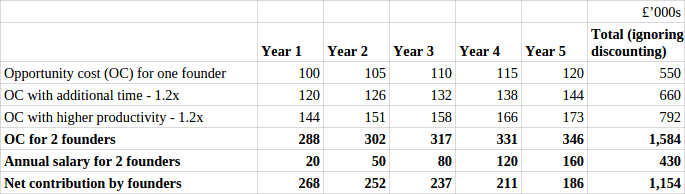

Obviously, everyone earns a different salary. But let’s say an entrepreneur who has the b*lls (sorry, not trying to be sexist here) to start a business is worth at least £75K per year, and the number could be as high as £200K-300K depending on the level. For our example here, let’s use £100K as a working salary. Keep in mind, you’ll be working longer hours and at higher productivity rate than at a corporate job.

Adjust the above table as required for the number of founders, annual salary, and other variables. The valuation you get is the minimum valuation you should aim for when you raise funds. Yes, I’m saying your company should be valued at at least £1.1m in the example above. If you have other factors, like the demand for your startup being higher, the valuation should be higher as well.

In pure economic terms, if you can’t raise money at the valuation above, you might as well just get a day job. Of course not all of us build startups for money, but by under-valuing yourself, you’ll struggle to raise enough funds and may not be able to hire the quality talent you’ll need.

I’ve stopped investing in startups that undervalue themselves for three reasons:

1) They will most likely fail because of not raising enough capital.

2) With not enough stake in the business, they will be tempted to take a high paying full-time job.

3) If they are underselling to current investors, how can I believe that they will do a good job when dealing with customers and future investors (like VCs with those term sheets).

For more information on the dangers of undervaluing a startup, I’d recommend reading Valuation Suicide from James Routledge, where he explains the downsides of undervaluing your startup in great detail.

Leave a Reply